Answered step by step

Verified Expert Solution

Question

1 Approved Answer

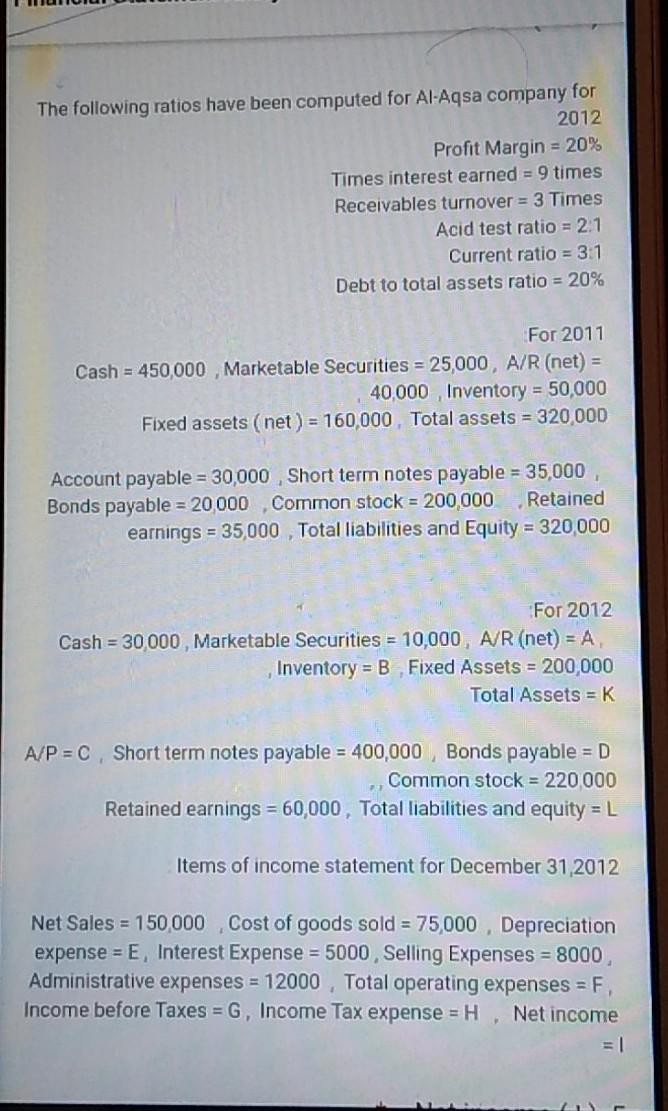

The following ratios have been computed for Al-Aqsa company for 2012 Profit Margin = 20% Times interest earned = 9 times Receivables turnover = 3

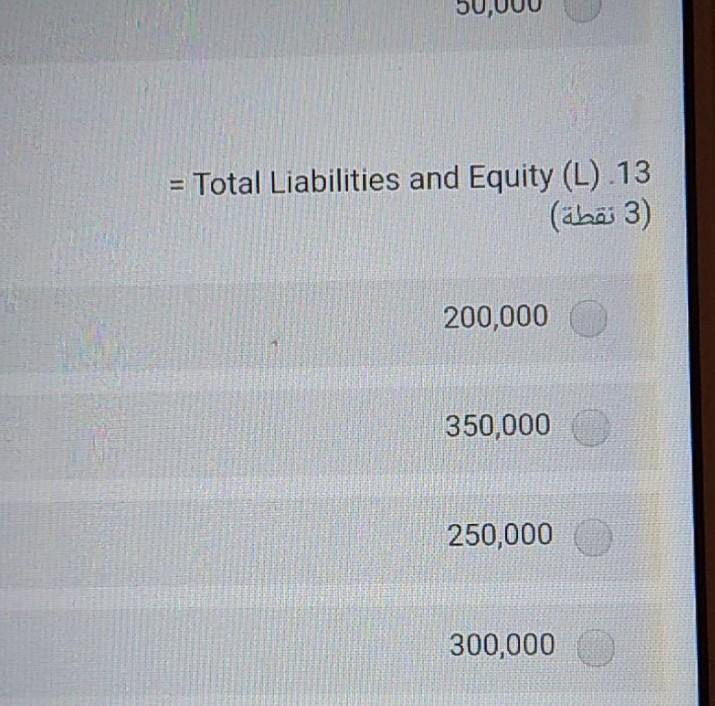

The following ratios have been computed for Al-Aqsa company for 2012 Profit Margin = 20% Times interest earned = 9 times Receivables turnover = 3 Times Acid test ratio = 2.1 Current ratio = 3:1 Debt to total assets ratio = 20% For 2011 Cash = 450,000 , Marketable Securities = 25,000, A/R (net) = 40,000 Inventory = 50,000 Fixed assets (net) = 160,000 Total assets = 320,000 Account payable = 30,000 Short term notes payable = 35,000 Bonds payable = 20 000 Common stock = 200,000 Retained earnings = 35,000 Total liabilities and Equity = 320,000 For 2012 Cash = 30,000 Marketable Securities = 10,000, A/R (net) = A Inventory = B , Fixed Assets = 200,000 Total Assets = K A/P = C, Short term notes payable = 400,000 Bonds payable =D Common stock = 220 000 Retained earnings = 60,000, Total liabilities and equity = L Items of income statement for December 31,2012 Net Sales = 150 000 ,Cost of goods sold = 75,000 Depreciation expense = E, Interest Expense = 5000, Selling Expenses = 8000 Administrative expenses = 12000 Total operating expenses = F, Income before Taxes = G, Income Tax expense = H Net income = Total Liabilities and Equity (L).13 (3 ) 200,000 350,000 250,000 300,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started