Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following pension-related data pertain to Metro Recreation's noncontributory, defined benefit pension plan for 2021: ($ in 000s) Jan. 1 Dec. 31 Projected benefit obligation

The following pension-related data pertain to Metro Recreation's noncontributory, defined benefit pension plan for 2021:

| ($ in 000s) | |||||||

| Jan. 1 | Dec. 31 | ||||||

| Projected benefit obligation | $ | 5,200 | $ | 5,480 | |||

| Accumulated benefit obligation | 3,770 | 4,060 | |||||

| Plan assets (fair value) | 6,180 | 6,625 | |||||

| Interest (discount) rate, 8% | |||||||

| Expected return on plan assets, 10% | |||||||

| Prior service costAOCI (from Dec. 31, 2020, amendment) | 950 | ||||||

| Net lossAOCI | 638 | ||||||

| Average remaining service life: 10 years | |||||||

| Gain due to changes in actuarial assumptions | 60 | ||||||

| Contributions to pension fund (end of year) | 450 | ||||||

| Pension benefits paid (end of year) | 405 | ||||||

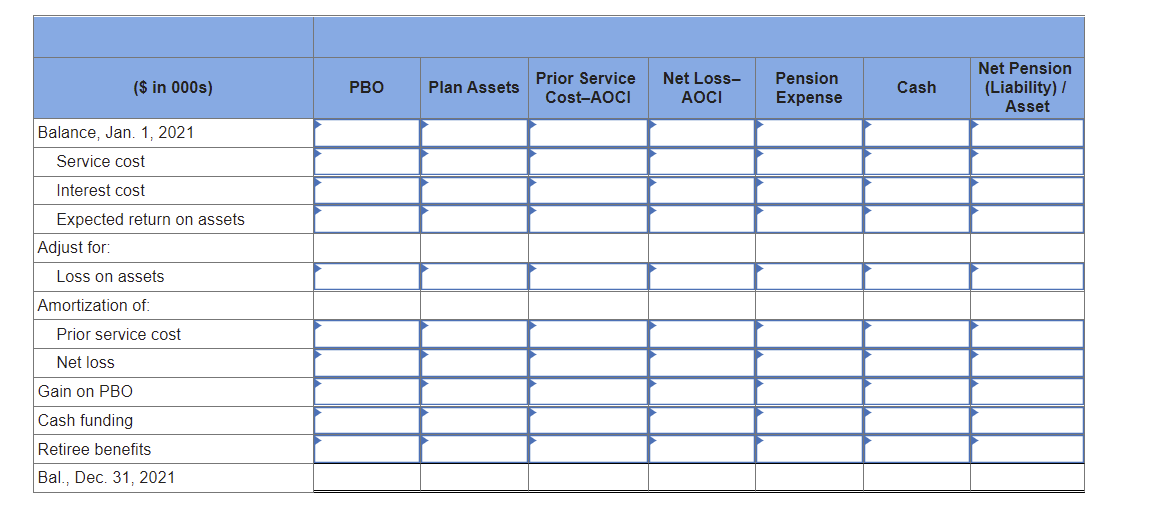

Required: Prepare a pension spreadsheet that shows the relationships among the various pension balances, shows the changes in those balances, and computes pension expense for 2021. (Enter credit amounts with a minus sign and debit amounts with a positive sign. Enter your answers in thousands (i.e. 200,000 should be entered as 200).)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started