Question

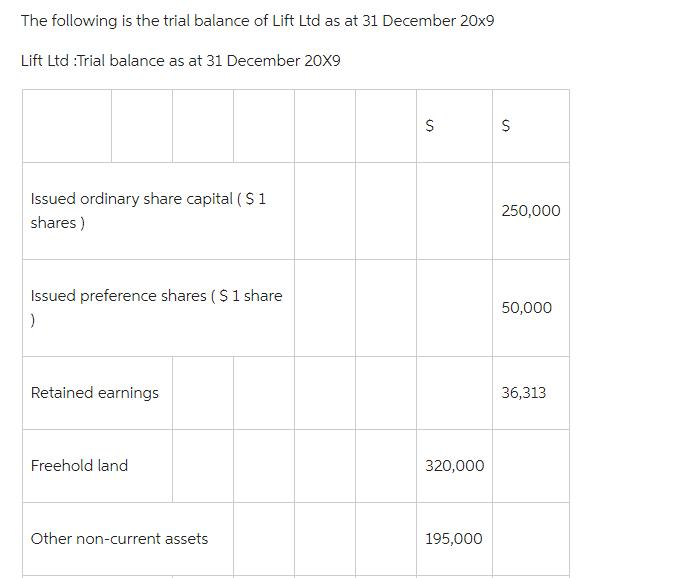

The following is the trial balance of Lift Ltd as at 31 December 20x9 Lift Ltd :Trial balance as at 31 December 20X9 Issued

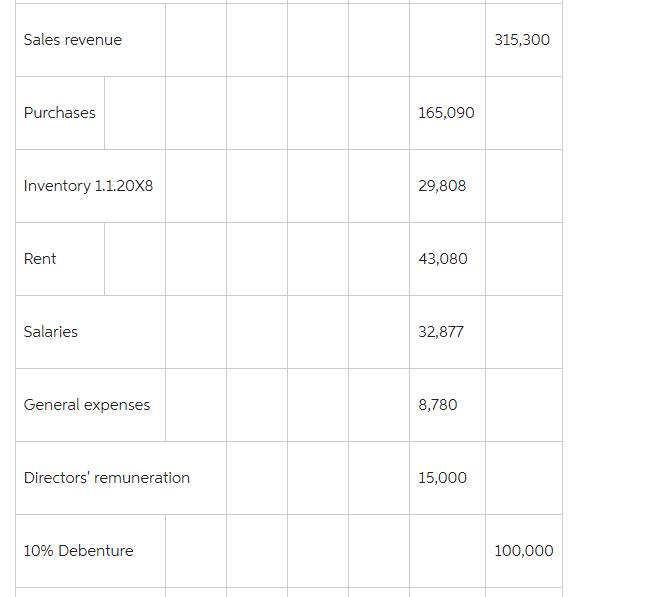

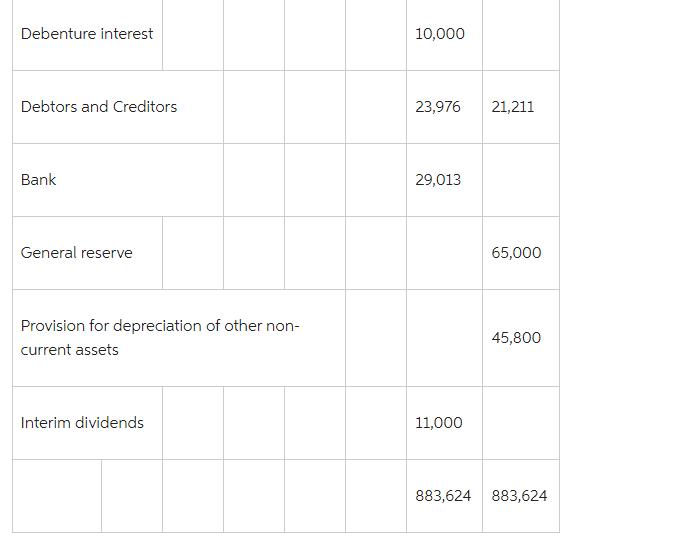

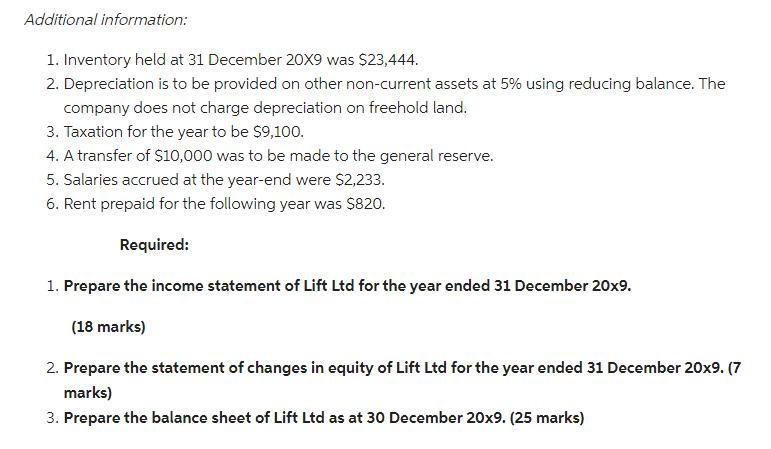

The following is the trial balance of Lift Ltd as at 31 December 20x9 Lift Ltd :Trial balance as at 31 December 20X9 Issued ordinary share capital ($1 shares ) Issued preference shares ($1 share ) Retained earnings Freehold land Other non-current assets S 320,000 195,000 S 250,000 50,000 36,313 Sales revenue Purchases Inventory 1.1.20X8 Rent Salaries General expenses Directors' remuneration 10% Debenture 165,090 29,808 43,080 32,877 8,780 15,000 315,300 100,000 Debenture interest Debtors and Creditors Bank General reserve Provision for depreciation of other non- current assets Interim dividends 10,000 23,976 29,013 11,000 21,211 65,000 45,800 883,624 883,624 Additional information: 1. Inventory held at 31 December 20X9 was $23,444. 2. Depreciation is to be provided on other non-current assets at 5% using reducing balance. The company does not charge depreciation on freehold land. 3. Taxation for the year to be $9,100. 4. A transfer of $10,000 was to be made to the general reserve. 5. Salaries accrued at the year-end were $2,233. 6. Rent prepaid for the following year was $820. Required: 1. Prepare the income statement of Lift Ltd for the year ended 31 December 20x9. (18 marks) 2. Prepare the statement of changes in equity of Lift Ltd for the year ended 31 December 20x9. (7 marks) 3. Prepare the balance sheet of Lift Ltd as at 30 December 20x9. (25 marks)

Step by Step Solution

3.54 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started