Answered step by step

Verified Expert Solution

Question

1 Approved Answer

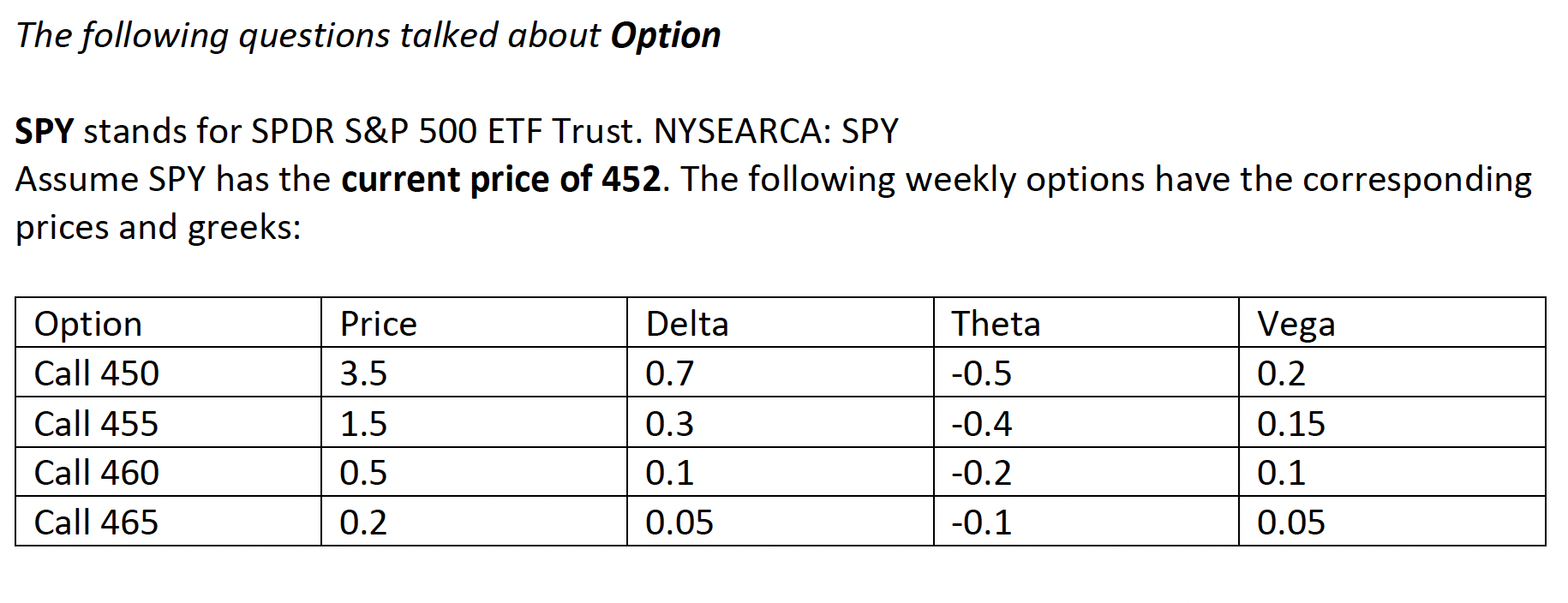

The following questions talked about Option SPY stands for SPDR S&P 500 ETF Trust. NYSEARCA: SPY Assume SPY has the current price of 452. The

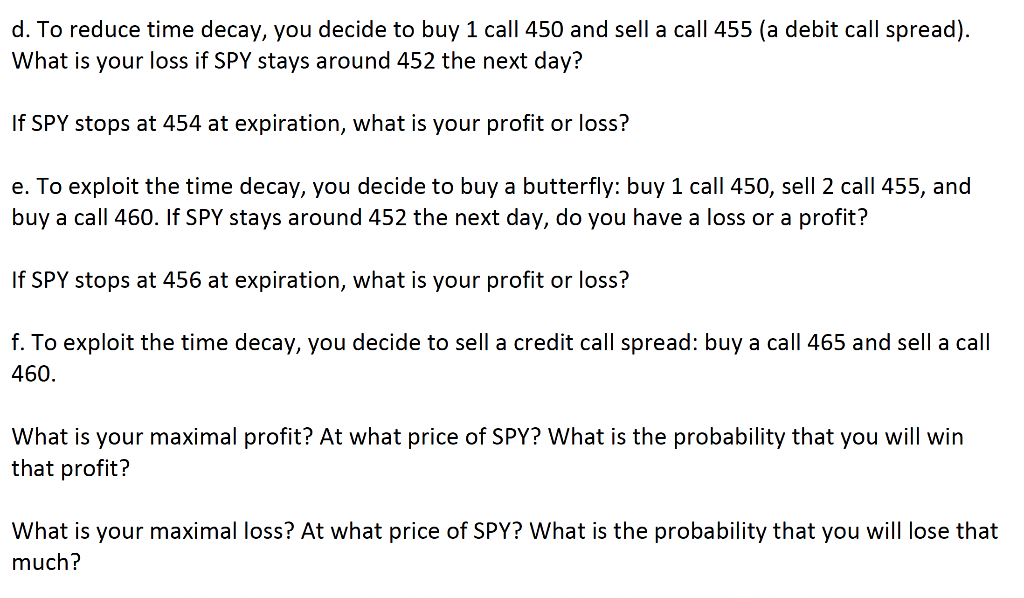

The following questions talked about Option SPY stands for SPDR S&P 500 ETF Trust. NYSEARCA: SPY Assume SPY has the current price of 452. The following weekly options have the corresponding prices and greeks: Price 3.5 Delta 0.7 Theta -0.5 Option Call 450 Call 455 Call 460 Call 465 Vega 0.2 0.15 -0.4 1.5 0.5 0.3 0.1 0.05 0.1 -0.2 -0.1 0.2 0.05 d. To reduce time decay, you decide to buy 1 call 450 and sell a call 455 (a debit call spread). What is your loss if SPY stays around 452 the next day? If SPY stops at 454 at expiration, what is your profit or loss? e. To exploit the time decay, you decide to buy a butterfly: buy 1 call 450, sell 2 call 455, and buy a call 460. If SPY stays around 452 the next day, do you have a loss or a profit? If SPY stops at 456 at expiration, what is your profit or loss? f. To exploit the time decay, you decide to sell a credit call spread: buy a call 465 and sell a call 460. What is your maximal profit? At what price of SPY? What is the probability that you will win that profit? What is your maximal loss? At what price of SPY? What is the probability that you will lose that much? The following questions talked about Option SPY stands for SPDR S&P 500 ETF Trust. NYSEARCA: SPY Assume SPY has the current price of 452. The following weekly options have the corresponding prices and greeks: Price 3.5 Delta 0.7 Theta -0.5 Option Call 450 Call 455 Call 460 Call 465 Vega 0.2 0.15 -0.4 1.5 0.5 0.3 0.1 0.05 0.1 -0.2 -0.1 0.2 0.05 d. To reduce time decay, you decide to buy 1 call 450 and sell a call 455 (a debit call spread). What is your loss if SPY stays around 452 the next day? If SPY stops at 454 at expiration, what is your profit or loss? e. To exploit the time decay, you decide to buy a butterfly: buy 1 call 450, sell 2 call 455, and buy a call 460. If SPY stays around 452 the next day, do you have a loss or a profit? If SPY stops at 456 at expiration, what is your profit or loss? f. To exploit the time decay, you decide to sell a credit call spread: buy a call 465 and sell a call 460. What is your maximal profit? At what price of SPY? What is the probability that you will win that profit? What is your maximal loss? At what price of SPY? What is the probability that you will lose that much

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started