Answered step by step

Verified Expert Solution

Question

1 Approved Answer

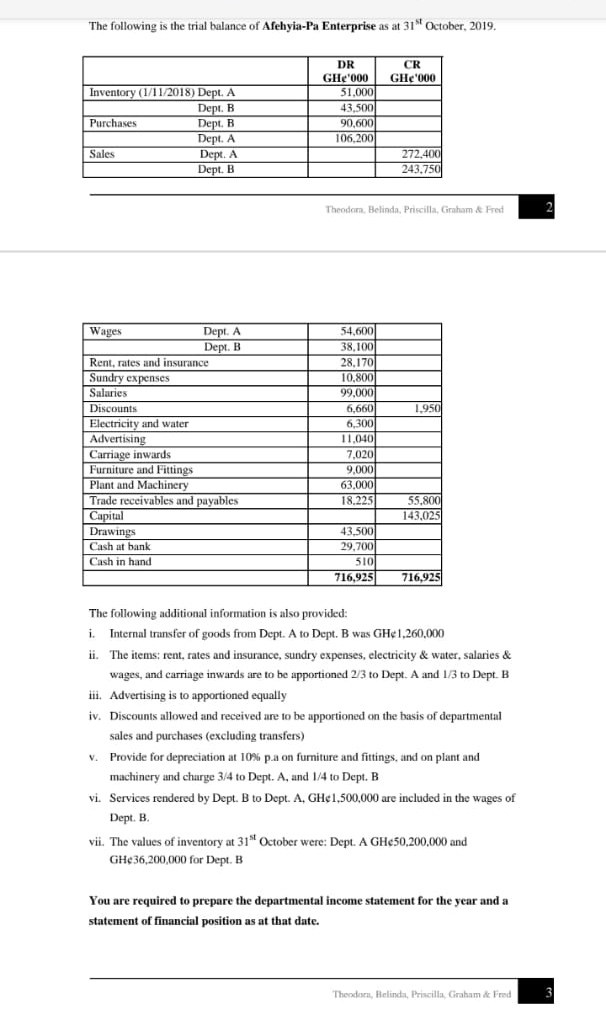

The following is the trial balance of Afehyia-Pa Enterprise as at 31st October, 2019. Theodom, Belinda, Priscilla, Ginham & Fred The following additional information is

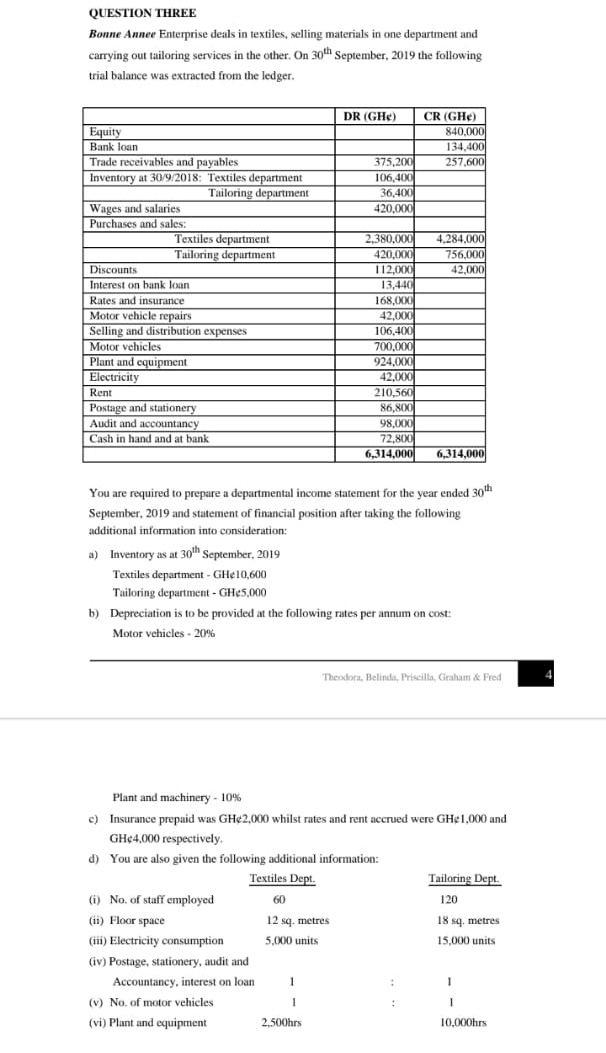

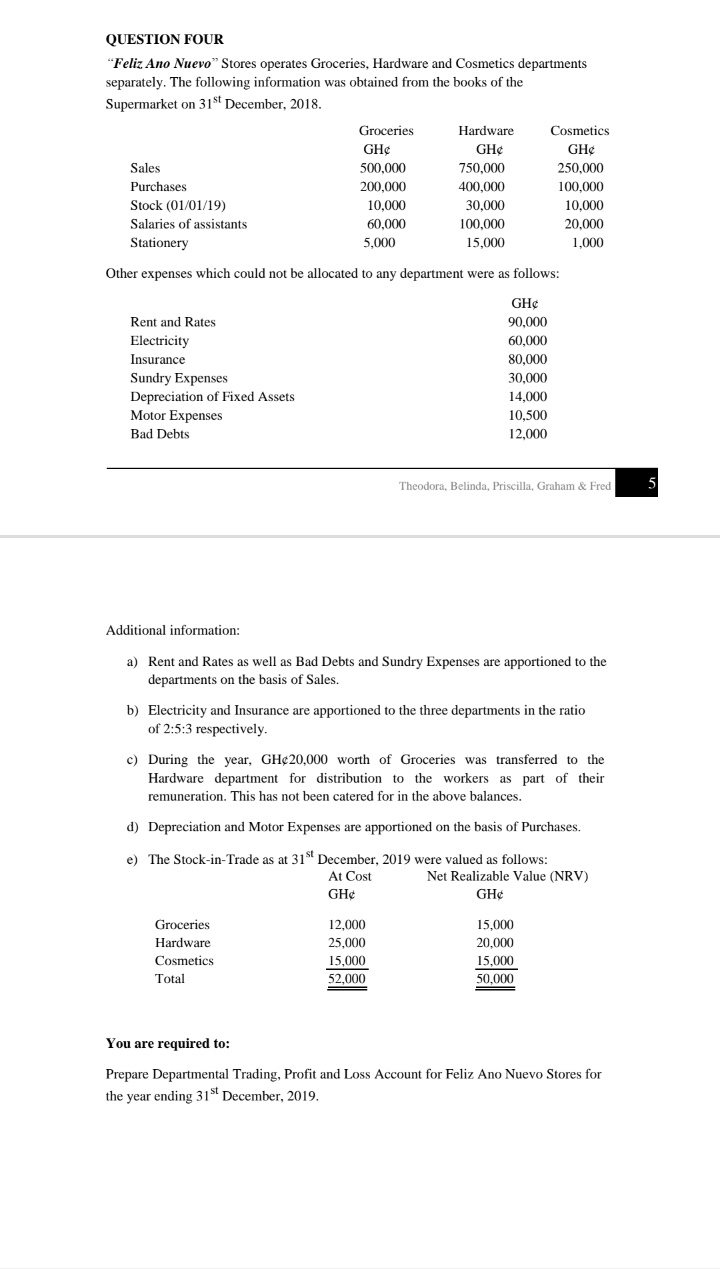

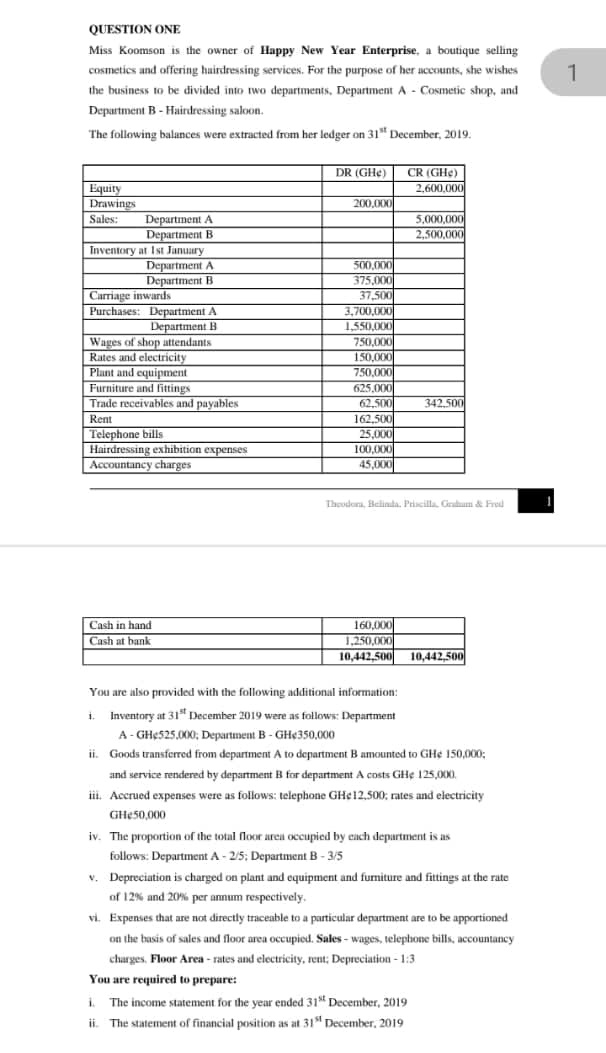

The following is the trial balance of Afehyia-Pa Enterprise as at 31st October, 2019. Theodom, Belinda, Priscilla, Ginham \& Fred The following additional information is also provided: i. Internal trunsfer of goods from Dept. A to Dept. B was GHe1,260,000 ii. The items; rent, rates and insurance, sundry expenses, electricity \& water, salaries \& wages, and carriage inwards are to be apportioned 2/3 to Dept. A and 1/3 to Dept. B iii. Advertising is to apportioned equally iv. Discounts allowed and received are to be apportioned on the basis of departmental sales and purchases (excluding transfers) v. Provide for depreciation at 10% p.a on furniture and fittings, and on plant and machinery and charge 3/4 to Dept. A, and 1/4 to Dept. B vi. Services rendered by Dept. B to Dept. A, GHe 1,500,000 are included in the wages of Dept. B. vii. The values of inventory at 31st October were: Dept. A GHe50,200,000 and GHe 36,200,000 for Dept. B You are required to prepare the departmental income statement for the year and a statement of financial position as at that date. QUESTION THREE Bonne Annee Enterprise deals in textiles, selling materials in one department and carrying out tailoring services in the other. On 30th September, 2019 the following trial balance was extracted from the ledger. You are required to prepare a departmental income statement for the year ended 30th September, 2019 and statement of financial position after taking the following additional information into consideration: a) Inventory as at 30th September, 2019 Textiles department - GHe10,600 Tailoring department - GH 5,000 b) Depreciation is to be provided at the following rates per annum on cost: Motor vehicles - 20% Theobora, Belinda, Prisella, Graham \& Fred Plant and machinery - 10% c) Insurance prepaid was GH/2,000 whilst rates and rent acerued were GH1,000 and GHe4,000 respectively. d) You are also given the following additional information: QUESTION FOUR "Feliz Ano Nuevo" Stores operates Groceries, Hardware and Cosmetics departments separately. The following information was obtained from the books of the Supermarket on 31st December, 2018. Other expenses which could not be allocated to any department were as follows: Theodora, Belinda, Priscilla, Graham \& Fred Additional information: a) Rent and Rates as well as Bad Debts and Sundry Expenses are apportioned to the departments on the basis of Sales. b) Electricity and Insurance are apportioned to the three departments in the ratio of 2:5:3 respectively. c) During the year, GH20,000 worth of Groceries was transferred to the Hardware department for distribution to the workers as part of their remuneration. This has not been catered for in the above balances. d) Depreciation and Motor Expenses are apportioned on the basis of Purchases. You are required to: Prepare Departmental Trading, Profit and Loss Account for Feliz Ano Nuevo Stores for the year ending 31st December, 2019 . QUESTION ONE Miss Koomson is the owner of Happy New Year Enterprise, a boutique selling cosmetics and offering hairdressing services. For the purpose of her accounts, she wishes the business to be divided into two departments, Depariment A - Cosmetic shop, and Deputment B - Hairdressing saloon. The following balances were extracted from her ledger on 31st December, 2019. You are also provided with the following additional information: i. Inventory at 31st December 2019 were as follows: Department A - GH 525,000; Department B - GH 350,000 ii. Goods transferred from department A to department B amounted to GHe 150,000; and service rendered by deparment B for department A costs GHe 125,000. iii. Accrued expenses were as follows: telephone GHe12,500; rates and electricity GHe50,000 iv. The proportion of the total floor area occupied by each department is as follows: Department A - 2/5; Department B - 3/5 v. Depreciation is charged on plant and equipment and furmiture and fittings at the rate of 12% and 20% per annum respectively. vi. Expenses that are not directly traceable to a particular department are to be apportioned on the basis of sales and floot area occupied. Sales - wages, telephone bills, accountancy charges. Floor Area - rates and electricity, rent; Depreciation - 1:3 You are required to prepare: i. The income statement for the year ended 31st December, 2019 ii. The satement of financial position as at 31st December. 2019 The following is the trial balance of Afehyia-Pa Enterprise as at 31st October, 2019. Theodom, Belinda, Priscilla, Ginham \& Fred The following additional information is also provided: i. Internal trunsfer of goods from Dept. A to Dept. B was GHe1,260,000 ii. The items; rent, rates and insurance, sundry expenses, electricity \& water, salaries \& wages, and carriage inwards are to be apportioned 2/3 to Dept. A and 1/3 to Dept. B iii. Advertising is to apportioned equally iv. Discounts allowed and received are to be apportioned on the basis of departmental sales and purchases (excluding transfers) v. Provide for depreciation at 10% p.a on furniture and fittings, and on plant and machinery and charge 3/4 to Dept. A, and 1/4 to Dept. B vi. Services rendered by Dept. B to Dept. A, GHe 1,500,000 are included in the wages of Dept. B. vii. The values of inventory at 31st October were: Dept. A GHe50,200,000 and GHe 36,200,000 for Dept. B You are required to prepare the departmental income statement for the year and a statement of financial position as at that date. QUESTION THREE Bonne Annee Enterprise deals in textiles, selling materials in one department and carrying out tailoring services in the other. On 30th September, 2019 the following trial balance was extracted from the ledger. You are required to prepare a departmental income statement for the year ended 30th September, 2019 and statement of financial position after taking the following additional information into consideration: a) Inventory as at 30th September, 2019 Textiles department - GHe10,600 Tailoring department - GH 5,000 b) Depreciation is to be provided at the following rates per annum on cost: Motor vehicles - 20% Theobora, Belinda, Prisella, Graham \& Fred Plant and machinery - 10% c) Insurance prepaid was GH/2,000 whilst rates and rent acerued were GH1,000 and GHe4,000 respectively. d) You are also given the following additional information: QUESTION FOUR "Feliz Ano Nuevo" Stores operates Groceries, Hardware and Cosmetics departments separately. The following information was obtained from the books of the Supermarket on 31st December, 2018. Other expenses which could not be allocated to any department were as follows: Theodora, Belinda, Priscilla, Graham \& Fred Additional information: a) Rent and Rates as well as Bad Debts and Sundry Expenses are apportioned to the departments on the basis of Sales. b) Electricity and Insurance are apportioned to the three departments in the ratio of 2:5:3 respectively. c) During the year, GH20,000 worth of Groceries was transferred to the Hardware department for distribution to the workers as part of their remuneration. This has not been catered for in the above balances. d) Depreciation and Motor Expenses are apportioned on the basis of Purchases. You are required to: Prepare Departmental Trading, Profit and Loss Account for Feliz Ano Nuevo Stores for the year ending 31st December, 2019 . QUESTION ONE Miss Koomson is the owner of Happy New Year Enterprise, a boutique selling cosmetics and offering hairdressing services. For the purpose of her accounts, she wishes the business to be divided into two departments, Depariment A - Cosmetic shop, and Deputment B - Hairdressing saloon. The following balances were extracted from her ledger on 31st December, 2019. You are also provided with the following additional information: i. Inventory at 31st December 2019 were as follows: Department A - GH 525,000; Department B - GH 350,000 ii. Goods transferred from department A to department B amounted to GHe 150,000; and service rendered by deparment B for department A costs GHe 125,000. iii. Accrued expenses were as follows: telephone GHe12,500; rates and electricity GHe50,000 iv. The proportion of the total floor area occupied by each department is as follows: Department A - 2/5; Department B - 3/5 v. Depreciation is charged on plant and equipment and furmiture and fittings at the rate of 12% and 20% per annum respectively. vi. Expenses that are not directly traceable to a particular department are to be apportioned on the basis of sales and floot area occupied. Sales - wages, telephone bills, accountancy charges. Floor Area - rates and electricity, rent; Depreciation - 1:3 You are required to prepare: i. The income statement for the year ended 31st December, 2019 ii. The satement of financial position as at 31st December. 2019

The following is the trial balance of Afehyia-Pa Enterprise as at 31st October, 2019. Theodom, Belinda, Priscilla, Ginham \& Fred The following additional information is also provided: i. Internal trunsfer of goods from Dept. A to Dept. B was GHe1,260,000 ii. The items; rent, rates and insurance, sundry expenses, electricity \& water, salaries \& wages, and carriage inwards are to be apportioned 2/3 to Dept. A and 1/3 to Dept. B iii. Advertising is to apportioned equally iv. Discounts allowed and received are to be apportioned on the basis of departmental sales and purchases (excluding transfers) v. Provide for depreciation at 10% p.a on furniture and fittings, and on plant and machinery and charge 3/4 to Dept. A, and 1/4 to Dept. B vi. Services rendered by Dept. B to Dept. A, GHe 1,500,000 are included in the wages of Dept. B. vii. The values of inventory at 31st October were: Dept. A GHe50,200,000 and GHe 36,200,000 for Dept. B You are required to prepare the departmental income statement for the year and a statement of financial position as at that date. QUESTION THREE Bonne Annee Enterprise deals in textiles, selling materials in one department and carrying out tailoring services in the other. On 30th September, 2019 the following trial balance was extracted from the ledger. You are required to prepare a departmental income statement for the year ended 30th September, 2019 and statement of financial position after taking the following additional information into consideration: a) Inventory as at 30th September, 2019 Textiles department - GHe10,600 Tailoring department - GH 5,000 b) Depreciation is to be provided at the following rates per annum on cost: Motor vehicles - 20% Theobora, Belinda, Prisella, Graham \& Fred Plant and machinery - 10% c) Insurance prepaid was GH/2,000 whilst rates and rent acerued were GH1,000 and GHe4,000 respectively. d) You are also given the following additional information: QUESTION FOUR "Feliz Ano Nuevo" Stores operates Groceries, Hardware and Cosmetics departments separately. The following information was obtained from the books of the Supermarket on 31st December, 2018. Other expenses which could not be allocated to any department were as follows: Theodora, Belinda, Priscilla, Graham \& Fred Additional information: a) Rent and Rates as well as Bad Debts and Sundry Expenses are apportioned to the departments on the basis of Sales. b) Electricity and Insurance are apportioned to the three departments in the ratio of 2:5:3 respectively. c) During the year, GH20,000 worth of Groceries was transferred to the Hardware department for distribution to the workers as part of their remuneration. This has not been catered for in the above balances. d) Depreciation and Motor Expenses are apportioned on the basis of Purchases. You are required to: Prepare Departmental Trading, Profit and Loss Account for Feliz Ano Nuevo Stores for the year ending 31st December, 2019 . QUESTION ONE Miss Koomson is the owner of Happy New Year Enterprise, a boutique selling cosmetics and offering hairdressing services. For the purpose of her accounts, she wishes the business to be divided into two departments, Depariment A - Cosmetic shop, and Deputment B - Hairdressing saloon. The following balances were extracted from her ledger on 31st December, 2019. You are also provided with the following additional information: i. Inventory at 31st December 2019 were as follows: Department A - GH 525,000; Department B - GH 350,000 ii. Goods transferred from department A to department B amounted to GHe 150,000; and service rendered by deparment B for department A costs GHe 125,000. iii. Accrued expenses were as follows: telephone GHe12,500; rates and electricity GHe50,000 iv. The proportion of the total floor area occupied by each department is as follows: Department A - 2/5; Department B - 3/5 v. Depreciation is charged on plant and equipment and furmiture and fittings at the rate of 12% and 20% per annum respectively. vi. Expenses that are not directly traceable to a particular department are to be apportioned on the basis of sales and floot area occupied. Sales - wages, telephone bills, accountancy charges. Floor Area - rates and electricity, rent; Depreciation - 1:3 You are required to prepare: i. The income statement for the year ended 31st December, 2019 ii. The satement of financial position as at 31st December. 2019 The following is the trial balance of Afehyia-Pa Enterprise as at 31st October, 2019. Theodom, Belinda, Priscilla, Ginham \& Fred The following additional information is also provided: i. Internal trunsfer of goods from Dept. A to Dept. B was GHe1,260,000 ii. The items; rent, rates and insurance, sundry expenses, electricity \& water, salaries \& wages, and carriage inwards are to be apportioned 2/3 to Dept. A and 1/3 to Dept. B iii. Advertising is to apportioned equally iv. Discounts allowed and received are to be apportioned on the basis of departmental sales and purchases (excluding transfers) v. Provide for depreciation at 10% p.a on furniture and fittings, and on plant and machinery and charge 3/4 to Dept. A, and 1/4 to Dept. B vi. Services rendered by Dept. B to Dept. A, GHe 1,500,000 are included in the wages of Dept. B. vii. The values of inventory at 31st October were: Dept. A GHe50,200,000 and GHe 36,200,000 for Dept. B You are required to prepare the departmental income statement for the year and a statement of financial position as at that date. QUESTION THREE Bonne Annee Enterprise deals in textiles, selling materials in one department and carrying out tailoring services in the other. On 30th September, 2019 the following trial balance was extracted from the ledger. You are required to prepare a departmental income statement for the year ended 30th September, 2019 and statement of financial position after taking the following additional information into consideration: a) Inventory as at 30th September, 2019 Textiles department - GHe10,600 Tailoring department - GH 5,000 b) Depreciation is to be provided at the following rates per annum on cost: Motor vehicles - 20% Theobora, Belinda, Prisella, Graham \& Fred Plant and machinery - 10% c) Insurance prepaid was GH/2,000 whilst rates and rent acerued were GH1,000 and GHe4,000 respectively. d) You are also given the following additional information: QUESTION FOUR "Feliz Ano Nuevo" Stores operates Groceries, Hardware and Cosmetics departments separately. The following information was obtained from the books of the Supermarket on 31st December, 2018. Other expenses which could not be allocated to any department were as follows: Theodora, Belinda, Priscilla, Graham \& Fred Additional information: a) Rent and Rates as well as Bad Debts and Sundry Expenses are apportioned to the departments on the basis of Sales. b) Electricity and Insurance are apportioned to the three departments in the ratio of 2:5:3 respectively. c) During the year, GH20,000 worth of Groceries was transferred to the Hardware department for distribution to the workers as part of their remuneration. This has not been catered for in the above balances. d) Depreciation and Motor Expenses are apportioned on the basis of Purchases. You are required to: Prepare Departmental Trading, Profit and Loss Account for Feliz Ano Nuevo Stores for the year ending 31st December, 2019 . QUESTION ONE Miss Koomson is the owner of Happy New Year Enterprise, a boutique selling cosmetics and offering hairdressing services. For the purpose of her accounts, she wishes the business to be divided into two departments, Depariment A - Cosmetic shop, and Deputment B - Hairdressing saloon. The following balances were extracted from her ledger on 31st December, 2019. You are also provided with the following additional information: i. Inventory at 31st December 2019 were as follows: Department A - GH 525,000; Department B - GH 350,000 ii. Goods transferred from department A to department B amounted to GHe 150,000; and service rendered by deparment B for department A costs GHe 125,000. iii. Accrued expenses were as follows: telephone GHe12,500; rates and electricity GHe50,000 iv. The proportion of the total floor area occupied by each department is as follows: Department A - 2/5; Department B - 3/5 v. Depreciation is charged on plant and equipment and furmiture and fittings at the rate of 12% and 20% per annum respectively. vi. Expenses that are not directly traceable to a particular department are to be apportioned on the basis of sales and floot area occupied. Sales - wages, telephone bills, accountancy charges. Floor Area - rates and electricity, rent; Depreciation - 1:3 You are required to prepare: i. The income statement for the year ended 31st December, 2019 ii. The satement of financial position as at 31st December. 2019 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started