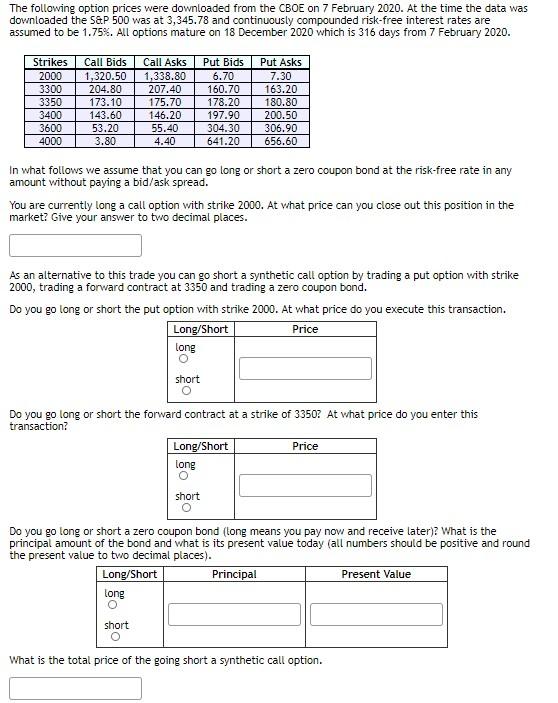

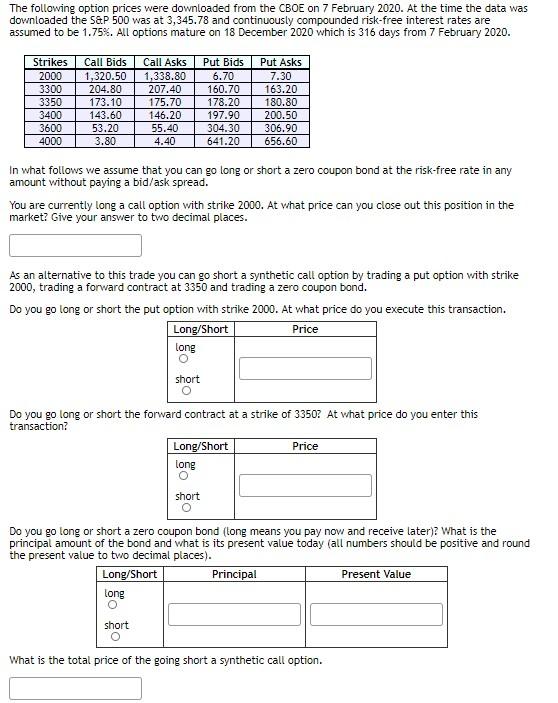

The following option prices were downloaded from the CBOE on 7 February 2020. At the time the data was downloaded the S&P 500 was at 3,345.78 and continuously compounded risk-free interest rates are assumed to be 1.75%. All options mature on 18 December 2020 which is 316 days from 7 February 2020. Strikes 2000 3300 3350 3400 3600 4000 Call Bids 1,320.50 204.80 173.10 143.60 53.20 3.80 Call Asks 1,338.80 207.40 175.70 146.20 55.40 4.40 Put Bids 6.70 160.70 178.20 197.90 304.30 641.20 Put Asks 7.30 163.20 180.80 200.50 306.90 656.60 In what follows we assume that you can go long or short a zero coupon bond at the risk-free rate in any amount without paying a bid/ask spread. You are currently long a call option with strike 2000. At what price can you close out this position in the market? Give your answer to two decimal places. As an alternative to this trade you can go short a synthetic call option by trading a put option with strike 2000, trading a forward contract at 3350 and trading a zero coupon bond. Do you go long or short the put option with strike 2000. At what price do you execute this transaction. Long/Short long Price short Do you go long or short the forward contract at a strike of 33502 At what price do you enter this transaction? Long/Short long Price short Do you go long or short a zero coupon bond (long means you pay now and receive later)? What is the principal amount of the bond and what is its present value today (all numbers should be positive and round the present value to two decimal places). Long/Short Principal Present Value long short What is the total price of the going short a synthetic call option. The following option prices were downloaded from the CBOE on 7 February 2020. At the time the data was downloaded the S&P 500 was at 3,345.78 and continuously compounded risk-free interest rates are assumed to be 1.75%. All options mature on 18 December 2020 which is 316 days from 7 February 2020. Strikes 2000 3300 3350 3400 3600 4000 Call Bids 1,320.50 204.80 173.10 143.60 53.20 3.80 Call Asks 1,338.80 207.40 175.70 146.20 55.40 4.40 Put Bids 6.70 160.70 178.20 197.90 304.30 641.20 Put Asks 7.30 163.20 180.80 200.50 306.90 656.60 In what follows we assume that you can go long or short a zero coupon bond at the risk-free rate in any amount without paying a bid/ask spread. You are currently long a call option with strike 2000. At what price can you close out this position in the market? Give your answer to two decimal places. As an alternative to this trade you can go short a synthetic call option by trading a put option with strike 2000, trading a forward contract at 3350 and trading a zero coupon bond. Do you go long or short the put option with strike 2000. At what price do you execute this transaction. Long/Short long Price short Do you go long or short the forward contract at a strike of 33502 At what price do you enter this transaction? Long/Short long Price short Do you go long or short a zero coupon bond (long means you pay now and receive later)? What is the principal amount of the bond and what is its present value today (all numbers should be positive and round the present value to two decimal places). Long/Short Principal Present Value long short What is the total price of the going short a synthetic call option