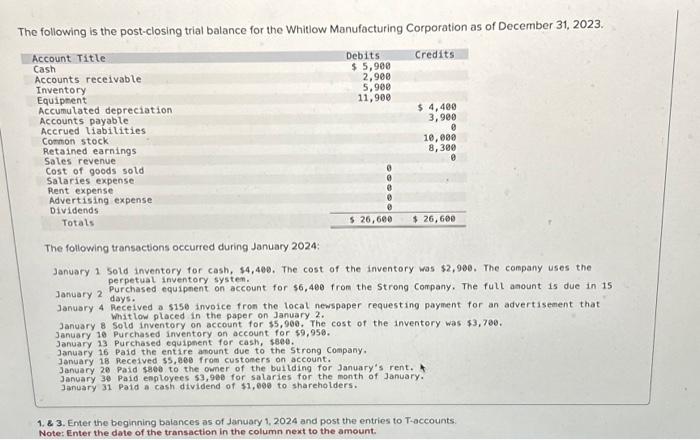

The following is the post-closing trial balance for the Whitlow Manufacturing Corporation as of December 31,2023 . The following transactions occurred during January 2024: January 1 sold inventory for cash, \$4,400. The cost of the inventory was \$2,900. The company uses the perpetual inventory systen. January 2 days. January 4 Received a $150 invoice fron the local newspaper requesting payment for an advertisement that Whit low placed in the paper on January 2. January 8 Sold inventory on account for $5,900. The cost of the inventory was $3,780. January 10 Purchased inventory on account for $9,958. January 13 Purchased equiphent for cash, s8eo. January 16 paid the entire anount due to the Strong company. January 18 Received $, bee from customers on account. January 20 paid \$8ea to the owner of the building for January's rent. January 30 Paid enployees 53,980 for salaries for the month of January. January 31 paid a cash dividend of $1,000 to shareholders. 1. 2 3. Enter the beginning balances as of January 1, 2024 and post the entries to T-accounts. Note: Enter the date of the transaction in the column next to the amount. The following is the post-closing trial balance for the Whitlow Manufacturing Corporation as of December 31,2023 . The following transactions occurred during January 2024: January 1 sold inventory for cash, \$4,400. The cost of the inventory was \$2,900. The company uses the perpetual inventory systen. January 2 days. January 4 Received a $150 invoice fron the local newspaper requesting payment for an advertisement that Whit low placed in the paper on January 2. January 8 Sold inventory on account for $5,900. The cost of the inventory was $3,780. January 10 Purchased inventory on account for $9,958. January 13 Purchased equiphent for cash, s8eo. January 16 paid the entire anount due to the Strong company. January 18 Received $, bee from customers on account. January 20 paid \$8ea to the owner of the building for January's rent. January 30 Paid enployees 53,980 for salaries for the month of January. January 31 paid a cash dividend of $1,000 to shareholders. 1. 2 3. Enter the beginning balances as of January 1, 2024 and post the entries to T-accounts. Note: Enter the date of the transaction in the column next to the amount