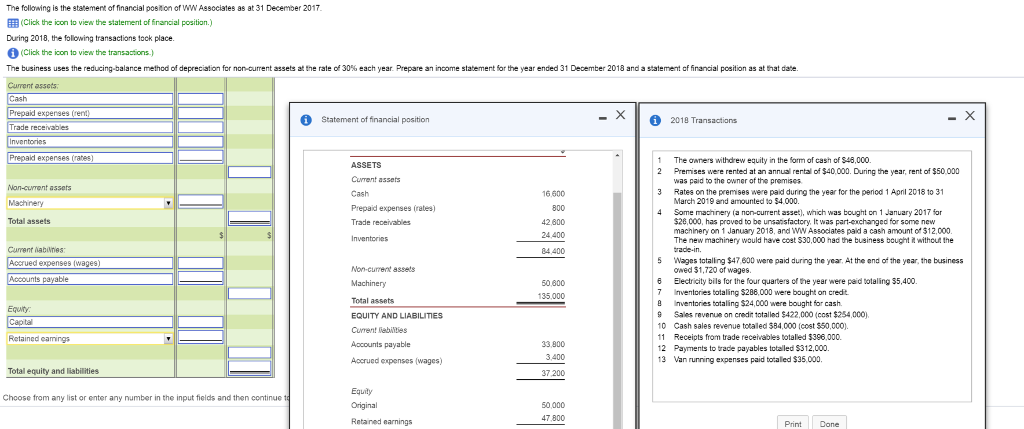

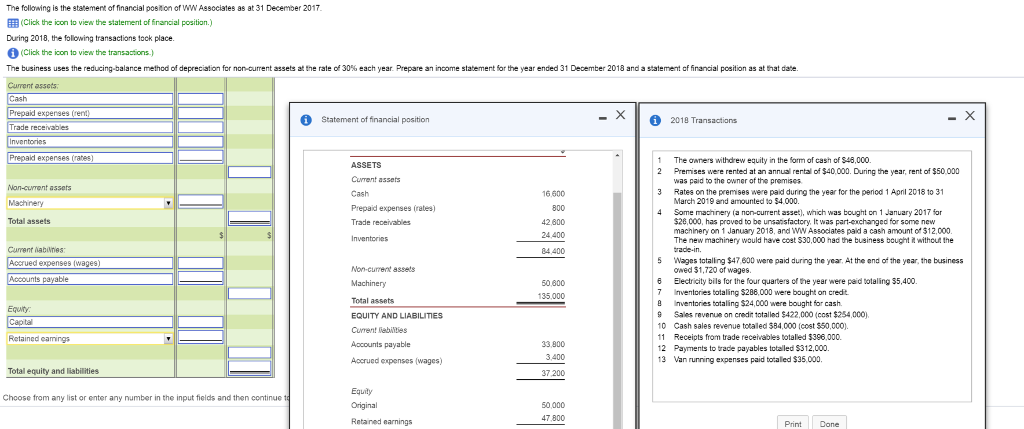

The following is the statement of financial poston ef WW Associates as at31 December 2017 Click the icon to view the statement of financial positian.) During 2018, the folowing transactions tock place (Click the icon to view the transactions The business uses the reducing balance method o depreciato for nonourrent assets at the rate of 30% each year Prepare an inoorme statement for the year ended 31 December 2018 and a statement of nanaal position as at at date 55015 Prepaid expenses (ren Statement of financial position 2018 Transactions Prepaid expenses (rabes) 1 The awners withdrew equity in the form of cash of S48,000. was paid to the owner of the premises March 2019 and amounted to $4,000. ASSETS 2 Premises were rented at an annua rental of $40,000. During the year, rent of $50,000 3 Rates on the premses were paid during the year for the period 1Apnl 2018 1o 31 4 Some machinery (a non-current asset), which was bought on 1 January 2017 for Cuvrent assets Nan-cLTent assets 16,600 Prepaid expenses (rates) Trade receivables Total assets 42 800 24.400 84 400 $28,000, has proved to be unsatisfactory It was part-exchanged for some new machinery on 1 January 2018, and WW Associates pald a cash amount of $12,000. The new machinery would have cost $30,000 had the business bought iwithout the Current nabines ued eoxpenses (wages) 5 Wages totalling $47,800 were paid during the year. At the end of the year, the business Non-current assets owed $1,720 of wages nts payable 50800 Electricity bils for the four quarters of the year were paid botaling 35,400. Inventories botaling $288,000 were bought on credt Inventories botaling $24,000 were bought for cash 135.000 Total assets EQUITY AND LIABILITIES Current iebilities Accounts payable Accrued expenses (wages) Sales revenue on credit totalled $422,000 (cost $254,000). 10 Cash sales revenue totaled $84,000 (cost $50,000). 11 Receipts from trade receivables totaled $396,000 tal Retained camings 33,800 3.400 37 200 12 Payments to trade payables totalled S312,000. 3 Van running expenses paid totaled $35,000. Total equity and liabilities Choose from any list or enter any number in the input fields and then continue 50 000 47.800 Reta ned earnings Print Cone