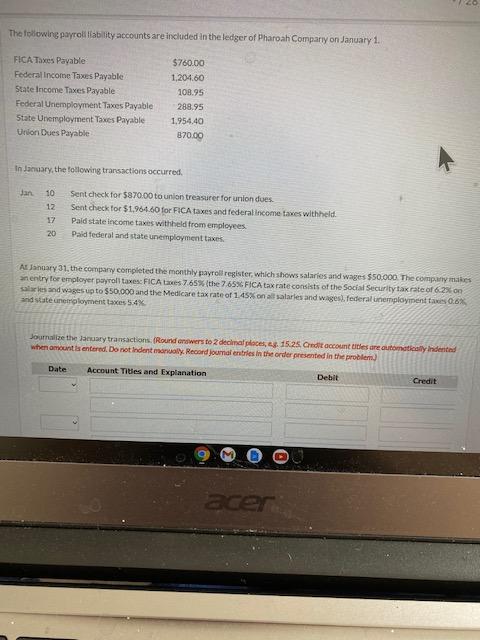

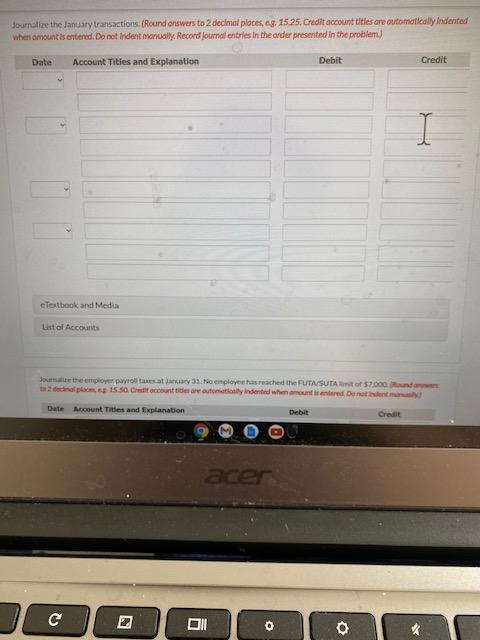

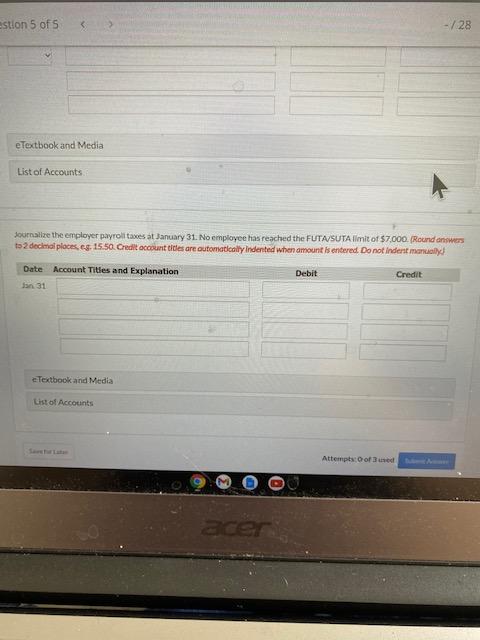

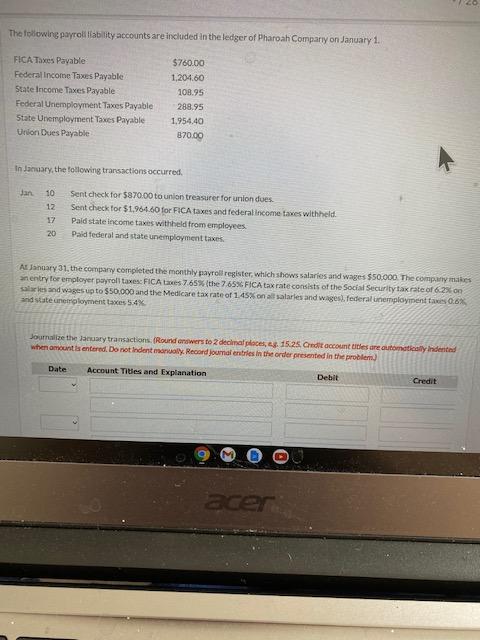

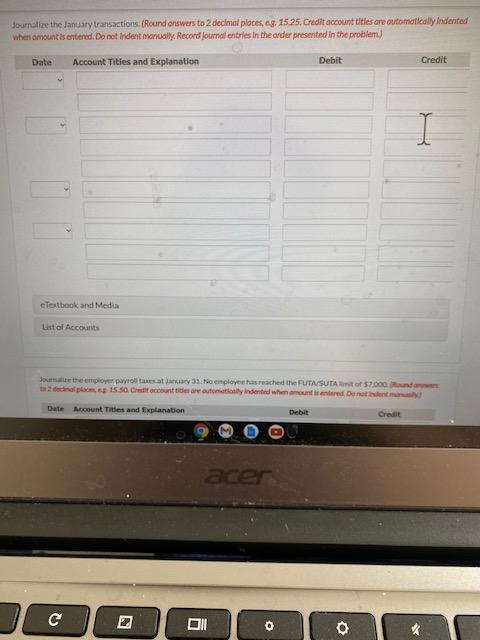

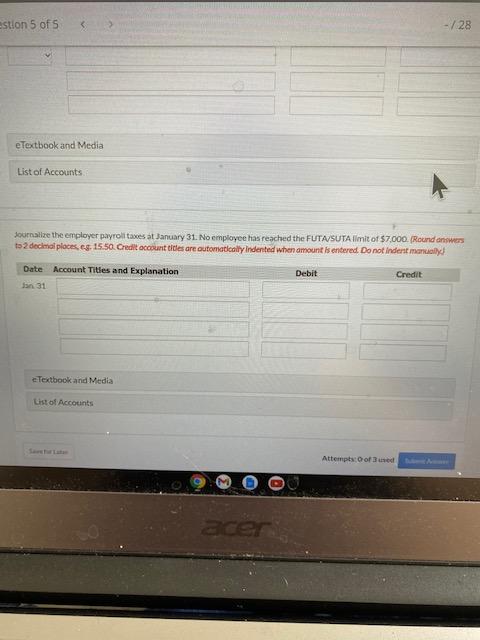

The following payroll ability accounts are included in the ledger of Pharoah Company on January 1. FICA Taxes Payable Federal Income Taxes Payable State Income Taxes Payable Federal Unemployment Taxes Payable State Unemployment Taxes Payable Union Dues Payable $760.00 1,204.60 108.95 288.95 1.954.40 870.00 In January, the following transactions occurred, 10 12 17 20 Sent check for $870.00 to union treasurer for union dues. Sent check for $1.964.60 for FICA taxes and federal income taxes withheld Pald state income taxes withheld from employees Paid federal and state unemployment taxes A January 31, the company completed the monthly payrollregister, which shows salaries and wages $50.000 The company makes entry for employer payroll taxes: FICA 7.65% (the 7.65% FICA tax rate consists of the Social Security tax rate of 62% on sales and wages up to $50.000 and the Medicare tax rate of 1.45% on all salaries and wages.federal unemployment 0.6% and state unemployment taxes 5:4% Journalize the January transactions. (Round answers to decimal places, 1525. Credit account thesare automatically indented when amount is entered. Do not indently. Record journal entries in the order presented in the problem Date Account Titles and Explanation Debit Credit acer Journalize the January transactions, (Round answers to 2 decimal places, c. 1525. Credit account Utles are automatically Indented when amount is entered. Do not Indent manually. Record Journal entries in the order presented in the problem) Date Account Tities and Explanation Debit Credit eTextbook and Media List of Accounts Journemopyroll taxes at ry 31. No employee has reached the FUTASUTA 57.000 diplom 15.50. Cellccount creational Indented when amount is entered Dune Date Account Tities and Explanation Debit Credit acer 0 0 estion 5 of 5 -/28 e Textbook and Media List of Accounts Journalize the employer payrolles at January 31. No employee has reached the FUTA SUTA limit of $7.000. (Round answers to 2 decimal places.eg. 15,50 Credit account tiles are automatically indented when amount is entered. Do not indent manual Date Account Titles and Explanation Debit Credit in 31 e Textbook and Media List of Accounts Attempts of use M