Answered step by step

Verified Expert Solution

Question

1 Approved Answer

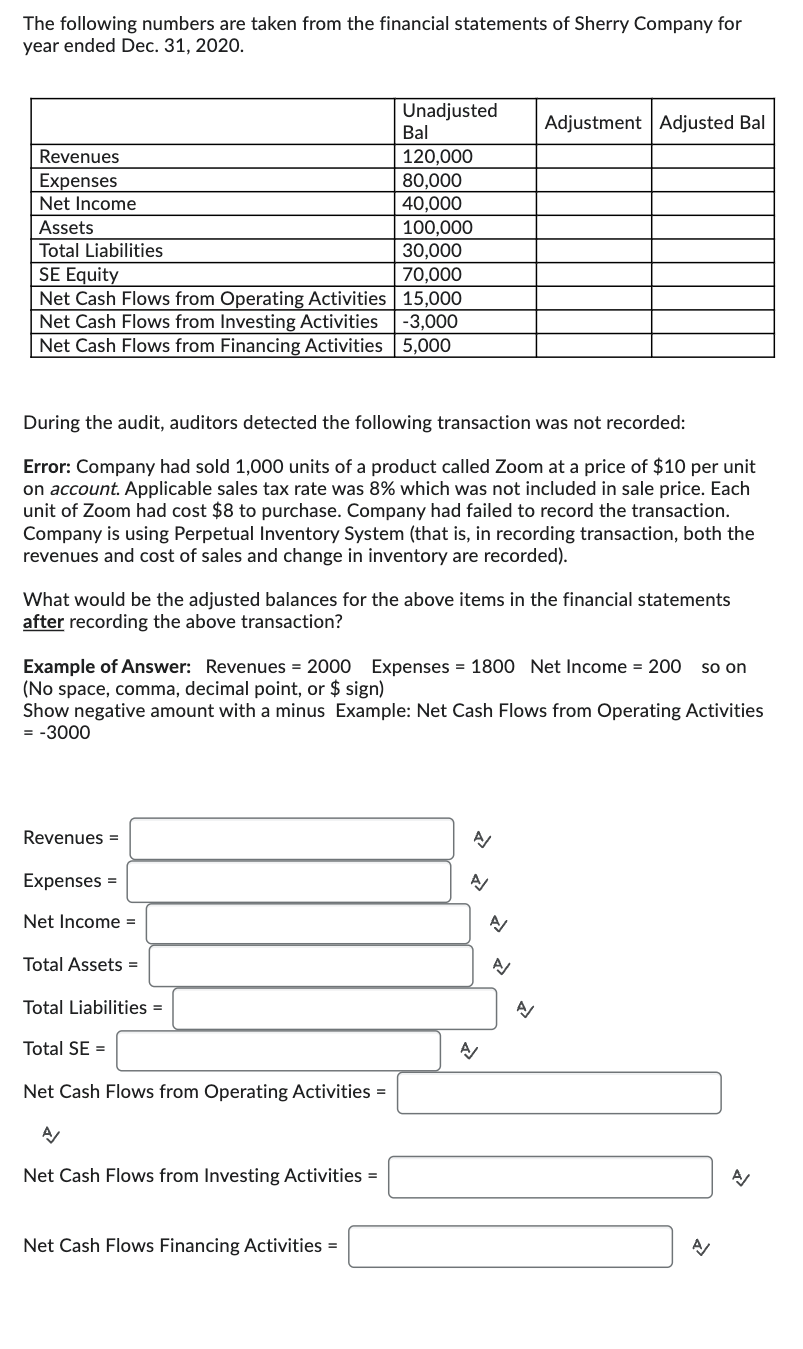

The following numbers are taken from the financial statements of Sherry Company for year ended Dec. 3 1 , 2 0 2 0 . During

The following numbers are taken from the financial statements of Sherry Company for

year ended Dec.

During the audit, auditors detected the following transaction was not recorded:

Error: Company had sold units of a product called Zoom at a price of $ per unit

on account. Applicable sales tax rate was which was not included in sale price. Each

unit of Zoom had cost $ to purchase. Company had failed to record the transaction.

Company is using Perpetual Inventory System that is in recording transaction, both the

revenues and cost of sales and change in inventory are recorded

What would be the adjusted balances for the above items in the financial statements

after recording the above transaction?

Example of Answer: Revenues Expenses Net Income so on

No space, comma, decimal point, or $ sign

Show negative amount with a minus Example: Net Cash Flows from Operating Activities

Revenues

Expenses

Net Income

Total Assets

Total Liabilities

Total SE

Net Cash Flows from Operating Activities

A

Net Cash Flows from Investing Activities

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started