Question

The following is the trial balance of Zachry Sdn Bhd as at 31 December 2021. Notes: Unadjusted entries are as follows: 1.10% discount on a

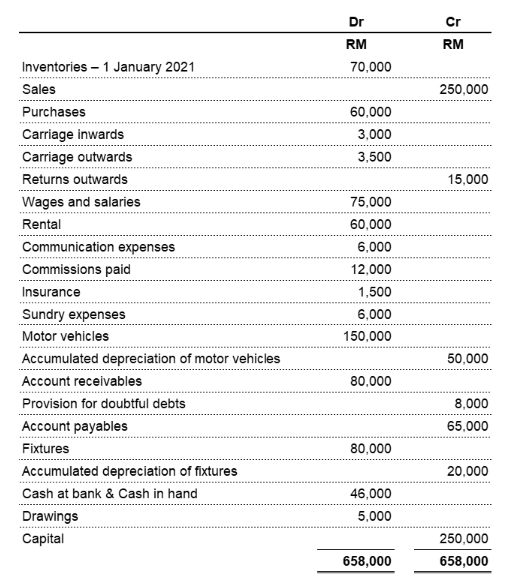

The following is the trial balance of Zachry Sdn Bhd as at 31 December 2021.

Notes: Unadjusted entries are as follows: 1.10% discount on a purchase of RM15,000 2.Inventories as of 31 December 2021 was RM45,000. 3.Drawing during the year are as follows a. Cash - RM1,000 b. Include in Sundry expenses, payment for his personal matters RM1,500 4.Loan received from bank RM100,000 on 1 July 2021 @ 5% per annum. Interest payment made accordingly on 31 December 2021. No principal payment required. 5.Depreciation on cost a.Motor vehicles 10% per annum (straight line method); and b.Fixtures 10% per annum (reducing balance method) 6.The provision for bad debts as of 31 December 2021 RM9,000 7.Posting Error a.Communication Expenses One of the transactions recorded as RM1,000 instead of RM100 Dr Bank Cr Communication Expenses

Required:

1. Draw up a trading and profit and loss account for the year ending 31 December 2021.

2. Statement of Financial Position as at 31 December 2021.

Inventories - 1 January 2021 Sales Purchases Carriage inwards Carriage outwards Returns outwards Wages and salaries Rental Communication expenses Commissions paid Insurance Sundry expenses Motor vehicles Accumulated depreciation of motor vehicles Account receivables Provision for doubtful debts Account payables Fixtures Accumulated depreciation of fixtures Cash at bank & Cash in hand Drawings Capital Dr RM 70,000 60,000 3,000 3,500 75,000 60,000 6,000 12,000 1,500 6,000 150,000 80,000 80,000 46,000 5,000 658,000 Cr RM 250,000 15,000 50,000 8,000 65,000 20,000 250,000 658,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started