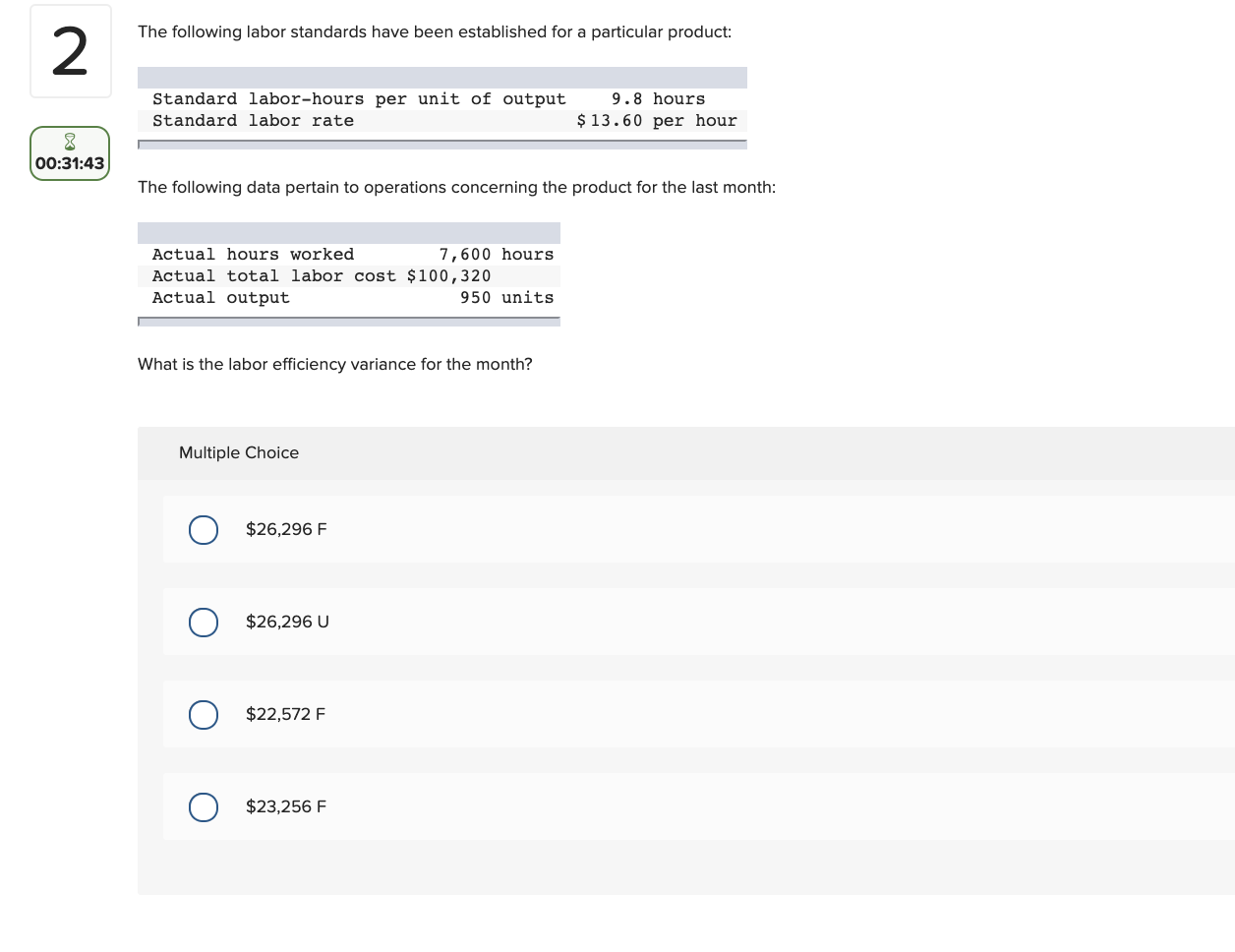

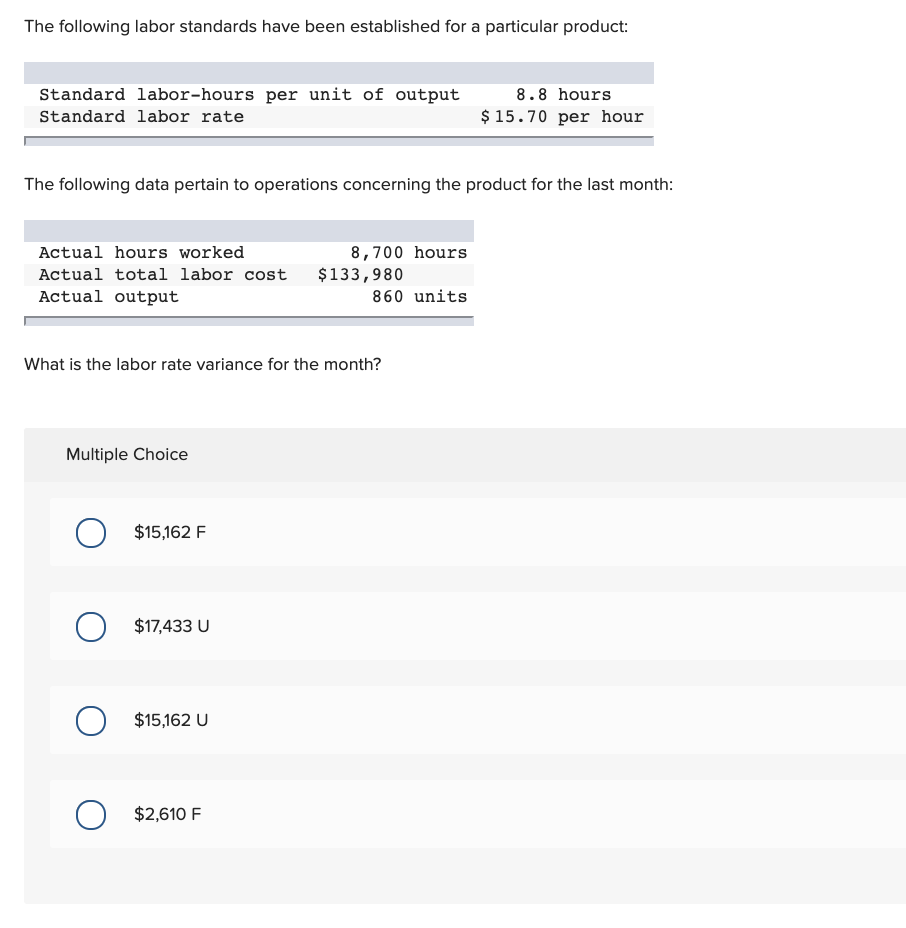

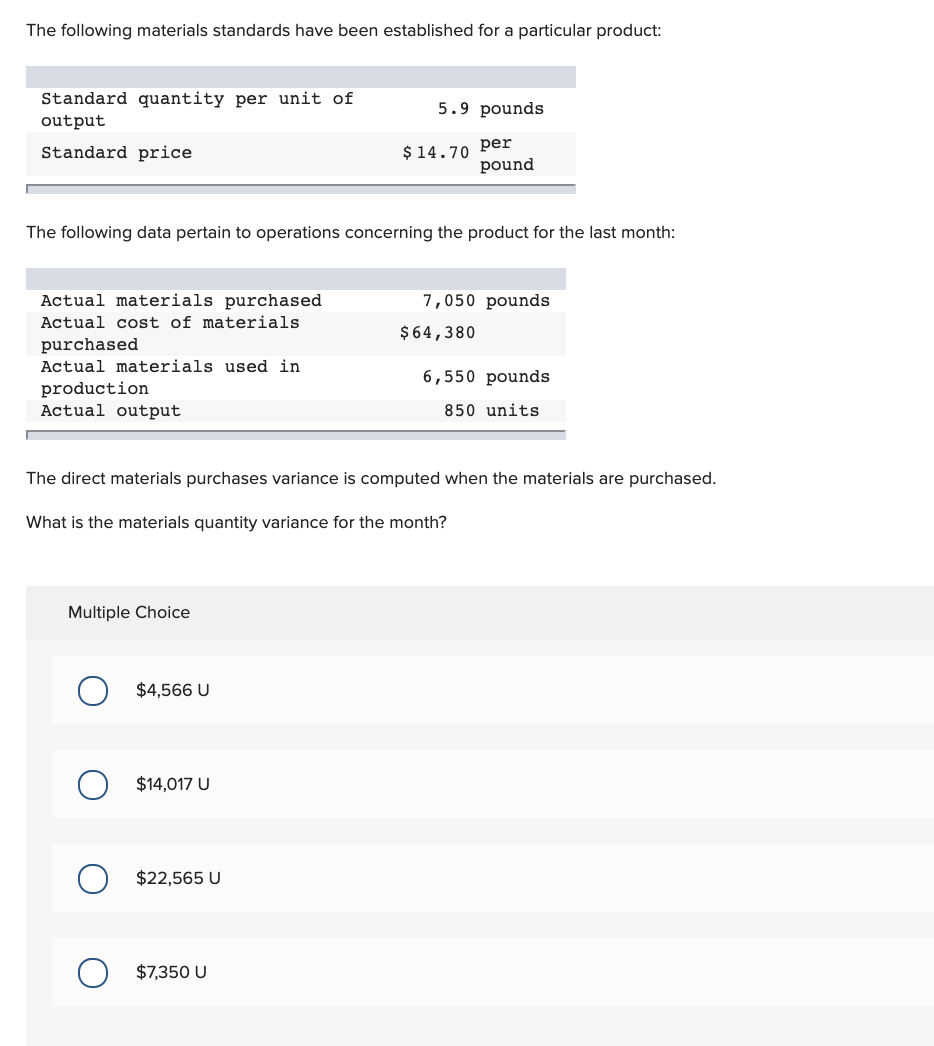

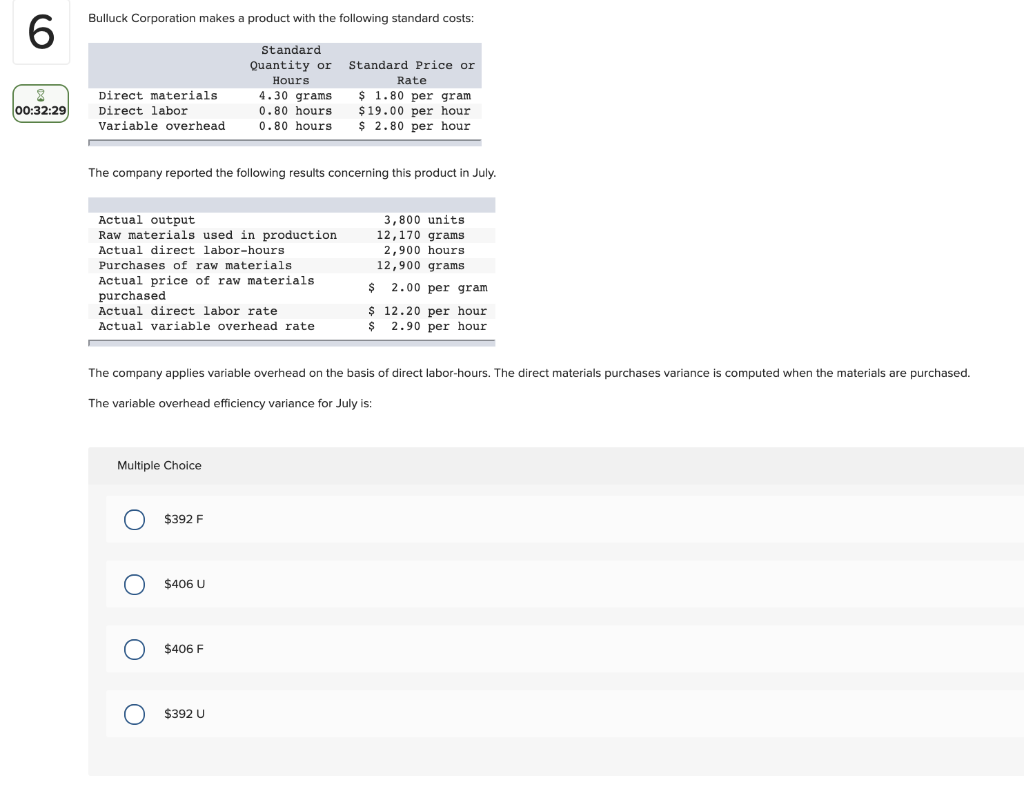

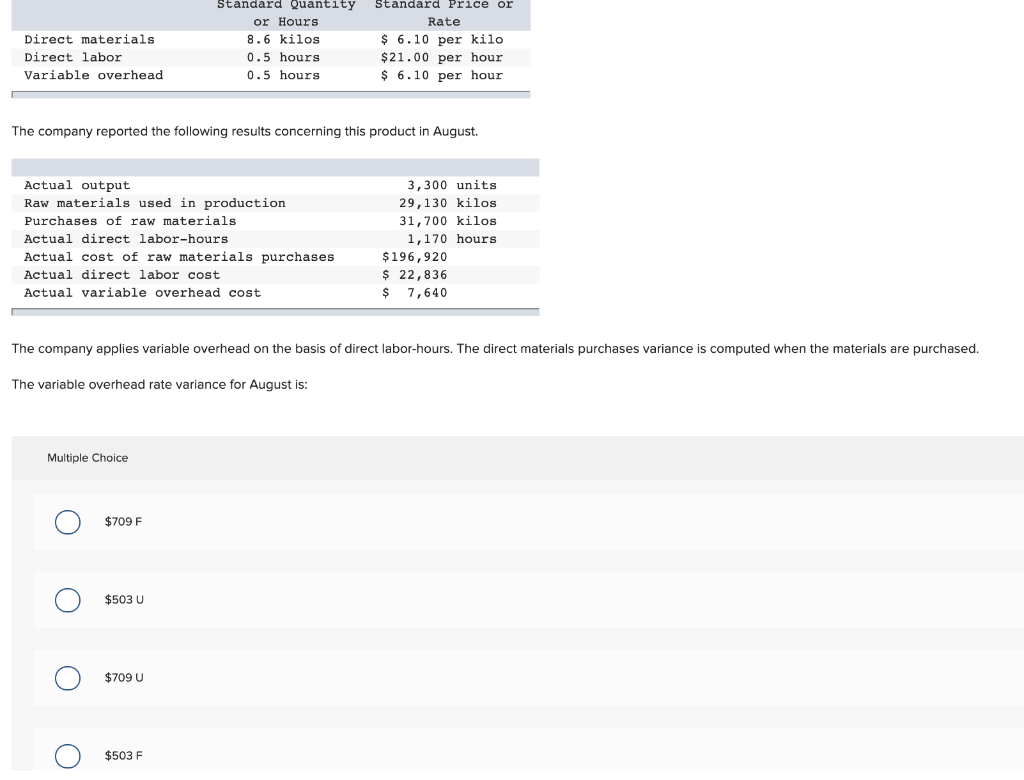

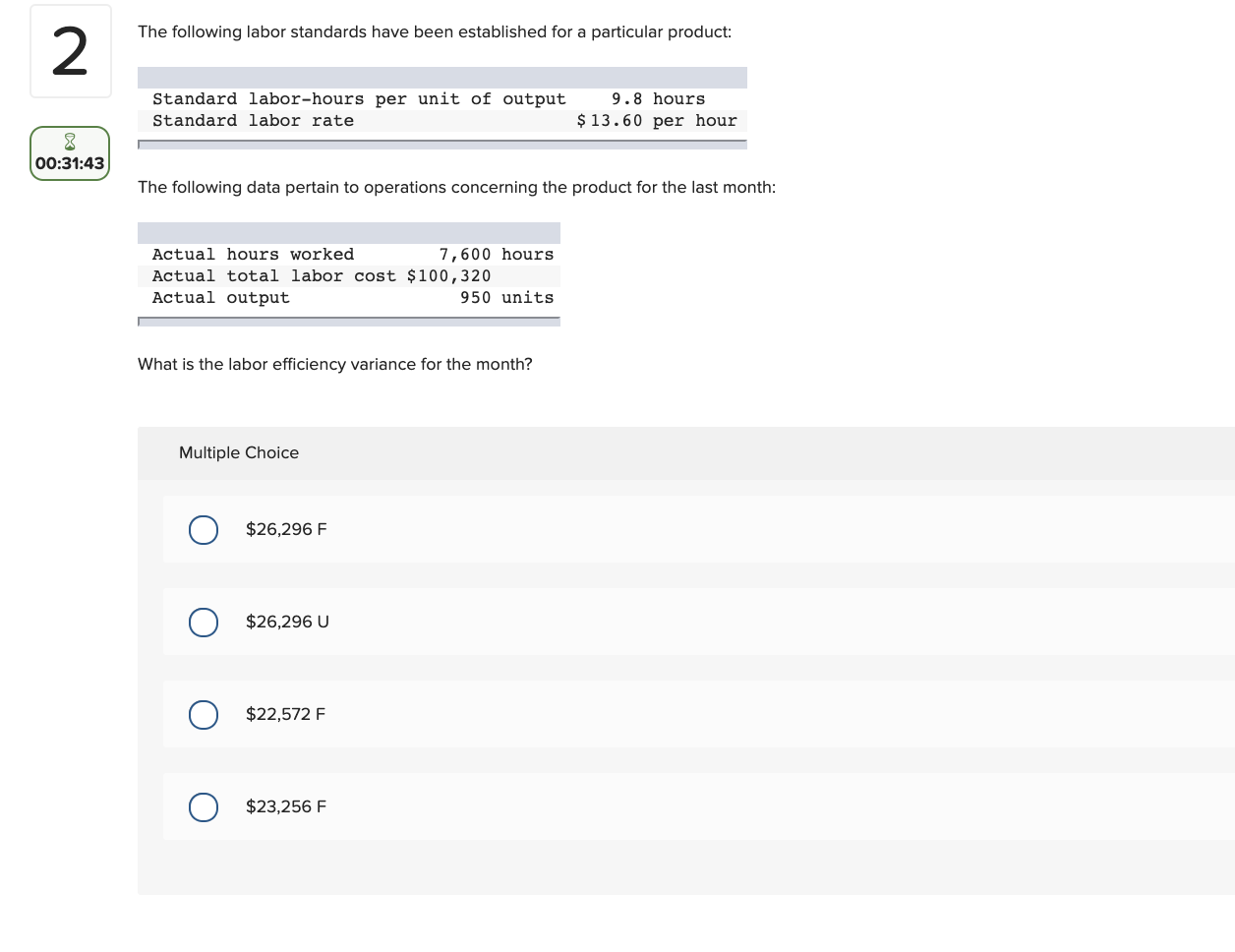

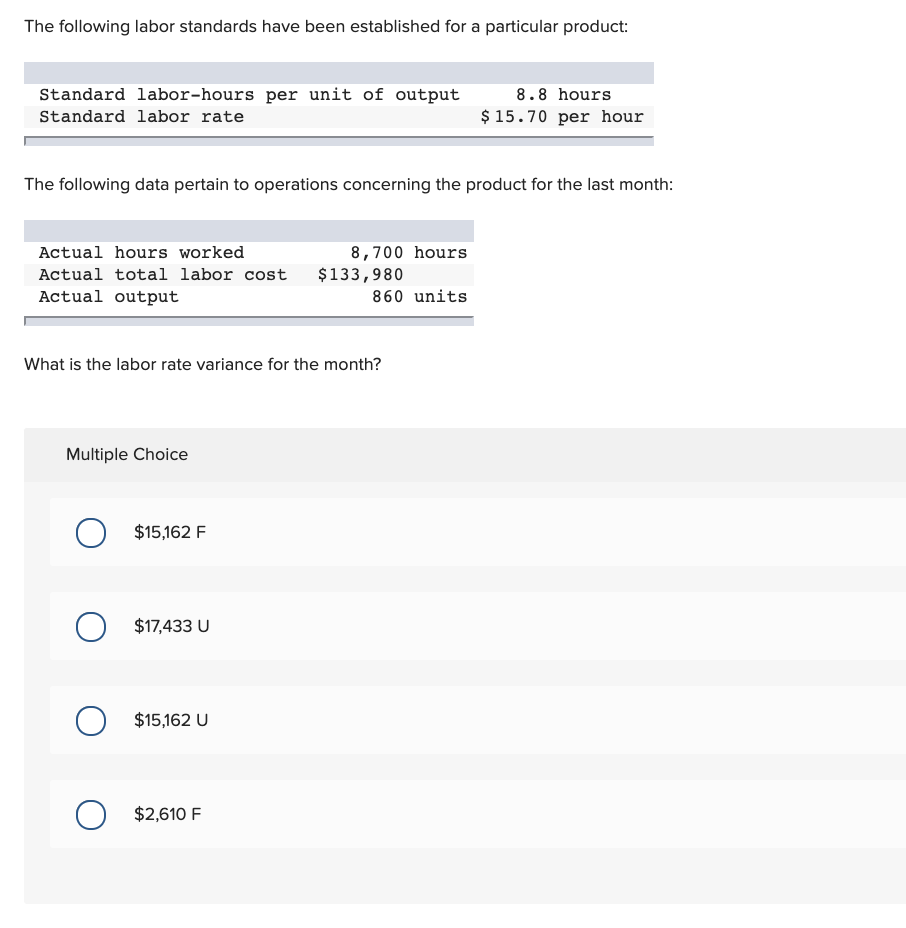

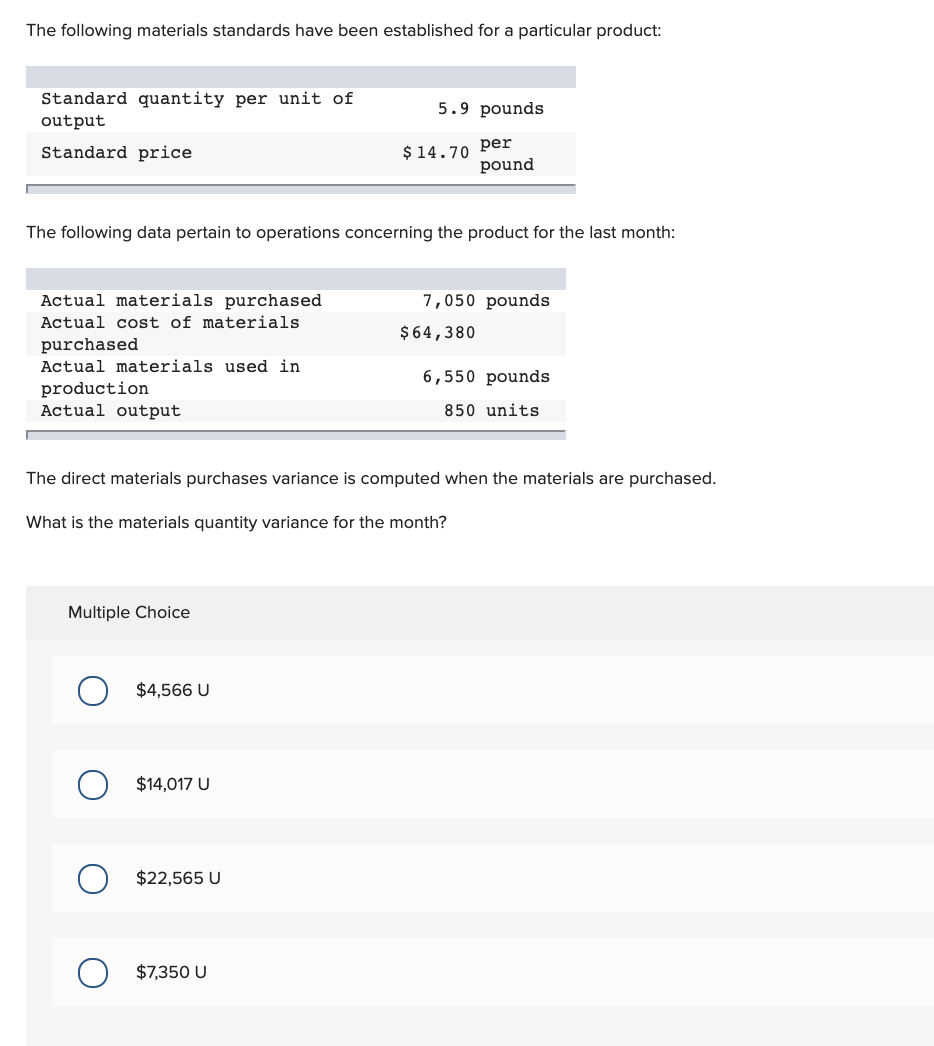

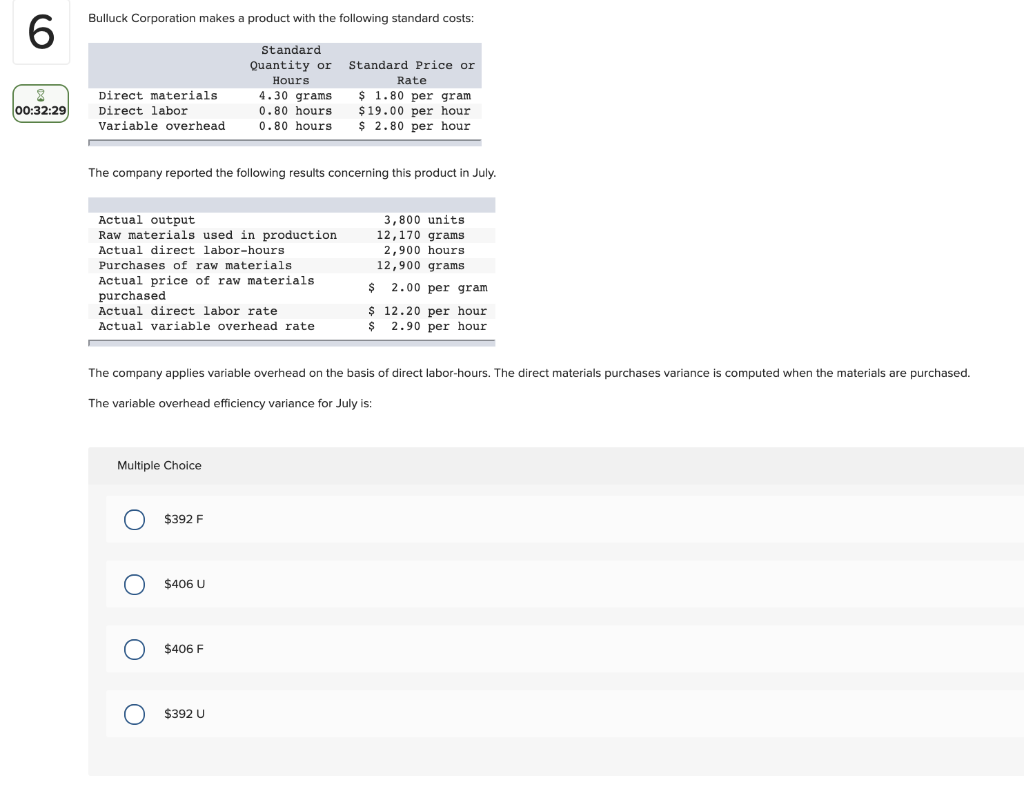

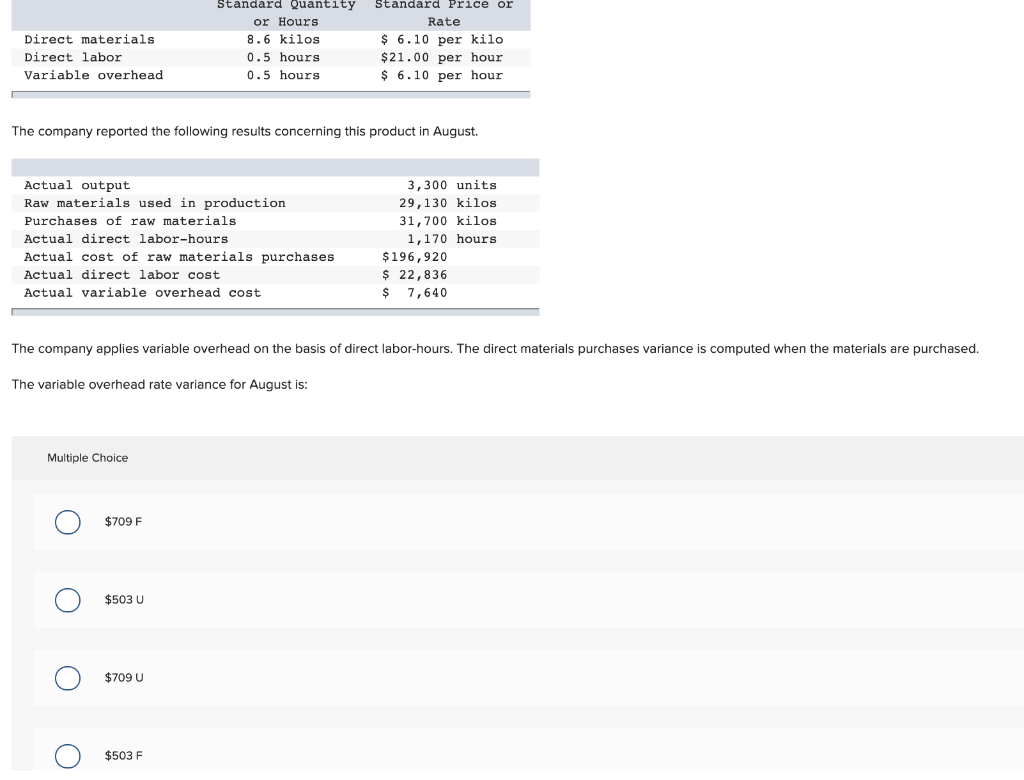

The following labor standards have been established for a particular product: 2 Standard labor-hours per unit of output 9.8 hours Standard labor rate $ 13.60 per hour 8 00:31:43 The following data pertain to operations concerning the product for the last month: Actual hours worked 7,600 hours Actual total labor cost $100,320 Actual output 950 units What is the labor efficiency variance for the month? Multiple Choice $26,296 F $26,296 U $22,572 F $23,256 F The following labor standards have been established for a particular product: Standard labor-hours per unit of output Standard labor rate 8.8 hours $15.70 per hour The following data pertain to operations concerning the product for the last month: Actual hours worked Actual total labor cost Actual output 8,700 hours $133,980 860 units What is the labor rate variance for the month? Multiple Choice $15,162 F $17,433 U O $15,162 U $2,610 F The following materials standards have been established for a particular product: 5.9 pounds Standard quantity per unit of output Standard price $ 14.70 per pound The following data pertain to operations concerning the product for the last month: 7,050 pounds $64,380 Actual materials purchased Actual cost of materials purchased Actual materials used in production Actual output 6,550 pounds 850 units The direct materials purchases variance is computed when the materials are purchased. What is the materials quantity variance for the month? Multiple Choice $4,566 U $14,017 U $22,565 U $7,350 U Bulluck Corporation makes a product with the following standard costs: 6 8 00:32:29 Standard Quantity or Hours 4.30 grams 0.80 hours 0.80 hours Direct materials Direct labor Variable overhead Standard Price or Rate $ 1.80 per gram $19.00 per hour $ 2.80 per hour The company reported the following results concerning this product in July. Actual output Raw materials used in production Actual direct labor-hours Purchases of raw materials Actual price of raw materials purchased Actual direct labor rate Actual variable overhead rate 3,800 units 12,170 grams 2,900 hours 12,900 grams $ 2.00 per gram $ 12.20 per hour 2.90 per hour $ The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased. The variable overhead efficiency variance for July is: Multiple Choice $392 F O $406 U O $406 F O $392 U Direct materials Direct labor Variable overhead Standard Quantity or Hours 8.6 kilos 0.5 hours 0.5 hours Standard Price or Rate $ 6.10 per kilo $21.00 per hour $ 6.10 per hour The company reported the following results concerning this product in August. Actual output Raw materials used in production Purchases of raw materials Actual direct labor-hours Actual cost of raw materials purchases Actual direct labor cost Actual variable overhead cost 3,300 units 29,130 kilos 31,700 kilos 1,170 hours $196,920 $ 22,836 7,640 $ The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased. The variable overhead rate variance for August is: Multiple Choice $709 O $503 U o $709 U $503 F o