Answered step by step

Verified Expert Solution

Question

1 Approved Answer

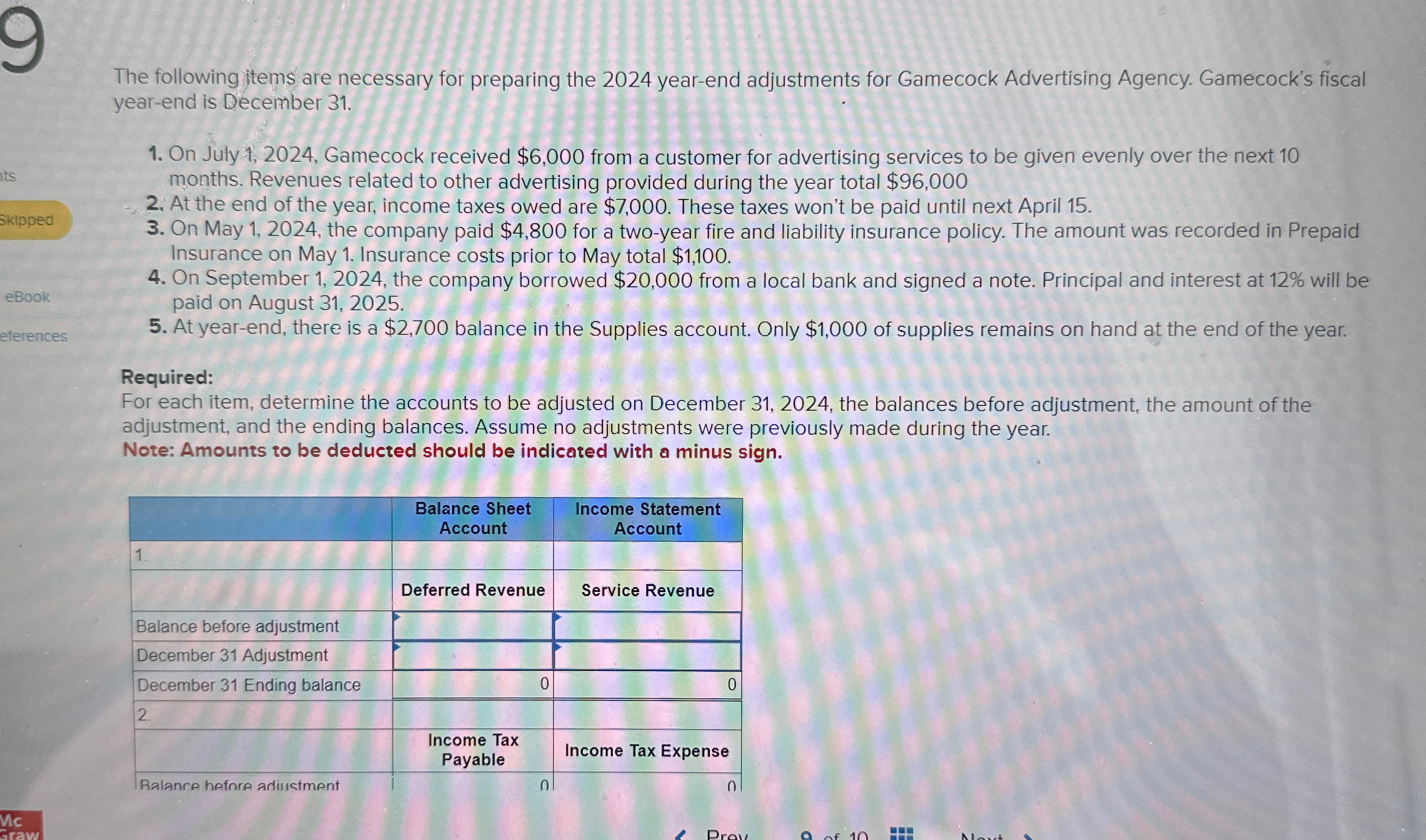

The following items are necessary for preparing the 2 0 2 4 year - end adjustments for Gamecock Advertising Agency. Gamecock's fiscal year - end

The following items are necessary for preparing the yearend adjustments for Gamecock Advertising Agency. Gamecock's fiscal yearend is December

On July Gamecock received $ from a customer for advertising services to be given evenly over the next months. Revenues related to other advertising provided during the year total $

At the end of the year, income taxes owed are $ These taxes won't be paid until next April

On May the company paid $ for a twoyear fire and liability insurance policy. The amount was recorded in Prepaid Insurance on May Insurance costs prior to May total $

On September the company borrowed $ from a local bank and signed a note. Principal and interest at will be paid on August

At yearend, there is a $ balance in the Supplies account. Only $ of supplies remains on hand at the end of the year.

Required:

For each item, determine the accounts to be adjusted on December the balances before adjustment, the amount of the adjustment, and the ending balances. Assume no adjustments were previously made during the year.

Note: Amounts to be deducted should be indicated with a minus sign.

tabletableBalance SheetAccounttableIncome StatementAccountDeferred Revenue,Service RevenueBalance before adjustment,,December Adjustment,,December Ending balance,,tableIncome TaxPayableIncome Tax ExpenseRalanre hefnre adiilatment,,

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started