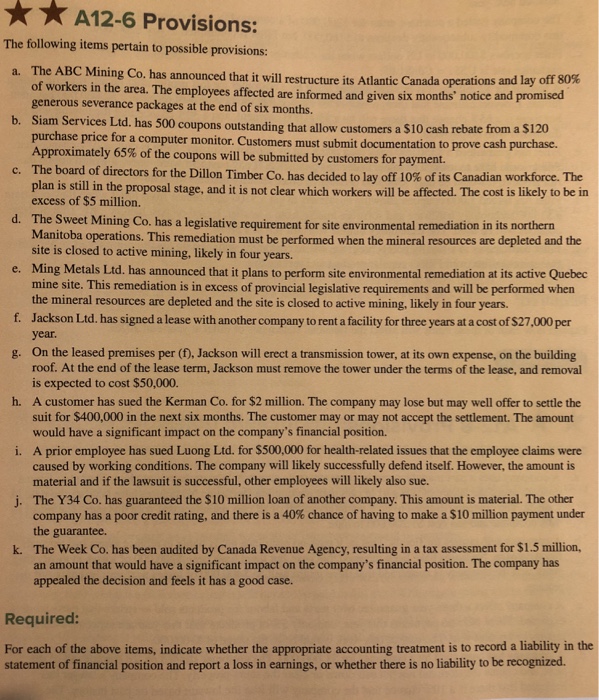

? ? The following items pertain to possible provisions: a. The ABC Mining Co. has announced that it will restructure its Atlantic Canada operations and lay off A12-6 Provisions: 80% of workers in the area. The employees affected are informed and given six months' notice generous severance packages at the end of six months Siam Services Ltd. has 500 and promised b. coupons outstanding that allow customers a $10 cash rebate from a o purchase price for a computer monitor. Customers must submit documentation to prove cash purchase. Approximately 65% of the coupons will be submitted by customers for payment The board of directors for the Dillon Timber Co. has decided to lay off 10% of its Canadian workforce. The plan is still in the proposal stage, and it is not clear which workers will be affected. The cost is likely to be in excess of $5 million. c. d. Th e Sweet Mining Co. has a legislative requirement for site environmental remediation in its northern Manitoba operations. This remediation must be performed when the mineral resources are depleted and the ite is closed to active mining, likely in four years. Ming Metals Ltd. has announced that it plans to perform site environmental remediation at its active Quebec mine site. This remediation is in excess of provincial legislative requirements and will be performed when the mineral resources are depleted and the site is closed to active mining, likely in four years. e. f. Jackson Ltd. has signed a lease with another company to rent a facility for three years at a cost of $27,000 per year On the leased premises per (f), Jackson will erect a transmission tower, at its own expense, on the building roof. At the end of the lease term, Jackson must remove the tower under the terms of the lease, and removal is expected to cost $50,000. A customer has sued the Kerman Co. for $2 million. The company may lose but may well offer to settle the suit for $400,000 in the next six months. The customer may or may not accept the settlement. The amount would have a significant impact on the company's financial position. A prior employee has sued Luong Ltd. for $500,000 for health-related issues that the employee claims were caused by working conditions. The company will likely successfully defend itself. However, the amount is material and if the lawsuit is successful, other employees will likely also sue. The Y34 Co. has guaranteed the $10 million loan of another company. This amount is material. The other company has a poor credit rating, and there is a 40% chance of having to make a $10 million payment under the guarantee. The Week Co. has been audited by Canada Revenue Agency, resulting in a tax assessment for $1.5 million, an amount that would have a significant impact on the company's financial position. The company has appealed the decision and feels it has a good case. g. h. j. k. Required: For each of the above items, indicate whether the appropriate accounting treatment is to record a liability in the statement of financial position and report a loss in earnings, or whether there is no liability to be recognized