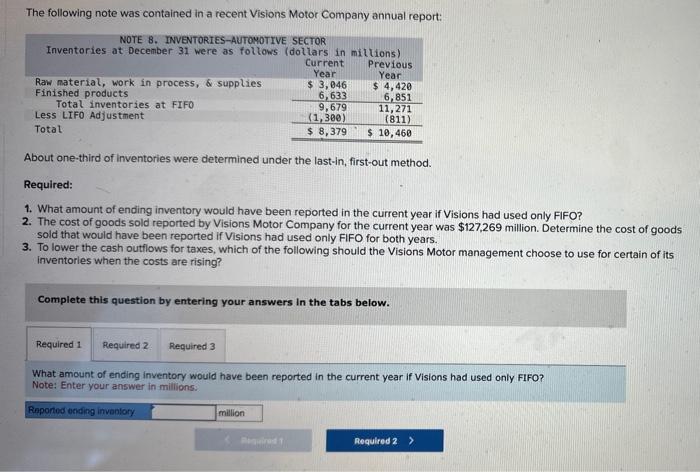

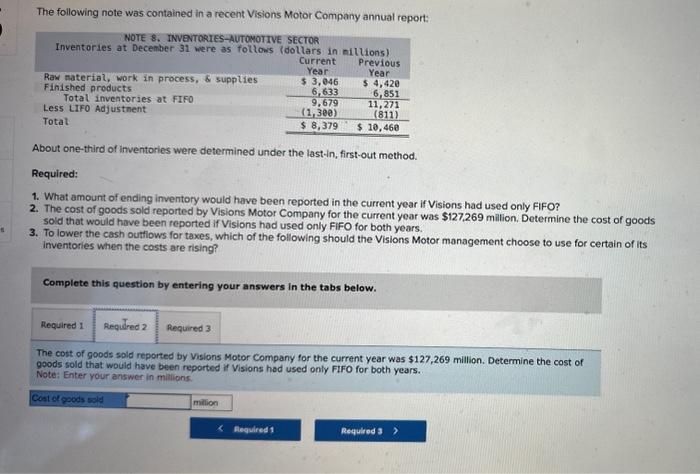

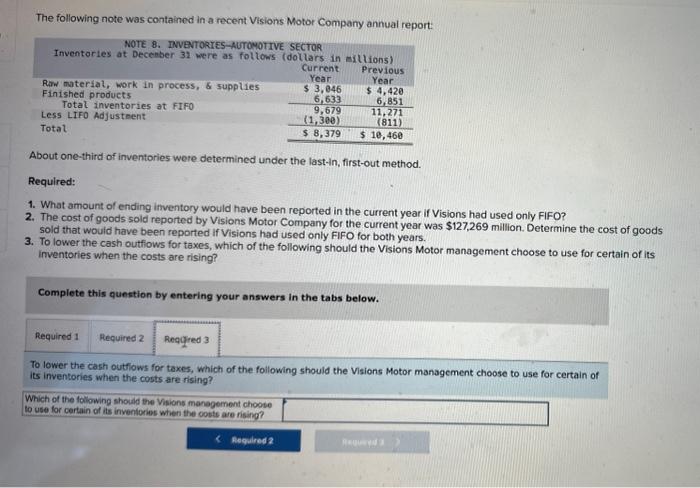

The following note was contained in a recent Visions Motor Company annual report: About one-third of inventories were determined under the last-in, first-out method. Required: 1. What amount of ending inventory would have been reported in the current year if Visions had used only FIFO? 2. The cost of goods sold reported by Visions Motor Company for the current year was $127,269 million. Determine the cost of goods sold that would have been reported if Visions had used only FIFO for both years. 3. To lower the cash outflows for taxes, which of the following should the Visions Motor management choose to use for certain of its inventories when the costs are rising? Complete this question by entering your answers in the tabs below. What amount of ending inventory would have been reported in the current year If Visions had used only FIFo? Note: Enter your answer in millions. The following note was contained in a recent Visions Motor Company annual report: About one-third of inventories were determined under the last-in, first-out method. Required: 1. What amount of ending inventory would have been reported in the current year if Visions had used only FIFO? 2. The cost of goods sold reported by Visions Motor Company for the current year was $127,269 milion. Determine the cost of goods sold that would have been reported if Visions had used only FIFO for both years. 3. To lower the cash outfiows for taxes, which of the following should the Visions Motor management choose to use for certain of its inventories when the costs are rising? Complete this question by entering your answers in the tabs below. The cost of goods soid reported by Visions Motor Company for the current year was $127,269 million. Determine the cost of goods sold that would have been reported if Visions had used only FIFO for both years. Note: Enter your answer in mlilions. The following note was contained in a recent Visions Motor Company annual report: About one-third of inventories were determined under the last-In, first-out method. Required: 1. What amount of ending inventory would have been reported in the current year if Visions had used only FIFO? 2. The cost of goods sold reported by Visions Motor Company for the current year was $127,269 million. Determine the cost of goods sold that would have been reported if Visions had used only FIFO for both years. 3. To lower the cash outfiows for taxes, which of the following should the Visions Motor management choose to use for certain of its inventories when the costs are rising? Complete this question by entering your answers in the tabs below. To lower the cash outfiows for taxes, which of the following should the Visions Motor management choose to use for certain of its inventories when the costs are rising? Which of the following should the Visions manegement choote to vee for certain of its inventoriss when the cotts are rising