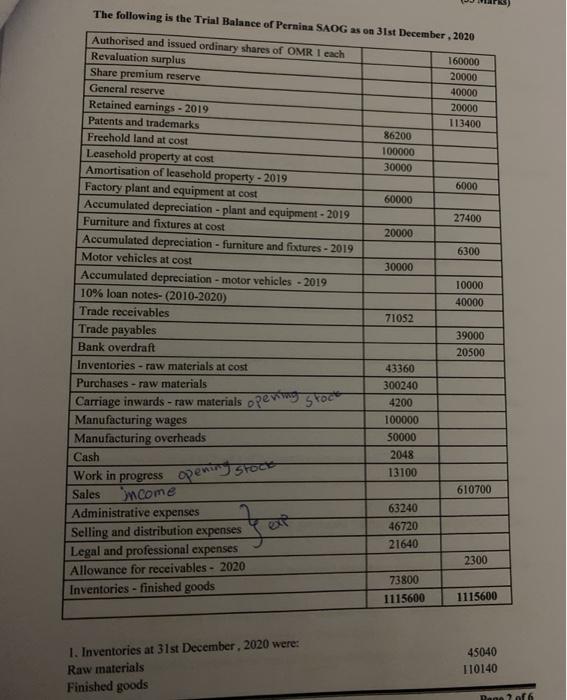

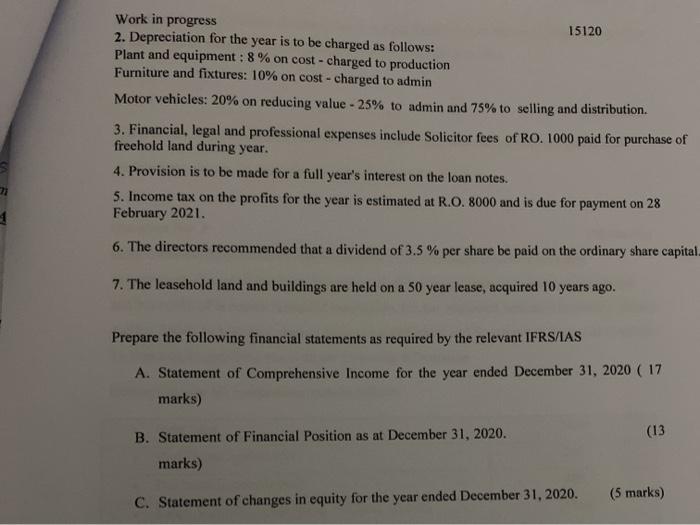

The following is the Trial Balance of Pernina SAOG as on 31st December, 2020 Authorised and issued ordinary shares of OMR I cach Revaluation surplus 160000 Share premium reserve 20000 General reserve 40000 Retained earnings - 2019 20000 Patents and trademarks 113400 86200 Freehold land at cost 100000 Leasehold property at cost 30000 Amortisation of leasehold property - 2019 6000 Factory plant and equipment at cost 60000 Accumulated depreciation - plant and equipment - 2019 27400 Furniture and fixtures at cost 20000 Accumulated depreciation - furniture and foctures - 2019 6300 Motor vehicles at cost 30000 Accumulated depreciation - motor vehicles - 2019 10000 10% loan notes- (2010-2020) 40000 Trade receivables 71052 Trade payables 39000 Bank overdraft 20500 Inventories - raw materials at cost 43360 Purchases - raw materials 300240 Carriage inwards - raw materials opening Stock 4200 Manufacturing wages 100000 50000 Manufacturing overheads 2048 Cash 13100 610700 Sales 63240 Administrative expenses 46720 Selling and distribution expenses 21640 Legal and professional expenses 2300 Allowance for receivables - 2020 73800 Inventories - finished goods 1115600 1115600 Work in progress opening stock Oncome 1. Inventories at 31st December, 2020 were: Raw materials Finished goods 45040 110140 Dane 2 of 6 Work in progress 15120 2. Depreciation for the year is to be charged as follows: Plant and equipment : 8% on cost-charged to production Furniture and fixtures: 10% on cost-charged to admin Motor vehicles: 20% on reducing value - 25% to admin and 75% to selling and distribution. 3. Financial, legal and professional expenses include Solicitor fees of RO. 1000 paid for purchase of freehold land during year. 4. Provision is to be made for a full year's interest on the loan notes. 5. Income tax on the profits for the year is estimated at R.O. 8000 and is due for payment on 28 February 2021. 6. The directors recommended that a dividend of 3.5 % per share be paid on the ordinary share capital. 7. The leasehold land and buildings are held on a 50 year lease, acquired 10 years ago. Prepare the following financial statements as required by the relevant IFRS/IAS A. Statement of Comprehensive Income for the year ended December 31, 2020 ( 17 marks) (13 B. Statement of Financial Position as at December 31, 2020. marks) (5 marks) C. Statement of changes in equity for the year ended December 31, 2020