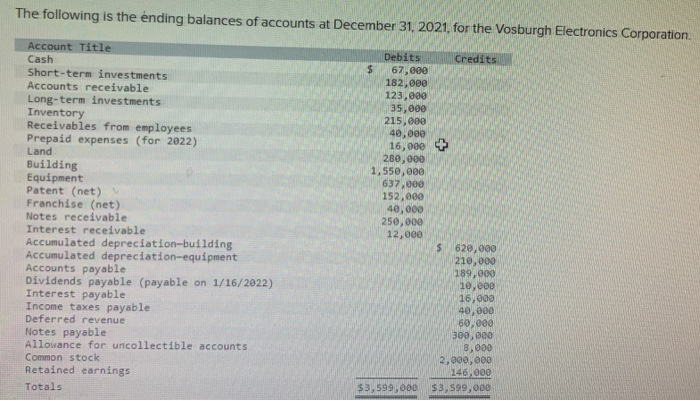

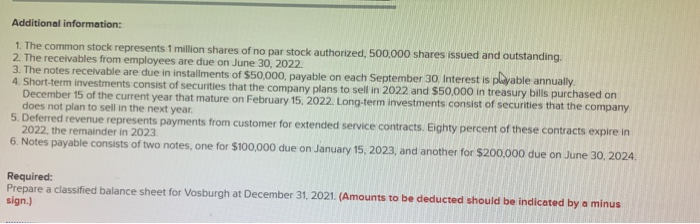

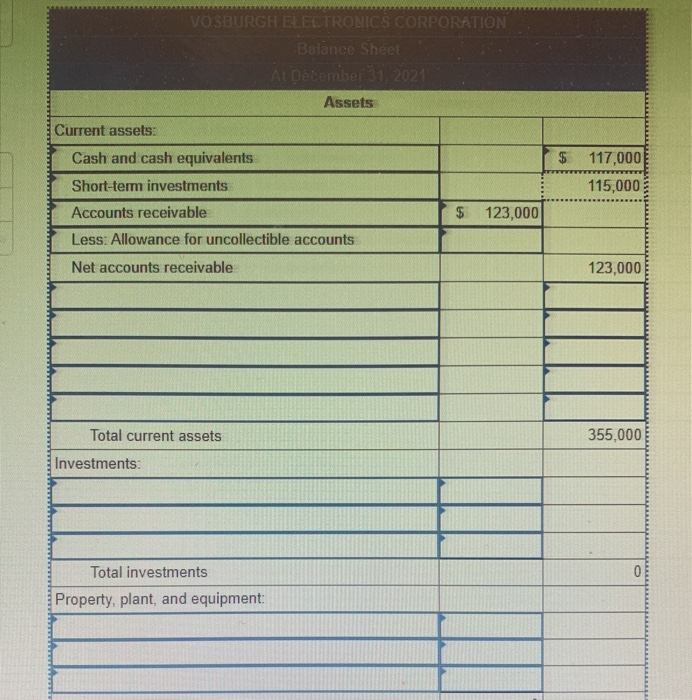

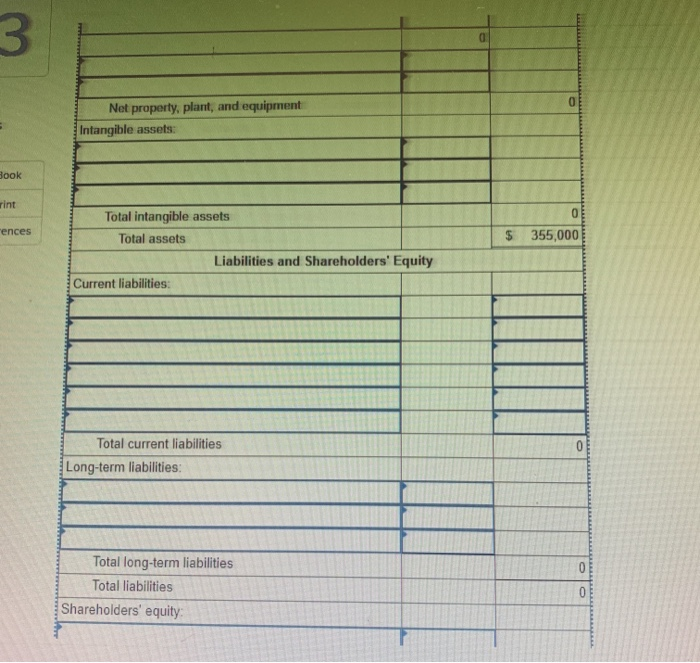

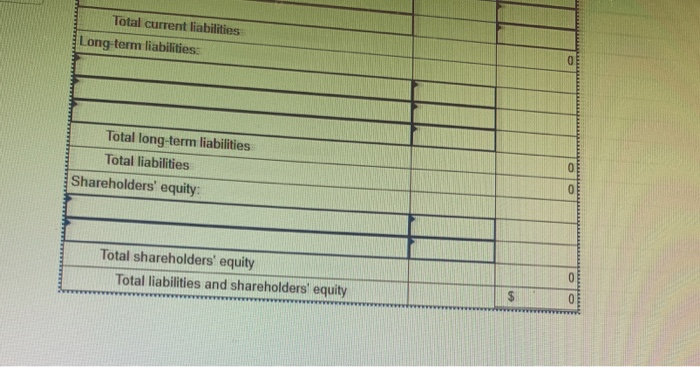

The following is the ending balances of accounts at December 31, 2021, for the Vosburgh Electronics Corporation Account Title Cash Short-term investments Accounts receivable Long-term investments Inventory Receivables from employees Prepaid expenses (for 2022) Land Building Equipment Patent (net) Franchise (net) Notes receivable Interest receivable Accumulated depreciation-building Accumulated depreciation-equipment Accounts payable Dividends payable (payable on 1/16/2022) Interest payable Income taxes payable Deferred revenue Notes payable Allowance for uncollectible accounts Common stock Retained earnings Totals Debits Credits $ 67,000 182,000 123,000 35,000 215,000 40,000 16,000 + 280,000 1,550,000 637,000 152,000 40,000 250,000 12,000 $ 620,000 210,000 189,000 10,000 16,00 40,000 60,000 300,000 8,000 2,000 000 146.000 $3,599,000 $3,599,000 Additional information: 1. The common stock represents 1 million shares of no par stock authorized, 500,000 shares issued and outstanding, 2. The receivables from employees are due on June 30, 2022 3. The notes receivable are due in installments of $50,000, payable on each September 30. Interest is playable annually 4. Short-term investments consist of securities that the company plans to sell in 2022 and $50,000 in treasury bills purchased on December 15 of the current year that mature on February 15, 2022. Long-term investments consist of securities that the company does not plan to sell in the next year. 5. Deferred revenue represents payments from customer for extended service contracts. Eighty percent of these contracts expire in 2022, the remainder in 2023 6. Notes payable consists of two notes, one for $100,000 due on January 15, 2023, and another for $200,000 due on June 30, 2024. Required: Prepare a classified balance sheet for Vosburgh at December 31, 2021. (Amounts to be deducted should be indicated by a minus sign.) VOSBURGH ELECTRONICS CORPORATION Balance Sheet At December 31, 2021 Assets $ 117,000 115,000 Current assets: Cash and cash equivalents Short-term investments Accounts receivable Less: Allowance for uncollectible accounts Net accounts receivable $ 123,000 123,000 Total current assets 355,000 Investments: 0 Total investments Property, plant, and equipment: 3 0 0 Net property, plant, and equipment Intangible assets: Book rint 0 ences $ 355,000 Total intangible assets Total assets Liabilities and Shareholders' Equity Current liabilities: 0 Total current liabilities Long-term liabilities: Total long-term liabilities Total liabilities Shareholders' equity 0 0 Total current liabilities Long term liabilities: 0 Total long-term liabilities Total liabilities Shareholders' equity: 09 0 Total shareholders' equity Total liabilities and shareholders' equity 0 $ 0