Answered step by step

Verified Expert Solution

Question

1 Approved Answer

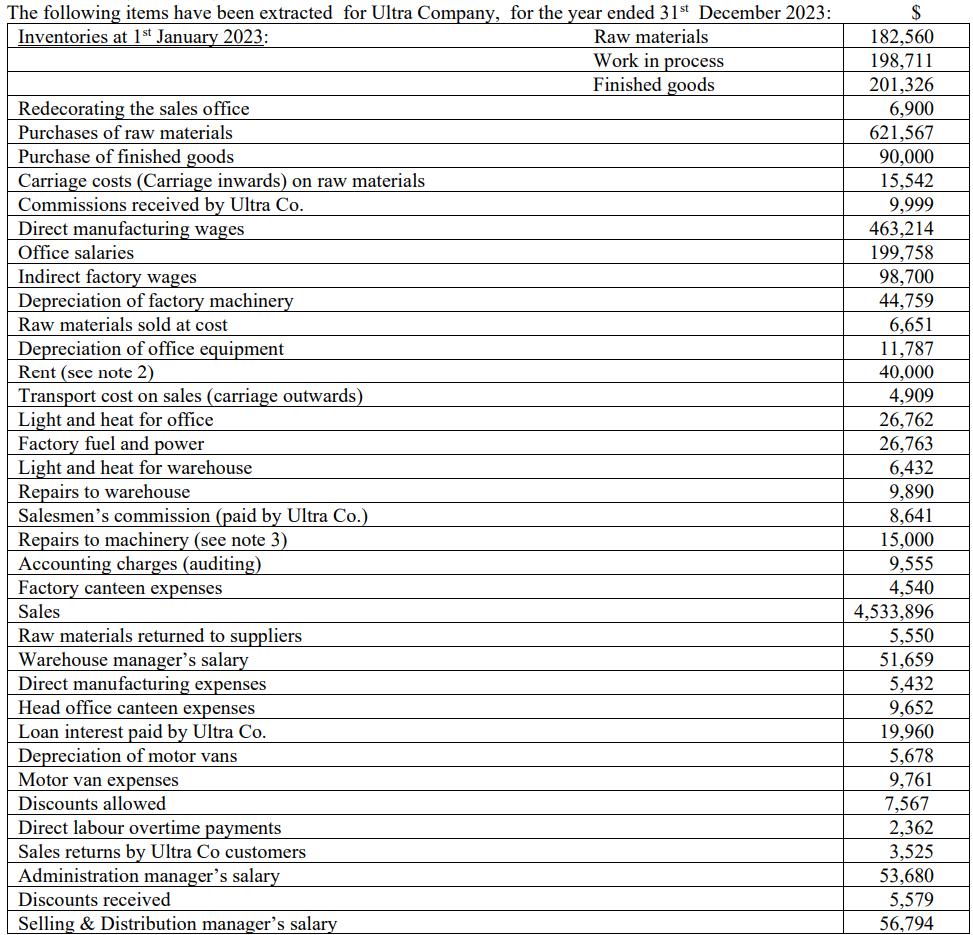

The following items have been extracted for Ultra Company, for the year ended 31st December 2023: Inventories at 1st January 2023: Raw materials Work

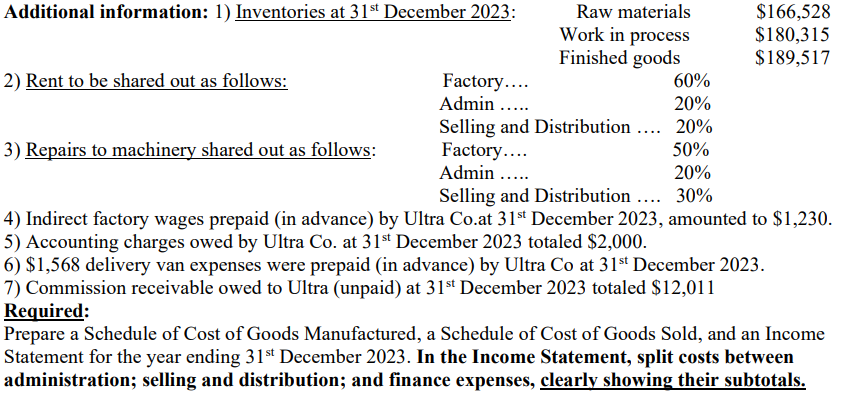

The following items have been extracted for Ultra Company, for the year ended 31st December 2023: Inventories at 1st January 2023: Raw materials Work in process Finished goods Redecorating the sales office Purchases of raw materials Purchase of finished goods Carriage costs (Carriage inwards) on raw materials. Commissions received by Ultra Co. Direct manufacturing wages Office salaries Indirect factory wages Depreciation of factory machinery Raw materials sold at cost Depreciation of office equipment Rent (see note 2) Transport cost on sales (carriage outwards) Light and heat for office Factory fuel and power Light and heat for warehouse Repairs to warehouse Salesmen's commission (paid by Ultra Co.) Repairs to machinery (see note 3) Accounting charges (auditing) Factory canteen expenses Sales Raw materials returned to suppliers Warehouse manager's salary Direct manufacturing expenses Head office canteen expenses Loan interest paid by Ultra Co. Depreciation of motor vans Motor van expenses Discounts allowed Direct labour overtime payments Sales returns by Ultra Co customers Administration manager's salary Discounts received Selling & Distribution manager's salary $ 182,560 198,711 201,326 6,900 621,567 90,000 15,542 9,999 463,214 199,758 98,700 44,759 6,651 11,787 40,000 4,909 26,762 26,763 6,432 9,890 8,641 15,000 9,555 4,540 4,533,896 5,550 51,659 5,432 9,652 19,960 5,678 9,761 7,567 2,362 3,525 53,680 5,579 56,794 Additional information: 1) Inventories at 31st December 2023: 2) Rent to be shared out as follows: Raw materials Work in process Finished goods Factory.... 60% Admin ..... 20% Selling and Distribution .... 20% Factory.... 50% Admin ..... 20% Selling and Distribution.... 30% 4) Indirect factory wages prepaid (in advance) by Ultra Co.at 31st December 2023, amounted to $1,230. 5) Accounting charges owed by Ultra Co. at 31st December 2023 totaled $2,000. 6) $1,568 delivery van expenses were prepaid (in advance) by Ultra Co at 31st December 2023. 7) Commission receivable owed to Ultra (unpaid) at 31st December 2023 totaled $12,011 3) Repairs to machinery shared out as follows: $166,528 $180,315 $189,517 Required: Prepare a Schedule of Cost of Goods Manufactured, a Schedule of Cost of Goods Sold, and an Income Statement for the year ending 31st December 2023. In the Income Statement, split costs between administration; selling and distribution; and finance expenses, clearly showing their subtotals.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Ultra Company Schedule of Cost of Goods Manufactured for the year ended December 31 2023 Opening Wor...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started