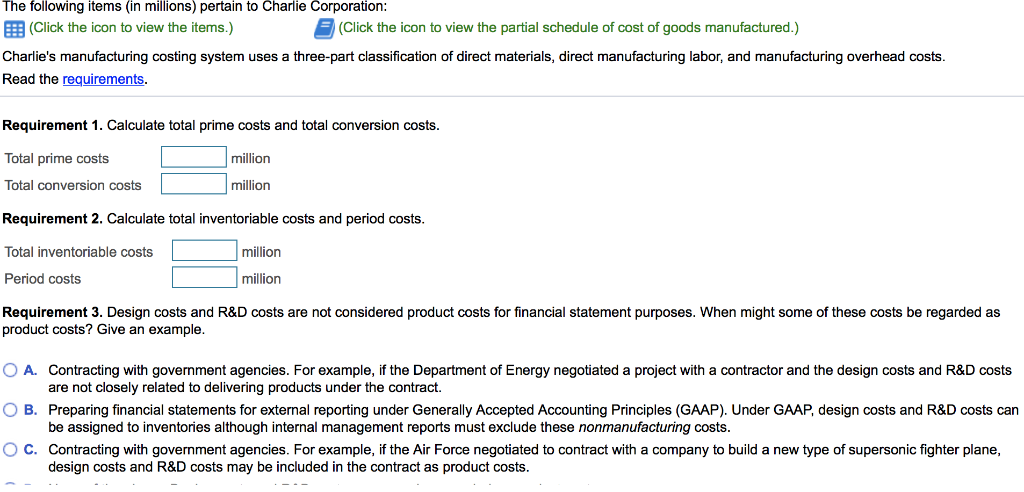

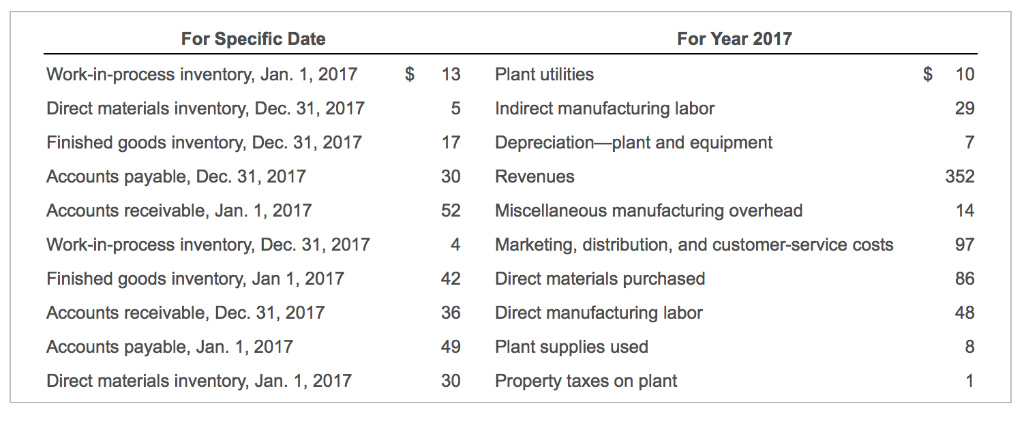

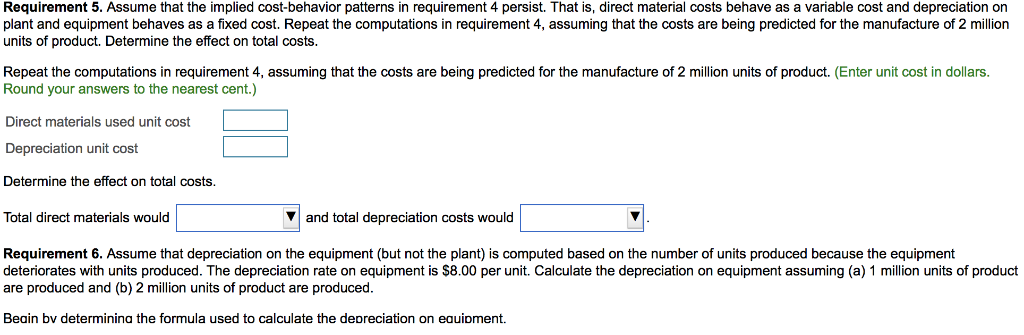

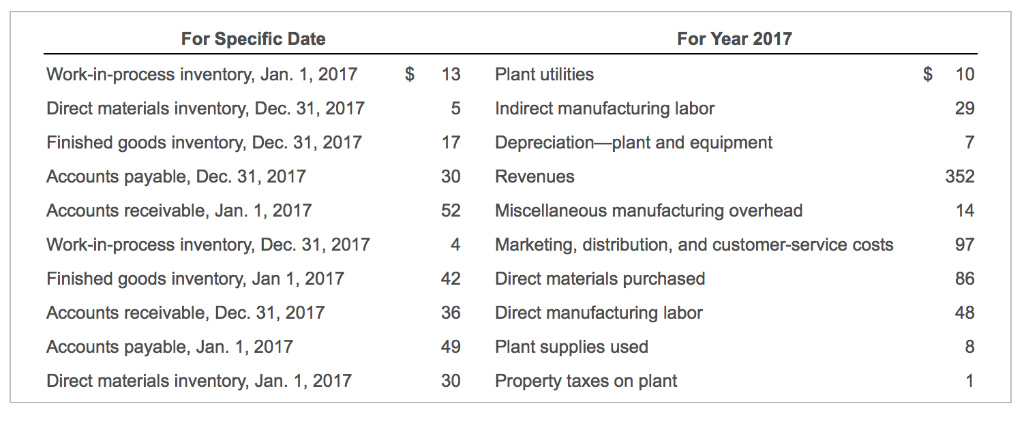

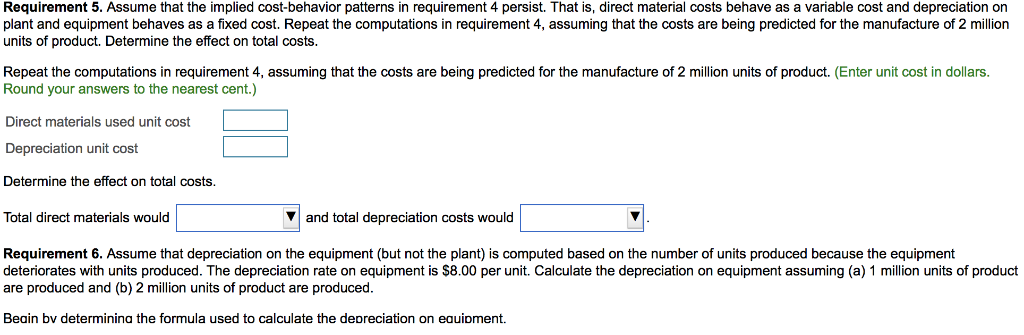

The following items (in millions) pertain to Charlie Corporation: (Click the icon to view the items.) Charlie's manufacturing costing system uses a three-part classification of direct materials, direct manufacturing labor, and manufacturing overhead costs Read the requirements (Click the icon to view the partial schedule of cost of goods manufactured.) Requirement 1. Calculate total prime costs and total conversion costs. Total prime costs Total conversion costs Requirement 2. Calculate total inventoriable costs and period costs Total inventoriable costs Period costs Requirement 3. Design costs and R&D costs are not considered product costs for financial statement purposes. When might some of these costs be regarded as million million million million product costs? Give an example. O A. Contracting with government agencies. For example, if the Department of Energy negotiated a project with a contractor and the design costs and R&D costs are not closely related to delivering products under the contract. O B. Preparing financial statements for external reporting under Generally Accepted Accounting Principles (GAAP). Under GAAP, design costs and R&D costs can be assigned to inventories although internal management reports must exclude these nonmanufacturing costs Contracting with government agencies. For example, if the Air Force negotiated to contract with a company to build a new type of supersonic fighter plane, design costs and R&D costs may be included in the contract as product costs. O C. For Specific Date For Year 2017 Work-in-process inventory, Jan. 1, 201713 Plant utilities Direct materials inventory, Dec. 31, 2017 Finished goods inventory, Dec. 31, 2017 Accounts payable, Dec. 31, 2017 Accounts receivable, Jan. 1, 2017 Work-in-process inventory, Dec. 31, 2017 Finished goods inventory, Jan 1, 2017 Accounts receivable, Dec. 31, 2017 Accounts payable, Jan. 1, 2017 Direct materials inventory, Jan. 1, 2017 29 7 352 14 97 86 48 5 Indirect manufacturing labor 1Depreciation-plant and equipment 30 Revenues 52 Miscellaneous manufacturing overhead 4 Marketing, distribution, and customer-service costs 42 Direct materials purchased 36 Direct manufacturing labor 49 Plant supplies used 30 Property taxes on plant Requirement 5. Assume that the implied cost-behavior patterns in requirement 4 persist. That is, direct material costs behave as a variable cost and depreciation on plant and equipment behaves as a fixed cost. Repeat the computations in requirement 4, assuming that the costs are being predicted for the manufacture of 2 million units of product. Determine the effect on total costs. Repeat the computations in requirement 4, assuming that the costs are being predicted for the manufacture of 2 million units of product. (Enter unit cost in dollars Round your answers to the nearest cent.) Direct materials used unit cost Depreciation unit cost Determine the effect on total costs. Total direct materials would Vand total depreciation costs would Requirement 6. Assume that depreciation on the equipment (but not the plant) is computed based on the number of units produced because the equipment deteriorates with units produced. The depreciation rate on equipment is $8.00 per unit. Calculate the depreciation on equipment assuming (a) 1 million units of product are produced and (b) 2 million units of product are produced. Beain bv determinina the formula used to calculate the depreciation on equioment