Answered step by step

Verified Expert Solution

Question

1 Approved Answer

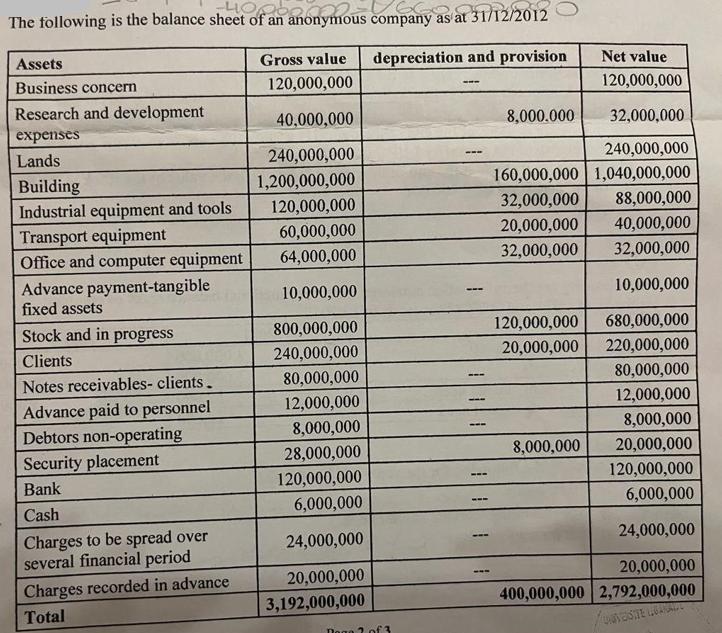

The following is the balance sheet of an anonymous company as at 31/12/2012 depreciation and provision Assets Business concern Research and development expenses Lands

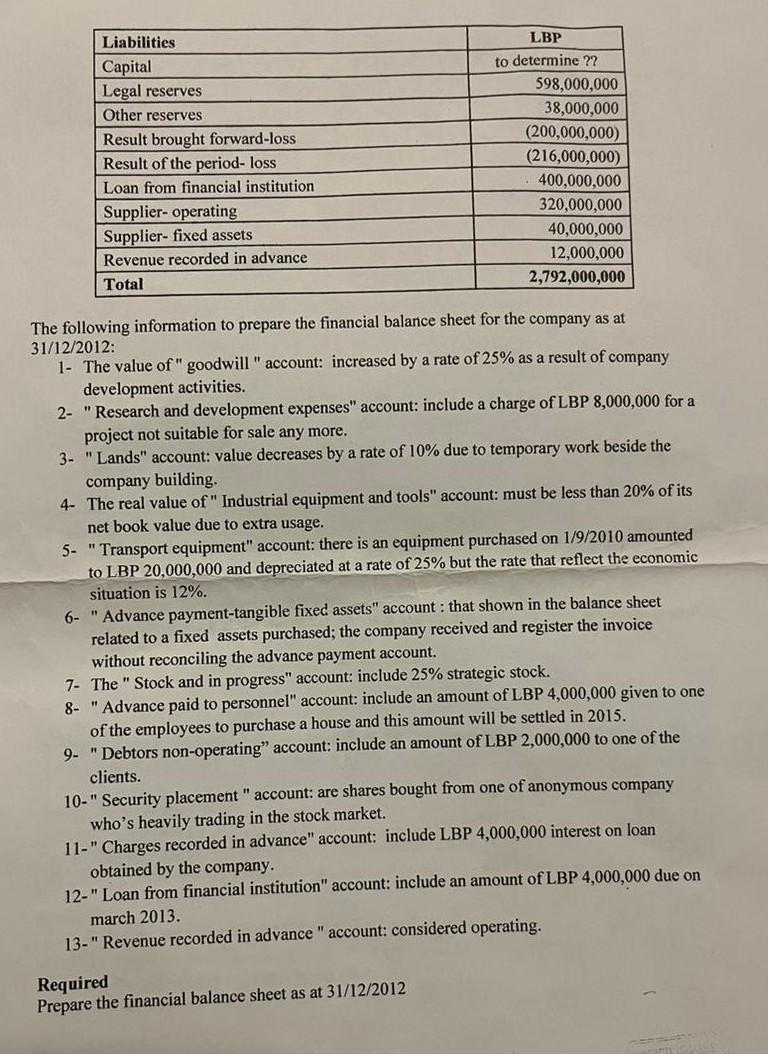

The following is the balance sheet of an anonymous company as at 31/12/2012 depreciation and provision Assets Business concern Research and development expenses Lands Building Industrial equipment and tools Transport equipment Office and computer equipment Advance payment-tangible fixed assets Stock and in progress Clients Notes receivables- clients. Advance paid to personnel Debtors non-operating Security placement Bank Cash Charges to be spread over several financial period Charges recorded in advance Total Gross value 120,000,000 40,000,000 240,000,000 1,200,000,000 120,000,000 60,000,000 64,000,000 10,000,000 800,000,000 240,000,000 80,000,000 12,000,000 8,000,000 28,000,000 120,000,000 6,000,000 24,000,000 20,000,000 3,192,000,000 Doge 2 of 3 www Net value 120,000,000 32,000,000 240,000,000 160,000,000 1,040,000,000 32,000,000 88,000,000 20,000,000 40,000,000 32,000,000 32,000,000 10,000,000 120,000,000 680,000,000 20,000,000 220,000,000 80,000,000 12,000,000 8,000,000 20,000,000 120,000,000 6,000,000 24,000,000 20,000,000 400,000,000 2,792,000,000 /UVOSITE LOANALL 8,000.000 8,000,000 Liabilities Capital Legal reserves Other reserves Result brought forward-loss Result of the period- loss Loan from financial institution Supplier- operating Supplier- fixed assets. Revenue recorded in advance Total LBP to determine ?? 598,000,000 38,000,000 (200,000,000) (216,000,000) 400,000,000 320,000,000 40,000,000 12,000,000 2,792,000,000 The following information to prepare the financial balance sheet for the company as at 31/12/2012: 1- The value of " goodwill " account: increased by a rate of 25% as a result of company development activities. 2- "Research and development expenses" account: include a charge of LBP 8,000,000 for a project not suitable for sale any more. 3- "Lands" account: value decreases by a rate of 10% due to temporary work beside the company building. 4- The real value of " Industrial equipment and tools" account: must be less than 20% of its net book value due to extra usage. 5- "Transport equipment" account: there is an equipment purchased on 1/9/2010 amounted to LBP 20,000,000 and depreciated at a rate of 25% but the rate that reflect the economic situation is 12%. 6- "Advance payment-tangible fixed assets" account that shown in the balance sheet related to a fixed assets purchased; the company received and register the invoice without reconciling the advance payment account. 7- The Stock and in progress" account: include 25% strategic stock. 8- "Advance paid to personnel" account: include an amount of LBP 4,000,000 given to one of the employees to purchase a house and this amount will be settled in 2015. 9- "Debtors non-operating" account: include an amount of LBP 2,000,000 to one of the clients. 10-" Security placement " account: are shares bought from one of anonymous company who's heavily trading in the stock market. 11-" Charges recorded in advance" account: include LBP 4,000,000 interest on loan Required Prepare the financial balance sheet as at 31/12/2012 obtained by the company. 12-" Loan from financial institution" account: include an amount of LBP 4,000,000 due on march 2013. 13-" Revenue recorded in advance " account: considered operating.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To prepare the financial balance sheet for the company as at 31122012 we need to make adjustments based on the provided information and calculate the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started