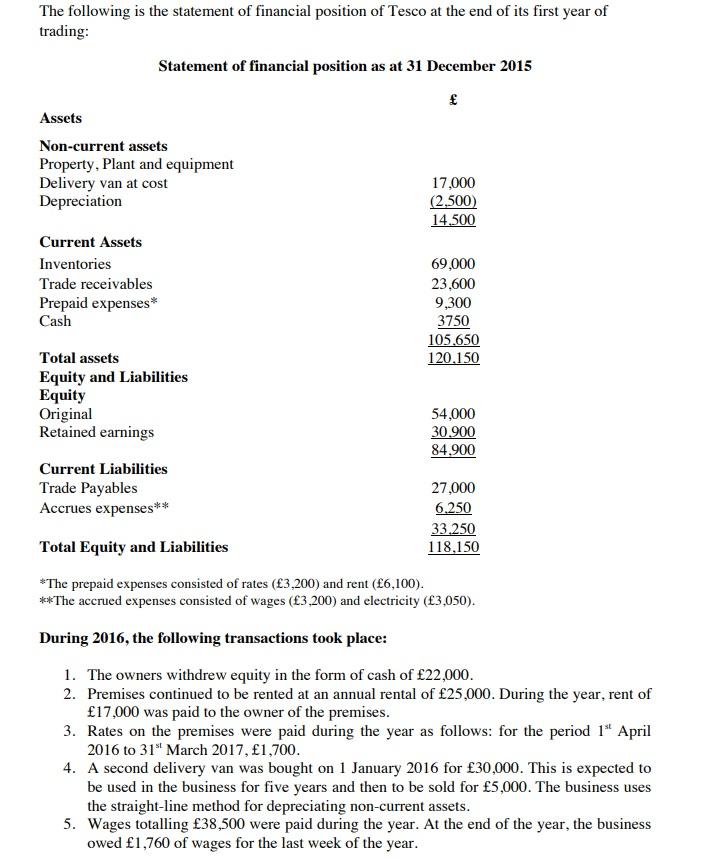

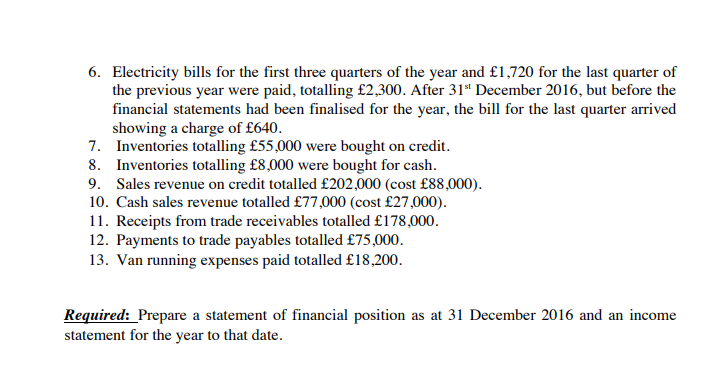

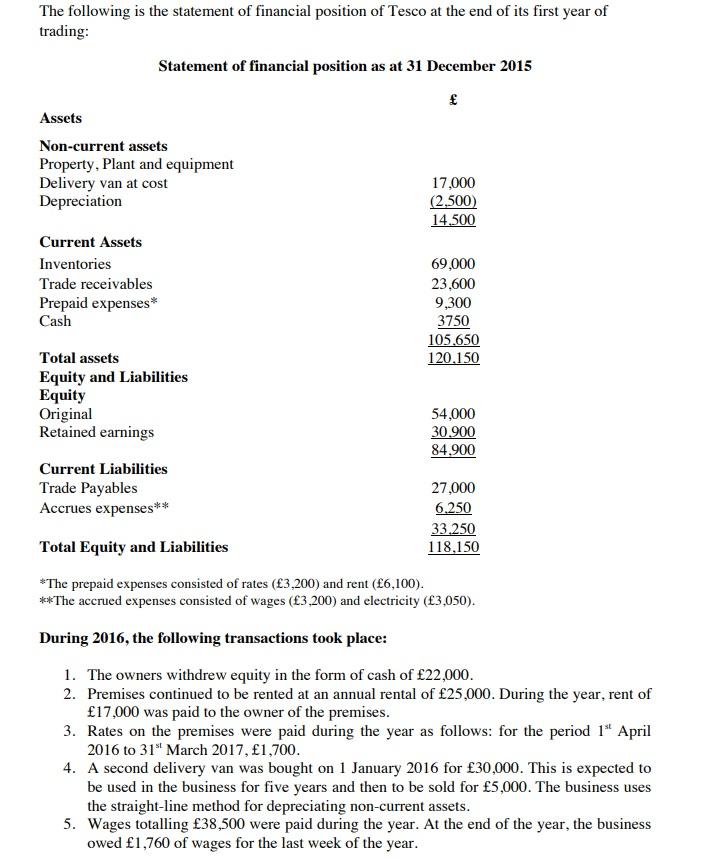

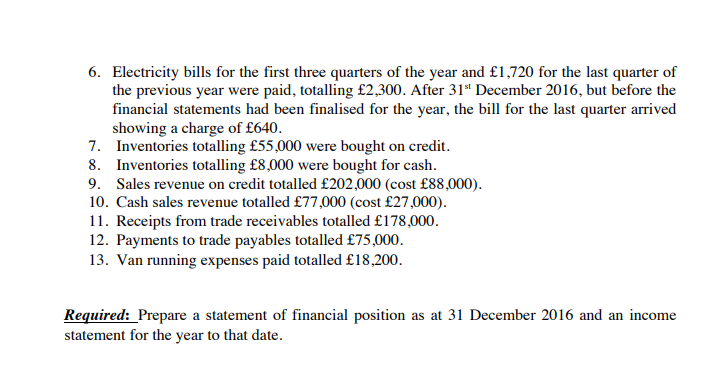

The following is the statement of financial position of Tesco at the end of its first year of trading: Statement of financial position as at 31 December 2015 Assets Non-current assets Property, Plant and equipment Delivery van at cost 17,000 Depreciation (2,500) 14.500 Current Assets Inventories 69,000 Trade receivables 23,600 Prepaid expenses* 9,300 Cash 3750 105.650 Total assets 120.150 Equity and Liabilities Equity Original 54,000 Retained earnings 30.900 84.900 Current Liabilities Trade Payables 27,000 Accrues expenses** 6.250 33.250 Total Equity and Liabilities 118,150 *The prepaid expenses consisted of rates (3,200) and rent (6,100). **The accrued expenses consisted of wages (3,200) and electricity (3,050). During 2016, the following transactions took place: 1. The owners withdrew equity in the form of cash of 22,000. 2. Premises continued to be rented at an annual rental of 25,000. During the year, rent of 17,000 was paid to the owner of the premises. 3. Rates on the premises were paid during the year as follows: for the period 1" April 2016 to 31" March 2017, 1,700. 4. A second delivery van was bought on 1 January 2016 for 30,000. This is expected to be used in the business for five years and then to be sold for 5,000. The business uses the straight-line method for depreciating non-current assets. 5. Wages totalling 38,500 were paid during the year. At the end of the year, the business owed 1,760 of wages for the last week of the year. 6. Electricity bills for the first three quarters of the year and 1,720 for the last quarter of the previous year were paid, totalling 2,300. After 31" December 2016, but before the financial statements had been finalised for the year, the bill for the last quarter arrived showing a charge of 640. 7. Inventories totalling 55,000 were bought on credit. 8. Inventories totalling 8,000 were bought for cash. 9. Sales revenue on credit totalled 202,000 (cost 88,000). 10. Cash sales revenue totalled 77,000 (cost 27,000). 11. Receipts from trade receivables totalled 178,000. 12. Payments to trade payables totalled 75,000. 13. Van running expenses paid totalled 18,200. Required: _Prepare a statement of financial position as at 31 December 2016 and an income statement for the year to that date. The following is the statement of financial position of Tesco at the end of its first year of trading: Statement of financial position as at 31 December 2015 Assets Non-current assets Property, Plant and equipment Delivery van at cost 17,000 Depreciation (2,500) 14.500 Current Assets Inventories 69,000 Trade receivables 23,600 Prepaid expenses* 9,300 Cash 3750 105.650 Total assets 120.150 Equity and Liabilities Equity Original 54,000 Retained earnings 30.900 84.900 Current Liabilities Trade Payables 27,000 Accrues expenses** 6.250 33.250 Total Equity and Liabilities 118,150 *The prepaid expenses consisted of rates (3,200) and rent (6,100). **The accrued expenses consisted of wages (3,200) and electricity (3,050). During 2016, the following transactions took place: 1. The owners withdrew equity in the form of cash of 22,000. 2. Premises continued to be rented at an annual rental of 25,000. During the year, rent of 17,000 was paid to the owner of the premises. 3. Rates on the premises were paid during the year as follows: for the period 1" April 2016 to 31" March 2017, 1,700. 4. A second delivery van was bought on 1 January 2016 for 30,000. This is expected to be used in the business for five years and then to be sold for 5,000. The business uses the straight-line method for depreciating non-current assets. 5. Wages totalling 38,500 were paid during the year. At the end of the year, the business owed 1,760 of wages for the last week of the year. 6. Electricity bills for the first three quarters of the year and 1,720 for the last quarter of the previous year were paid, totalling 2,300. After 31" December 2016, but before the financial statements had been finalised for the year, the bill for the last quarter arrived showing a charge of 640. 7. Inventories totalling 55,000 were bought on credit. 8. Inventories totalling 8,000 were bought for cash. 9. Sales revenue on credit totalled 202,000 (cost 88,000). 10. Cash sales revenue totalled 77,000 (cost 27,000). 11. Receipts from trade receivables totalled 178,000. 12. Payments to trade payables totalled 75,000. 13. Van running expenses paid totalled 18,200. Required: _Prepare a statement of financial position as at 31 December 2016 and an income statement for the year to that date