Answered step by step

Verified Expert Solution

Question

1 Approved Answer

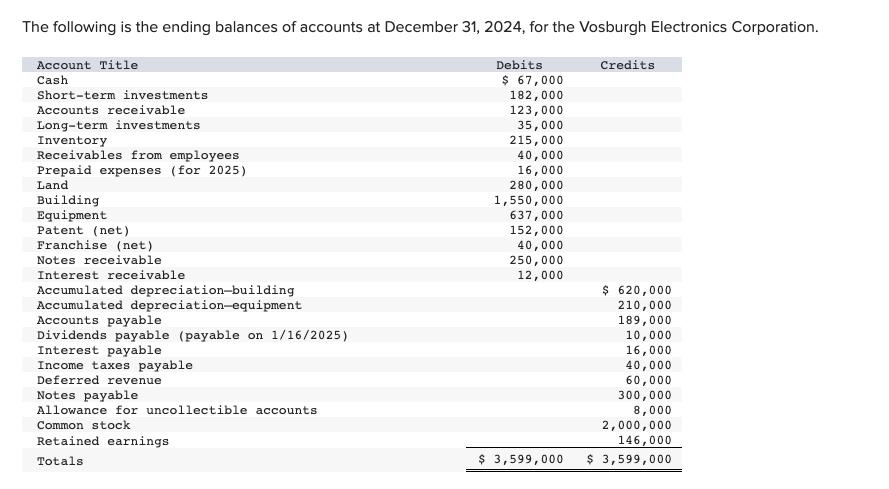

The following is the ending balances of accounts at December 31, 2024, for the Vosburgh Electronics Corporation. Account Title Cash Short-term investments Accounts receivable

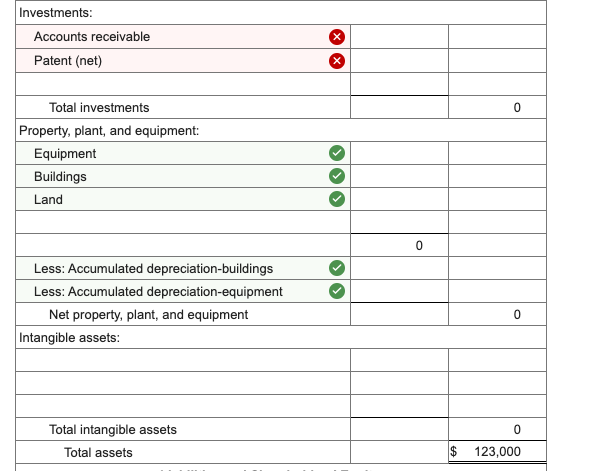

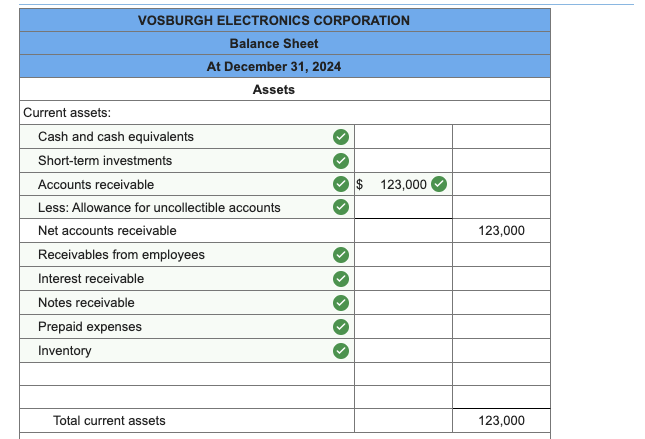

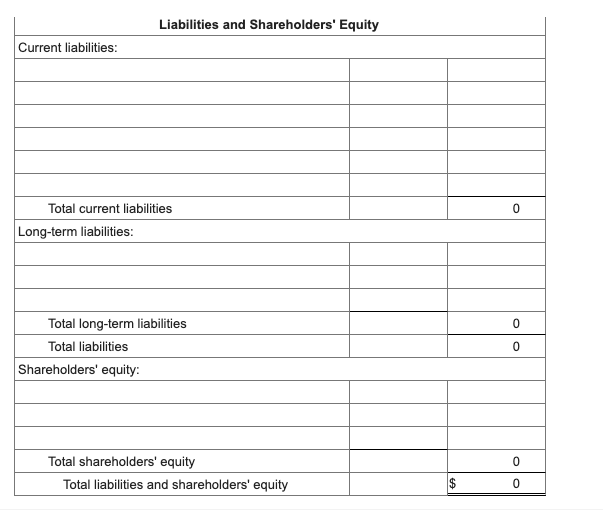

The following is the ending balances of accounts at December 31, 2024, for the Vosburgh Electronics Corporation. Account Title Cash Short-term investments Accounts receivable Long-term investments Inventory Receivables from employees Prepaid expenses (for 2025) Land Building Debits $ 67,000 Credits 182,000 123,000 35,000 215,000 40,000 16,000 280,000 1,550,000 637,000 Equipment Patent (net) Franchise (net) Notes receivable Interest receivable Accumulated depreciation-building Accumulated depreciation-equipment Accounts payable Dividends payable (payable on 1/16/2025) Interest payable Income taxes payable Deferred revenue Notes payable Allowance for uncollectible accounts Common stock Retained earnings Totals 152,000 40,000 250,000 12,000 $ 3,599,000 $ 620,000 210,000 189,000 10,000 16,000 40,000 60,000 300,000 8,000 2,000,000 146,000 $ 3,599,000 Investments: Accounts receivable Patent (net) Total investments Property, plant, and equipment: Equipment Buildings Land Less: Accumulated depreciation-buildings Less: Accumulated depreciation-equipment Net property, plant, and equipment Intangible assets: 0 0 0 Total intangible assets Total assets 0 $ 123,000 Current assets: VOSBURGH ELECTRONICS CORPORATION Balance Sheet At December 31, 2024 Cash and cash equivalents Assets Short-term investments Accounts receivable 123,000 Less: Allowance for uncollectible accounts Net accounts receivable Receivables from employees Interest receivable Notes receivable Prepaid expenses Inventory 123,000 Total current assets 123,000 Current liabilities: Liabilities and Shareholders' Equity Total current liabilities Long-term liabilities: Total long-term liabilities Total liabilities Shareholders' equity: Total shareholders' equity Total liabilities and shareholders' equity 69 0 0 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started