Answered step by step

Verified Expert Solution

Question

1 Approved Answer

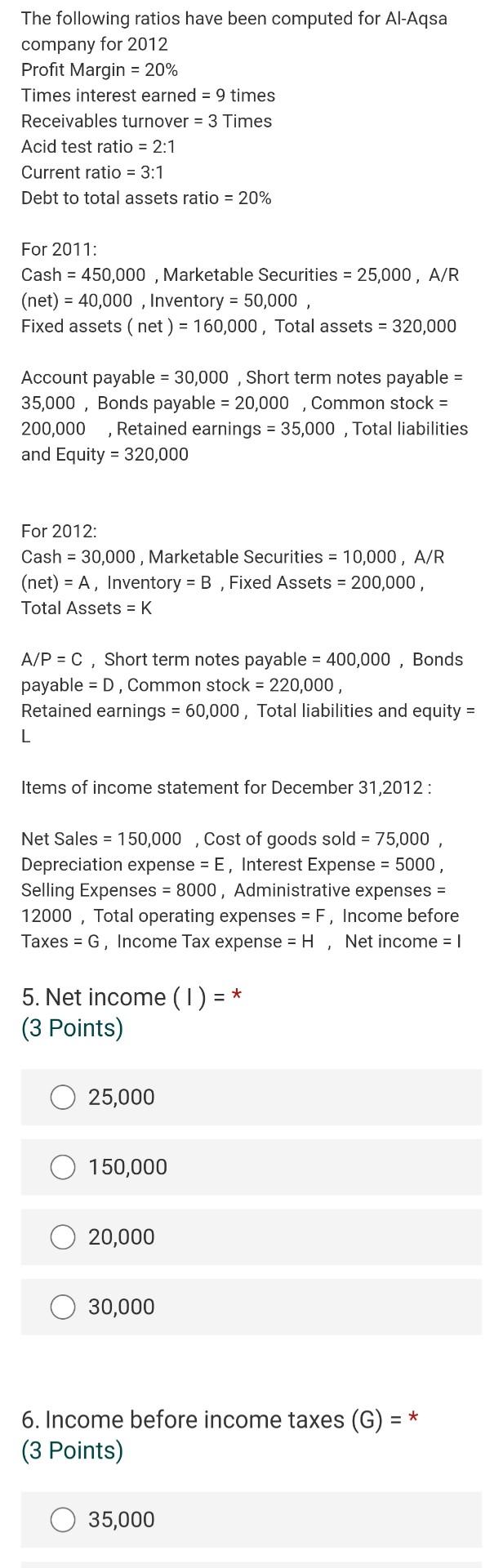

The following ratios have been computed for Al-Aqsa company for 2012 Profit Margin = 20% Times interest earned = 9 times Receivables turnover = 3

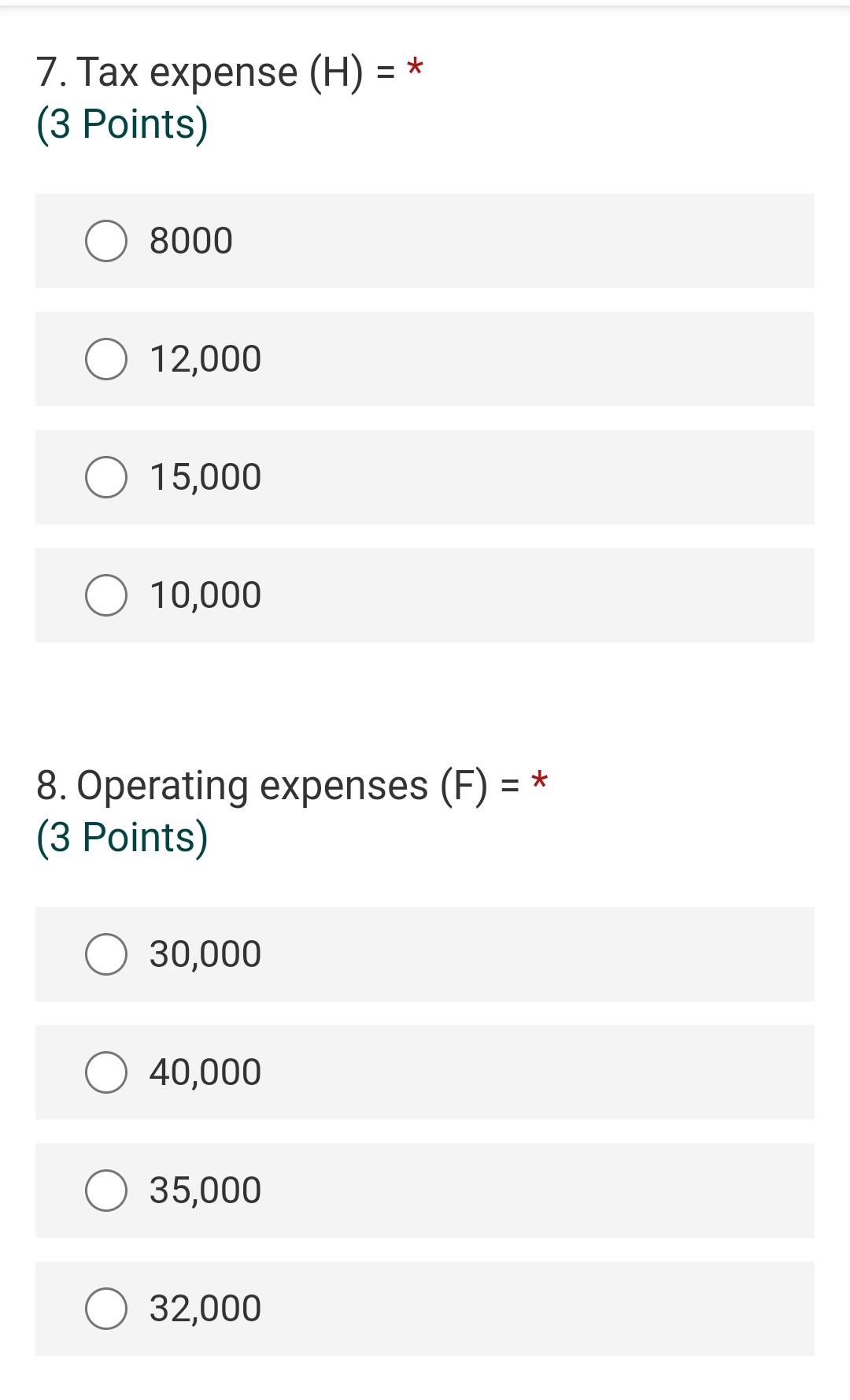

The following ratios have been computed for Al-Aqsa company for 2012 Profit Margin = 20% Times interest earned = 9 times Receivables turnover = 3 Times Acid test ratio = 2:1 Current ratio = 3:1 Debt to total assets ratio = 20% For 2011: Cash = 450,000 , Marketable Securities = 25,000, A/R (net) = 40,000 , Inventory = 50,000 , Fixed assets ( net ) = 160,000, Total assets = 320,000 Account payable = 30,000 , Short term notes payable 35,000, Bonds payable = 20,000, Common stock = 200,000 Retained earnings = 35,000 Total liabilities and Equity = 320,000 For 2012: Cash = 30,000, Marketable Securities = 10,000, A/R (net) = A, Inventory = B , Fixed Assets = 200,000, Total Assets = K A/P = C, Short term notes payable = 400,000, Bonds payable = D. Common stock = 220,000, Retained earnings = 60,000, Total liabilities and equity = L Items of income statement for December 31,2012: Net Sales = 150,000 ,Cost of goods sold = 75,000 Depreciation expense = E, Interest Expense = 5000, Selling Expenses = 8000, Administrative expenses = 12000, Total operating expenses = F, Income before Taxes = G, Income Tax expense = H Net income = 1 5. Net income (1) = * (3 Points) 25,000 150,000 0 20,000 30,000 6. Income before income taxes (G) = * (3 Points) 35,000 7. Tax expense (H) = * (3 Points) 8000 12,000 15,000 10,000 8. Operating expenses (F) = * (3 Points) 30,000 40,000 35,000 32,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started