Question

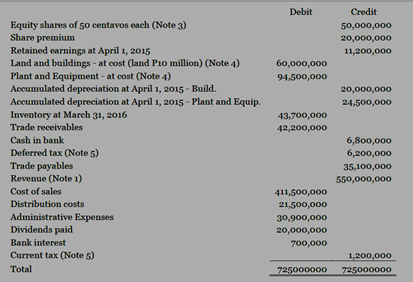

The following is the trial balance that relates to Reliever at March 31, 2016 Notes: 1. Revenue includes the sale of P10 million of maturing

The following is the trial balance that relates to Reliever at March 31, 2016

Notes:

1. Revenue includes the sale of P10 million of maturing inventory made to Speed on October 1, 2015. The cost of the goods at the date of sale was P7 million and Reliever has an option to repurchase these goods at any time within three years of the sale at a price of P10 million plus accrued interest from the date of sale at 10% per annum. At March 31, 2016, the option had not been exercised, but it is highly likely that it will be before the date it lapses.

2. At March 31, 2016, a provision is required for directors bonuses equal to 1% of revenue for this year.

3. On July 1, 2015, Reliever made and recorded a fully subscribed rights issue of 1 for 4 at P1.20 each. Immediately before this issue, the stock market value of the shares was P2.

4. A. On October 1, 2015, Reliever terminated the production of one of its product lines. From this date, the plant used to manufacture the product has been actively marketed at an advertised price of P4.2 million which is considered realistic. It is include in the trial balance at a cost of P9 million with accumulated depreciation (April 1, 205) of P5 million.

B. On April 1. 2015, the directors of Reliever decided that the financial statements would show an improved position if the land and buildings were revalued to market value. At that date, an independent valuer valued the land at P12 million and the buildings at P35 million and these valuations were accepted by the directors. The remaining life of the buildings at the date was 14 years. Reliever does not make a transfer to retained earnings for excess depreciation. (Assume for the purpose of this problem that this is correct). Ignore deferred tax on the revaluation surplus.

C. Plant and equipment is depreciated at 20% per annum using the reducing balance method and time apportioned as appropriate.

D. All depreciation is charged to cost of sales, but none has yet been charged on any non-current asset for the year ended March 31, 2016.

5. Reliever estimates that an income tax provision of P27.2 million is required for the year ended March 31, 2016 and at that date the liability to deferred tax id P9.4 million. The movement on deferred tax should be taken to profit or loss. The balance on current tax in the trial balance represents the under/over provision of the tax liability for the year ended March 31, 2015.

Questions:

1. How much is the total revenue for the year ended March 31, 2016?

2. How much is the total cost of sales for the year ended March 31, 2016?

3. How much is the total expenses for the year ended March 31, 2016?

4. How much is the total profit for the year ended March 31, 2016?

5. How much is the total comprehensive income for the year ended March 31, 2016?

6. How much is the total current assets for the year ended March 31, 2016?

7. How much is the total noncurrent assets for the year ended March 31, 2016?

8. How much is the total current liabilities for the year ended March 31, 2016?

9. How much is the total noncurrent liabilities for the year ended March 31, 2016?

10. How much is the total equity for the year ended for the year ended March 31, 2016?

11. What is the basic earnings per share for the year ended March 31, 2016?

Debit Credit 50,000,000 20,000,000 11,200,000 60,000,000 94,500,000 20,000,000 24,500,000 43,700,000 42,200,000 Equity shares of 50 centavos each (Note 3) Share premium Retained earnings at April 1, 2015 Land and buildings - at cost (land P10 million) (Note 4) Plant and Equipment - at cost (Note 4) Accumulated depreciation at April 1, 2015 - Build. Accumulated depreciation at April 1, 2015 - Plant and Equip. Inventory at March 31, 2016 Trade receivables Cash in bank Deferred tax (Note 5) Trade payables Revenue (Note 1) Cost of sales Distribution costs Administrative Expenses Dividends paid Bank interest Current tax (Note 5) Total 6,800,000 6,200,000 35,100,000 550,000,000 411,500,000 21,500,000 30,900,000 20,000,000 700,000 1,200,000 725000000 725000000 Debit Credit 50,000,000 20,000,000 11,200,000 60,000,000 94,500,000 20,000,000 24,500,000 43,700,000 42,200,000 Equity shares of 50 centavos each (Note 3) Share premium Retained earnings at April 1, 2015 Land and buildings - at cost (land P10 million) (Note 4) Plant and Equipment - at cost (Note 4) Accumulated depreciation at April 1, 2015 - Build. Accumulated depreciation at April 1, 2015 - Plant and Equip. Inventory at March 31, 2016 Trade receivables Cash in bank Deferred tax (Note 5) Trade payables Revenue (Note 1) Cost of sales Distribution costs Administrative Expenses Dividends paid Bank interest Current tax (Note 5) Total 6,800,000 6,200,000 35,100,000 550,000,000 411,500,000 21,500,000 30,900,000 20,000,000 700,000 1,200,000 725000000 725000000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started