Question

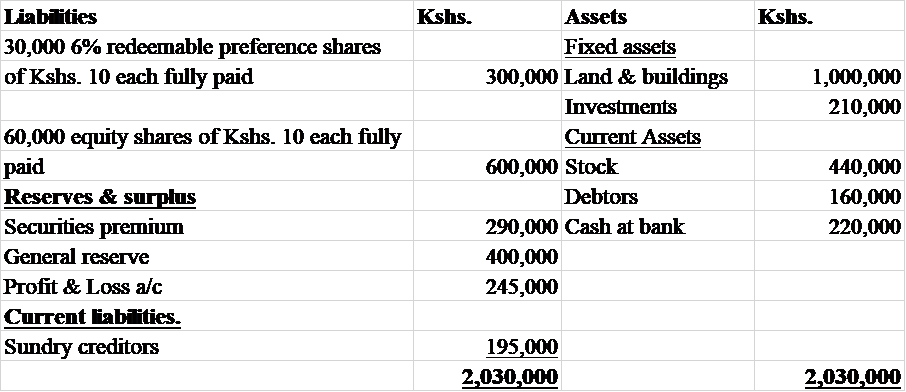

The following is the balance sheet of Safaricom Ltd. As on June 30 th 2013. The company excised its option to redeem on July 1

The following is the balance sheet of Safaricom Ltd. As on June 30th 2013.

The company excised its option to redeem on July 1st 2013 the whole of the preference shares at the premium of 5%. To assist in financing the redemption, all the investment were sold realizing Kshs. 195,000. On September 1st ,2013, the company made a fresh issue of 500 equity shares of Kshs. 100 each. The appropriate resolutions were passed and the above transactions were duly completed.

You are required to show the journal entries and the balance sheet of the company as it will appear after completion of the transactions. (15 marks)

Kshs. Kshs. Liabilities 30,000 6% redeemable preference shares of Kshs. 10 each fully paid 1,000,000 210,000 Assets Fixed assets 300,000 Land & buildings Investments Current Assets 600,000 Stock Debtors 290,000 Cash at bank 400,000 245,000 60,000 equity shares of Kshs. 10 each fully paid Reserves & surplus Securities premium General reserve Profit & Loss a/c Current liabilities. Sundry creditors 440,000 160,000 220,000 195,000 2,030,000 2,030,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started