Answered step by step

Verified Expert Solution

Question

1 Approved Answer

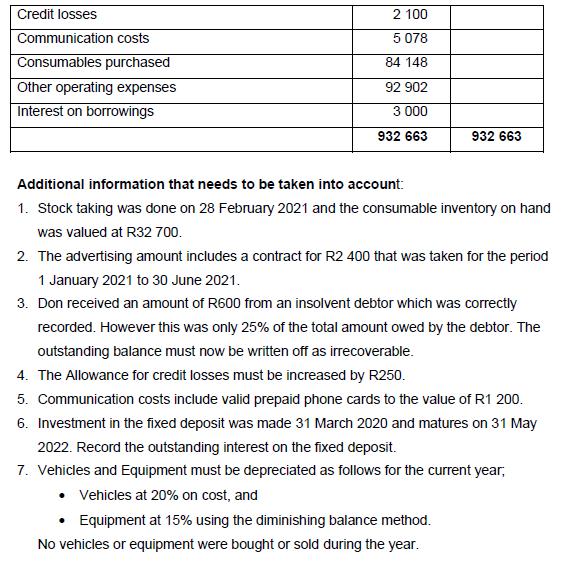

QUESTION THREE [20] The following list of account balances were extracted from the accounting records of Don's Electrical Services as at 28 February 2021:

![QUESTION THREE [20] The following list of account balances were extracted from the accounting records of Dons Electrical Ser](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2022/10/6348fa13d2370_1665727247436.jpg)

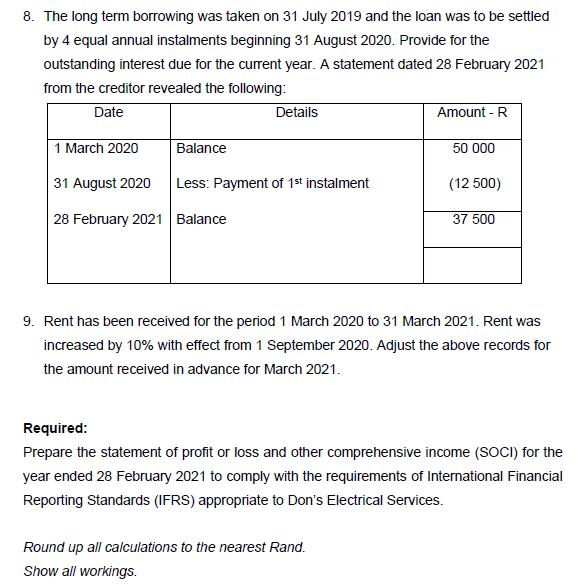

QUESTION THREE [20] The following list of account balances were extracted from the accounting records of Don's Electrical Services as at 28 February 2021: List of accounts Land and buildings at cost Vehicles at cost Accumulated depreciation: Vehicles -1 March 2020 Equipment at cost Accumulated depreciation: Equipment -1 March 2020 12% Fixed deposit: Lock Bank Inventory: Consumables -1 March 2020 Debtors' control Allowance for credit losses Bank Long term borrowing: 10% per year Creditors' control Capital: Don Dude Drawings Service fees Interest on fixed deposit Rent income Advertising Debit - R 250 000 155 000 85 000 30 000 21 000 25 000 80 373 89 327 9 735 Credit - R 90 000 40 000 1 125 37 500 20 835 197 500 524 835 1 688 19 180 Credit losses Communication costs Consumables purchased Other operating expenses Interest on borrowings 2 100 5 078 84 148 92 902 3 000 932 663 932 663 Additional information that needs to be taken into account: 1. Stock taking was done on 28 February 2021 and the consumable inventory on hand was valued at R32 700. 2. The advertising amount includes a contract for R2 400 that was taken for the period 1 January 2021 to 30 June 2021. 3. Don received an amount of R600 from an insolvent debtor which was correctly recorded. However this was only 25% of the total amount owed by the debtor. The outstanding balance must now be written off as irrecoverable. 4. The Allowance for credit losses must be increased by R250. 5. Communication costs include valid prepaid phone cards to the value of R1 200. 6. Investment in the fixed deposit was made 31 March 2020 and matures on 31 May 2022. Record the outstanding interest on the fixed deposit. 7. Vehicles and Equipment must be depreciated as follows for the current year, Vehicles at 20% on cost, and Equipment at 15% using the diminishing balance method. No vehicles or equipment were bought or sold during the year. 8. The long term borrowing was taken on 31 July 2019 and the loan was to be settled by 4 equal annual instalments beginning 31 August 2020. Provide for the outstanding interest due for the current year. A statement dated 28 February 2021 from the creditor revealed the following: Date 1 March 2020 Balance 31 August 2020 28 February 2021 Balance Details Less: Payment of 1st instalment Amount - R 50 000 Round up all calculations to the nearest Rand. Show all workings. (12 500) 37 500 9. Rent has been received for the period 1 March 2020 to 31 March 2021. Rent was increased by 10% with effect from 1 September 2020. Adjust the above records for the amount received in advance for March 2021. Required: Prepare the statement of profit or loss and other comprehensive income (SOCI) for the year ended 28 February 2021 to comply with the requirements of International Financial Reporting Standards (IFRS) appropriate to Don's Electrical Services.

Step by Step Solution

★★★★★

3.41 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

statement of PL To opening stock TO Consumables 10 Com...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started