Question

The following is the trial balance of Asbar Sdn Bhd as at 31 December 2019. Unadjusted entries are as follows: 1. Sales of RM10,000 given

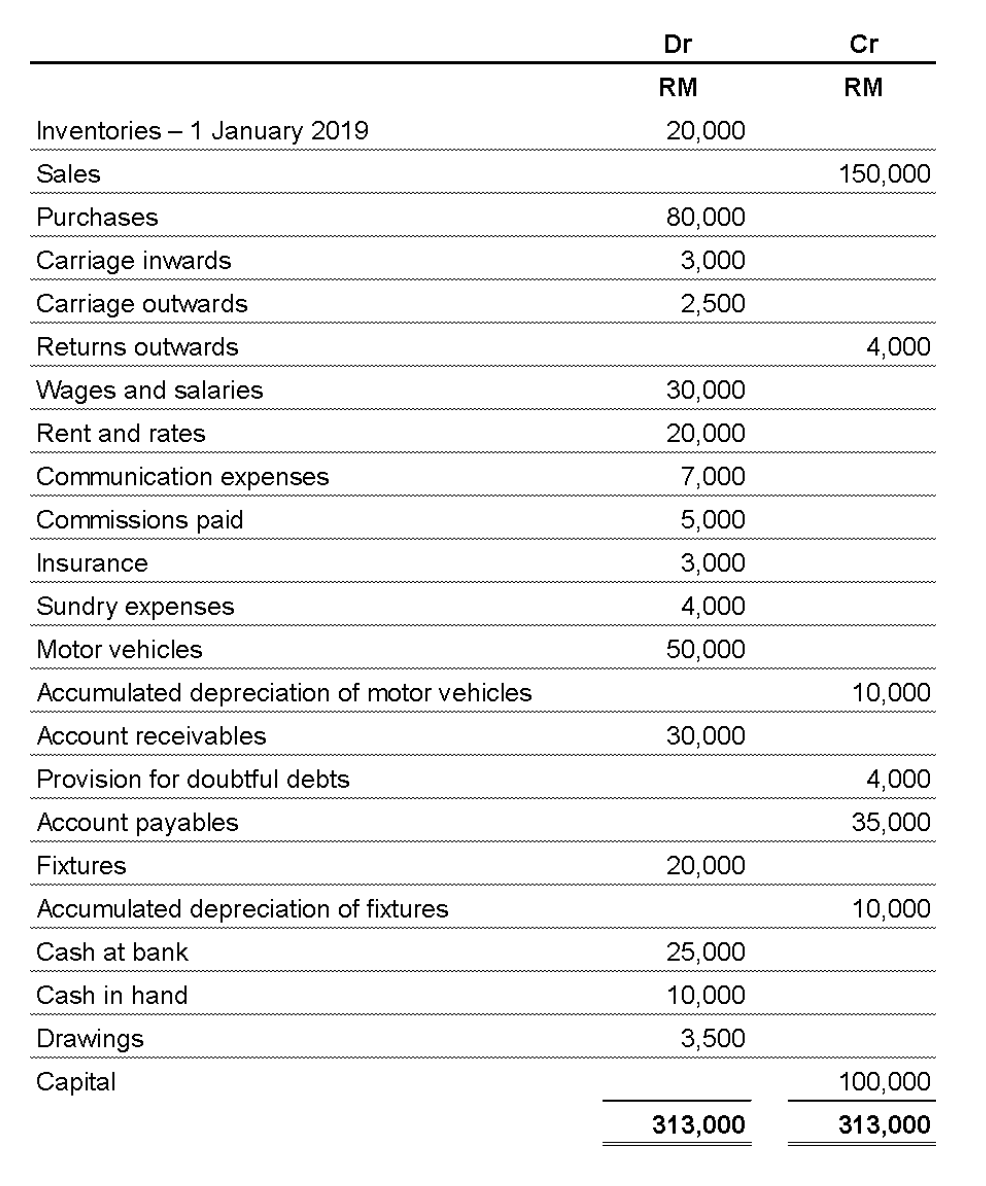

The following is the trial balance of Asbar Sdn Bhd as at 31 December 2019.

Unadjusted entries are as follows:

1. Sales of RM10,000 given 10% discount

2. Inventories at 31 December 2019 was RM63,000.

3. Cash donated to charity was RM8,000

4. Loan received from bank RM50,000 on 1 January 2019 @ 10% per annum with bullet repayment in 2022

5. Depreciation on cost

a. Motor vehicles 10% per annum; and

b. Fixtures 20% per annum

both straight-line method

6. The provision for bad debts is to be adjusted to 10 per cent of account receivables (after taking into consideration item 1).

| Required: a. Draw up a trading and profit and loss account for the year ending 31 December 2019. (8 marks) b. Statement of Financial Position as at 31 December 2019. (7 marks) |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started