Answered step by step

Verified Expert Solution

Question

1 Approved Answer

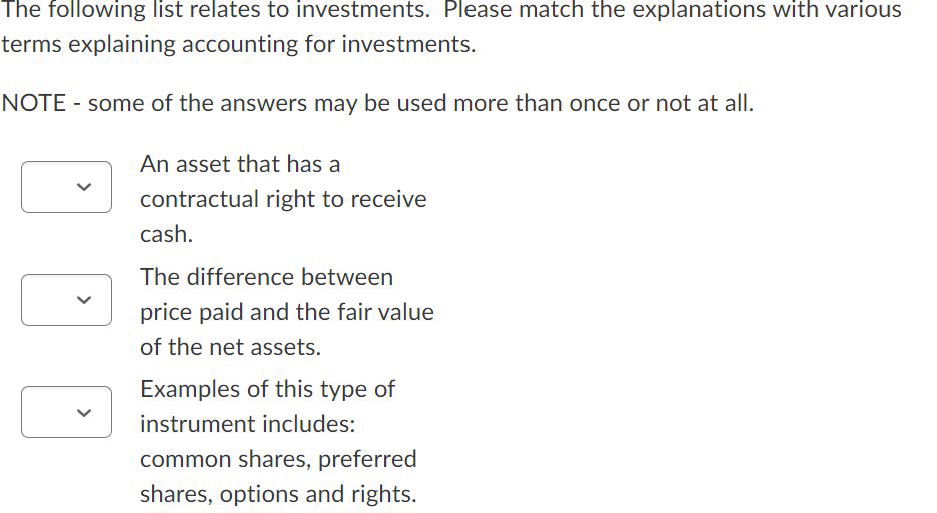

The following list relates to investments. Please match the explanations with various terms explaining accounting for investments. NOTE - some of the answers may

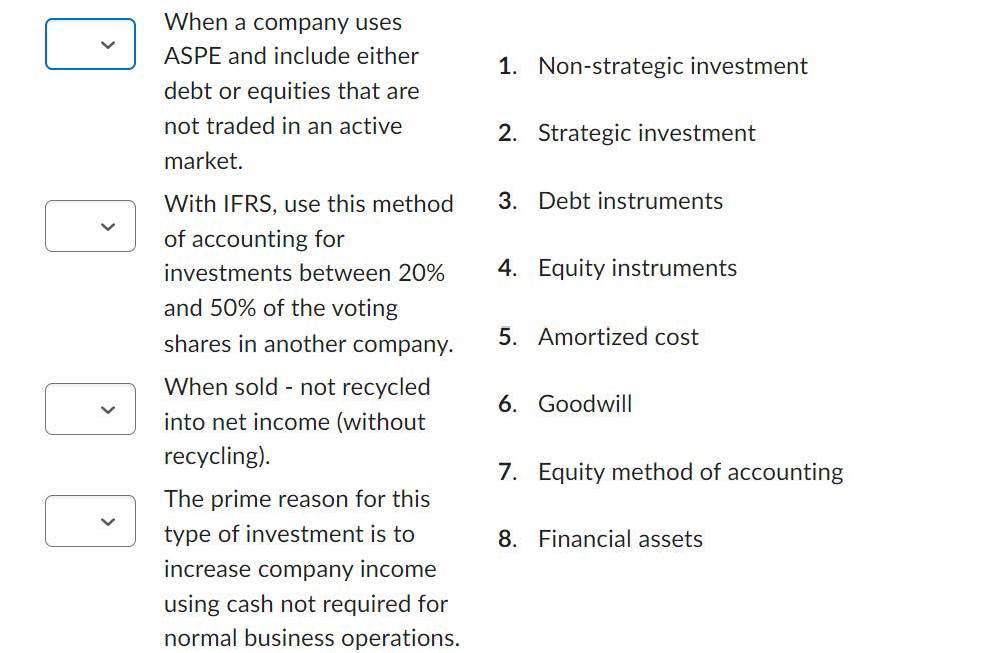

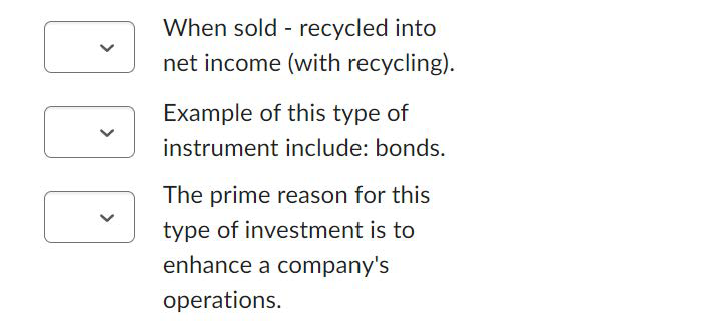

The following list relates to investments. Please match the explanations with various terms explaining accounting for investments. NOTE - some of the answers may be used more than once or not at all. An asset that has a contractual right to receive cash. The difference between price paid and the fair value of the net assets. Examples of this type of instrument includes: common shares, preferred shares, options and rights. When a company uses ASPE and include either debt or equities that are not traded in an active market. With IFRS, use this method of accounting for investments between 20% and 50% of the voting shares in another company. When sold not recycled into net income (without recycling). The prime reason for this type of investment is to increase company income using cash not required for normal business operations. 1. Non-strategic investment 2. Strategic investment 3. Debt instruments 4. Equity instruments 5. Amortized cost 6. Goodwill 7. Equity method of accounting 8. Financial assets When sold recycled into net income (with recycling). Example of this type of instrument include: bonds. The prime reason for this type of investment is to enhance a company's operations.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Heres the matching of explanations with accounting for investment terms Terms Explanation Financial ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started