Answered step by step

Verified Expert Solution

Question

1 Approved Answer

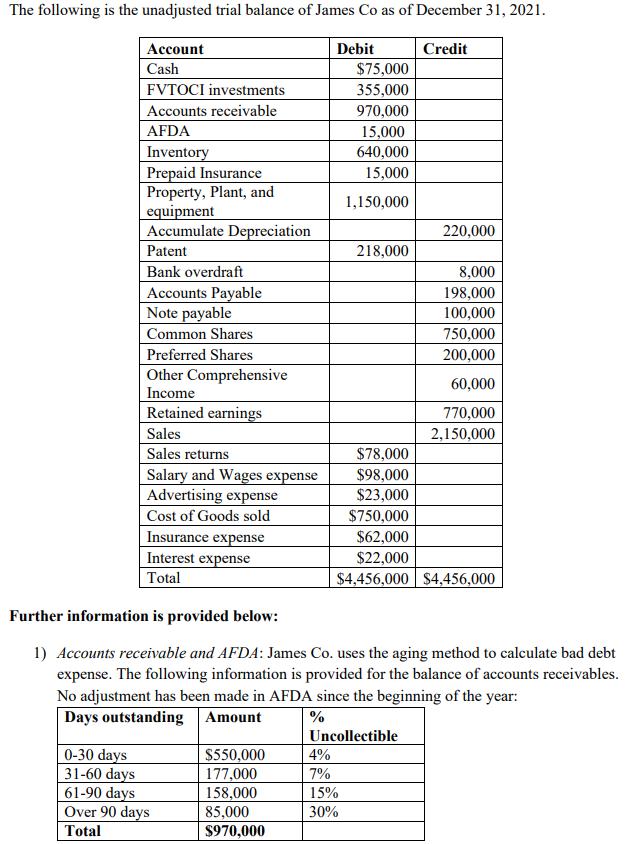

The following is the unadjusted trial balance of James Co as of December 31, 2021. Account Debit Credit Cash $75,000 FVTOCI investments 355,000 Accounts

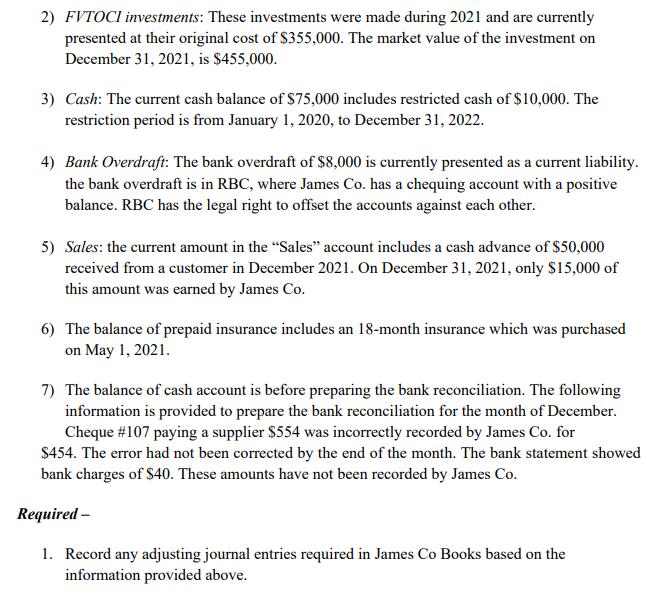

The following is the unadjusted trial balance of James Co as of December 31, 2021. Account Debit Credit Cash $75,000 FVTOCI investments 355,000 Accounts receivable AFDA 970,000 15,000 640,000 15,000 Inventory Prepaid Insurance Property, Plant, and equipment Accumulate Depreciation 1,150,000 220,000 Patent 218,000 Bank overdraft 8,000 Accounts Payable Note payable 198,000 100,000 Common Shares 750,000 Preferred Shares 200,000 Other Comprehensive Income Retained earnings Sales 60,000 770,000 2,150,000 Sales returns $78,000 Salary and Wages expense Advertising expense $98,000 $23,000 Cost of Goods sold $750,000 Insurance expense Interest expense $62,000 $22,000 $4,456,000 $4,456,000 Total Further information is provided below: 1) Accounts receivable and AFDA: James Co. uses the aging method to calculate bad debt expense. The following information is provided for the balance of accounts receivables. No adjustment has been made in AFDA since the beginning of the year: Days outstanding Amount Uncollectible 0-30 days 31-60 days 61-90 days Over 90 days $550,000 177,000 158,000 85,000 $970,000 4% 7% 15% 30% Total 2) FVTOCI investments: These investments were made during 2021 and are currently presented at their original cost of $355,000. The market value of the investment on December 31, 2021, is $455,000. 3) Cash: The current cash balance of S75,000 includes restricted cash of $10,000. The restriction period is from January 1, 2020, to December 31, 2022. 4) Bank Overdraft: The bank overdraft of $8,000 is currently presented as a current liability. the bank overdraft is in RBC, where James Co. has a chequing account with a positive balance. RBC has the legal right to offset the accounts against each other. 5) Sales: the current amount in the "Sales" account includes a cash advance of $50,000 received from a customer in December 2021. On December 31, 2021, only $15,000 of this amount was earned by James Co. 6) The balance of prepaid insurance includes an 18-month insurance which was purchased on May 1, 2021. 7) The balance of cash account is before preparing the bank reconciliation. The following information is provided to prepare the bank reconciliation for the month of December. Cheque #107 paying a supplier $554 was incorrectly recorded by James Co. for $454. The error had not been corrected by the end of the month. The bank statement showed bank charges of $40. These amounts have not been recorded by James Co. Required 1. Record any adjusting journal entries required in James Co Books based on the information provided above.

Step by Step Solution

★★★★★

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Adjusting Journal entries in the Books of James Co Account titl...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started