Question

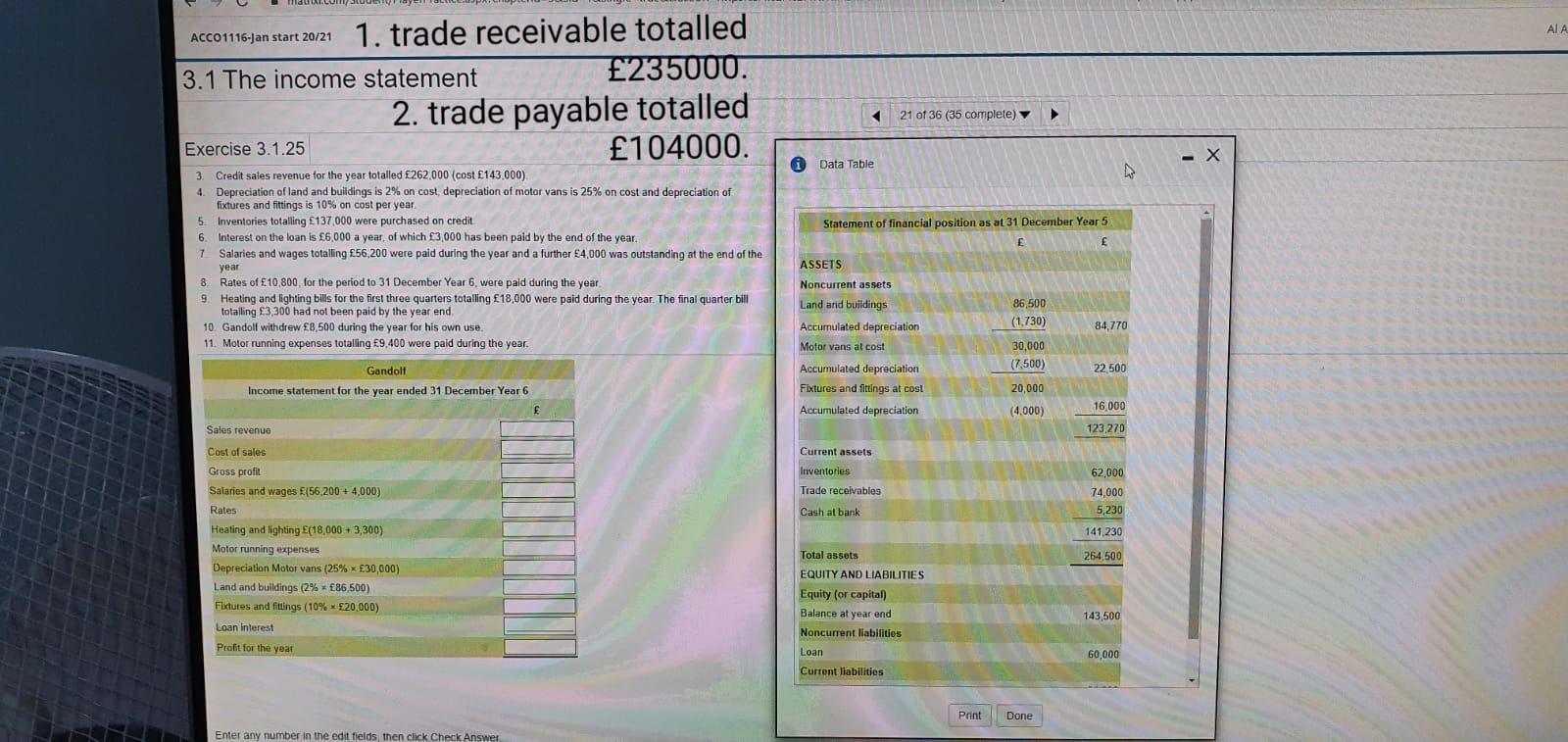

The following is the statement of financial position for Gandolf, a ball bearings distributor, at 31 December Year 5: LOADING... (Click here to view the

The following is the statement of financial position for Gandolf, a ball bearings distributor, at 31 December Year 5:

LOADING...

(Click here to view the statement of financial position for Gandolf.)

During Year 6, the following took place:

| 1. | Receipts from trade receivables totalled 235,000. |

| 2. | Payments to trade payables totalled 104,000. |

| 3. | Credit sales revenue for the year totalled 262,000 (cost 143,000). |

| 4. | Depreciation of land and buildings is 2% on cost, depreciation of motor vans is 25% on cost and depreciation of fixtures and fittings is 10% on cost per year. |

| 5. | Inventories totalling 137,000 were purchased on credit. |

| 6. | Interest on the loan is 6,000 a year, of which 3,000 has been paid by the end of the year. |

| 7. | Salaries and wages totalling 56,200 were paid during the year and a further 4,000 was outstanding at the end of the year. |

| 8. | Rates of 10,800, for the period to 31 December Year 6, were paid during the year. |

| 9. | Heating and lighting bills for the first three quarters totalling 18,000 were paid during the year. The final quarter bill totalling 3,300 had not been paid by the year end. |

| 10. | Gandolf withdrew 8,500 during the year for his own use. |

| 11. | Motor running expenses totalling 9,400 were paid during the year. |

Required:

Prepare an income statement for the year to that date.

(Fill in the relevant cells with its corresponding figures. Negative figures should be entered in brackets.)

ACCO1116-Jan start 20121 1. trade receivable totalled 3.1 The income statement 235000. 2. trade payable totalled 104000. 21 of 36 (35 complete) - X i Data Table Statement of financial position as at 31 December Year 5 6 Exercise 3.1.25 3 Credit sales revenue for the year totalled 262,000 (cost 143,000) 4. Depreciation of land and buildings is 2% on cost, depreciation of motor vans is 25% on cost and depreciation of fixtures and fittings is 10% on cost per year. 5 Inventories totalling 137 000 were purchased on credit Interest on the loan is 6,000 a year of which 3,000 has been paid by the end of the year 1 Salaries and wages totaling 56,200 were paid during the year and a further 4,000 was outstanding at the end of the year 8. Rates of 10,800, for the period to 31 December Year 6 were paid during the year, 9 Heating and lighting bills for the first three quarters totaling 18,000 were paid during the year. The final quarter bill totalling 3,300 had not been paid by the year end 10 Gandolf withdrew 8,500 during the year for his own use 11. Motor running expenses totalling 9.400 were paid during the year. ASSETS Noncurrent assets Land and buildings 84,770 Accumulated depreciation Motor vans at cost Accumulated depreciation Fixtures and fittings at cost 86,500 (1.730) 30,000 (7.500) 22,500 Gandolt Income statement for the year ended 31 December Year 6 20,000 16,000 Accumulated depreciation (4.000) Sales revenue 123,270 Current assets Inventories Trade receivables 62,000 74,000 5,230 Cash at bank 141 230 Cost of sales Gross profit Salaries and wages (56,200 +4,000) Rates Heating and lighting E(18,000 + 3,300) Motor running expenses Depreciation Motor vans (25% * 30,000) Land and buildings (2% = 86,500) Fixtures and fittings (10% 20,000) Loan Interest Profit for the year ANTINO 264,500 Total assets EQUITY AND LIABILITIES Equity (or capital) Balance at year end Noncurrent liabilities 143,500 Loan 60,000 Current liabilities Print Done Enter any number in the edit fields, then click CheckStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started