Question

The following option prices were observed for calls and puts on a stock for the trading day of July 6 of a particular year. Use

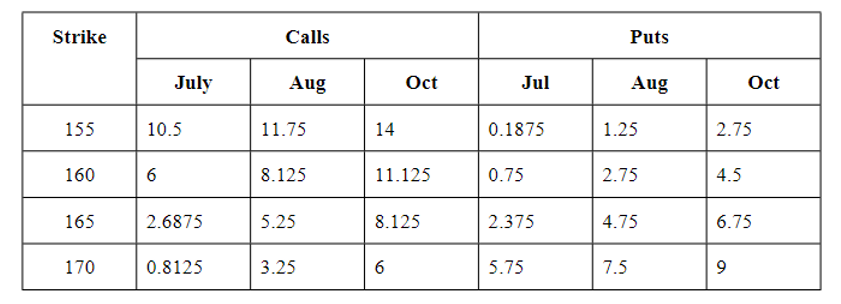

The following option prices were observed for calls and puts on a stock for the trading

day of July 6 of a particular year. Use this information in problems 12 through 20. The stock was priced at 165.125. The expirations were July 17, August 21, and October 16.

Let the standard deviation of the continuously compounded return on the stock (volatility) be 0.21. Ignore dividends. Answer the following:

a. What is the theoretical fair value of the Oct 165 call?

b. Based on your answer in part a, recommend a riskless strategy to exploit the price of this option.

c. If the stock price decreases by $1, how will the option position offset the loss on the stock?

d. Use the Black-Scholes European put option pricing formula for the October 165 put option. Repeat parts a, b, and c of question 6 with respect to the put.

e. Suppose on July 7 the stock will go ex-dividend with a dividend of $2. If the options were American, determine whether the July 160 call would be exercised.

\begin{tabular}{|c|l|l|l|l|l|l|} \hline \multirow{2}{*}{ Strike } & \multicolumn{3}{|c|}{ Calls } & \multicolumn{3}{c|}{ Puts } \\ \cline { 2 - 7 } & \multicolumn{1}{|c|}{ July } & \multicolumn{1}{|c|}{ Aug } & \multicolumn{1}{c|}{ Oct } & \multicolumn{1}{c|}{ Jul } & \multicolumn{1}{c|}{ Aug } & \multicolumn{1}{c|}{ Oct } \\ \hline 155 & 10.5 & 11.75 & 14 & 0.1875 & 1.25 & 2.75 \\ \hline 160 & 6 & 8.125 & 11.125 & 0.75 & 2.75 & 4.5 \\ \hline 165 & 2.6875 & 5.25 & 8.125 & 2.375 & 4.75 & 6.75 \\ \hline 170 & 0.8125 & 3.25 & 6 & 5.75 & 7.5 & 9 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started