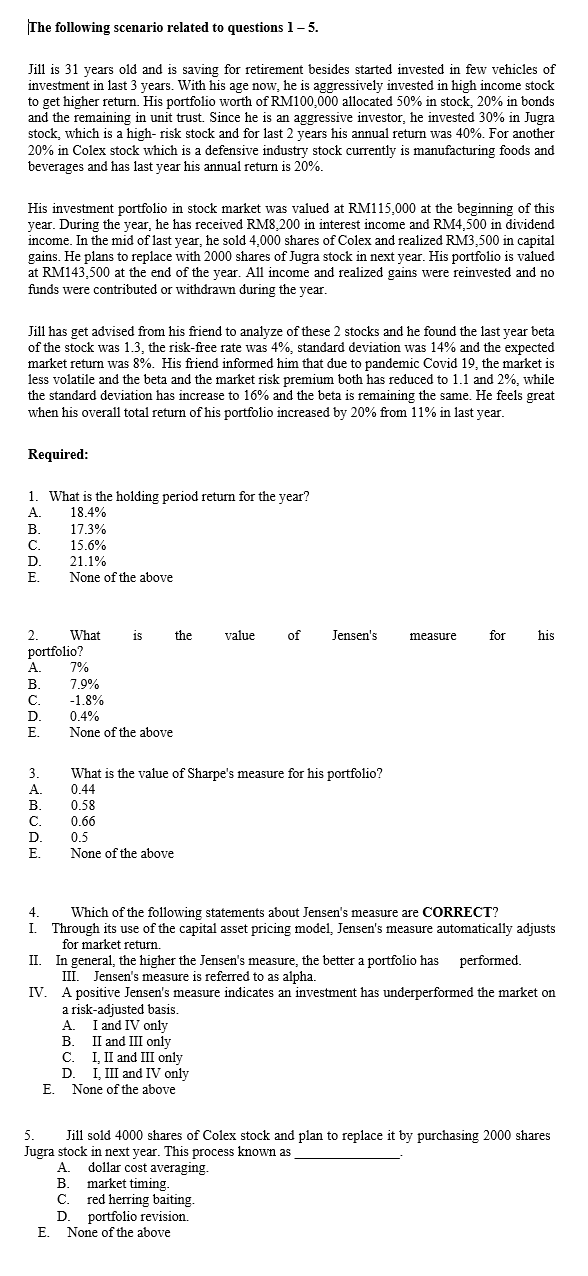

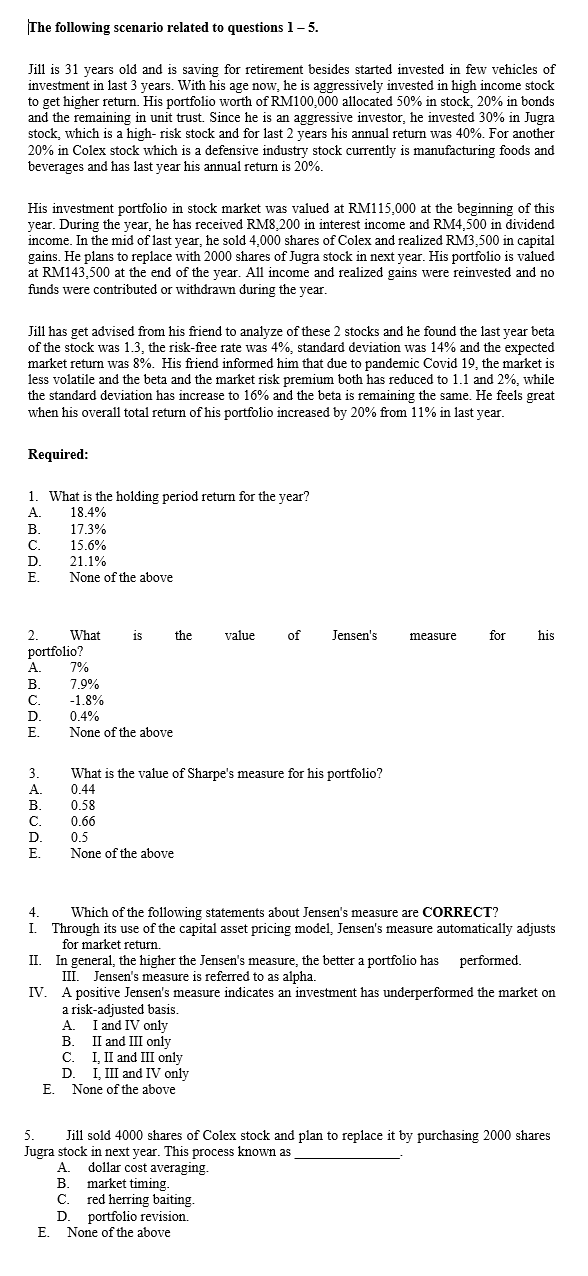

The following scenario related to questions 1-5. Jill is 31 years old and is saving for retirement besides started invested in few vehicles of investment in last 3 years. With his age now, he is aggressively invested in high income stock to get higher return. His portfolio worth of RM100,000 allocated 50% in stock, 20% in bonds and the remaining in unit trust . Since he is an aggressive investor, he invested 30% in Jugra stock, which is a high-risk stock and for last 2 years his annual return was 40%. For another 20% in Colex stock which is a defensive industry stock currently is manufacturing foods and beverages and has last year his annual return is 20%. His investment portfolio in stock market was valued at RM115,000 at the beginning of this year. During the year, he has received RM8,200 in interest income and RM4,500 in dividend income. In the mid of last year, he sold 4.000 shares of Colex and realized RM3,500 in capital gains. He plans to replace with 2000 shares of Jugra stock in next year. His portfolio is valued at RM143,500 at the end of the year. All income and realized gains were reinvested and no funds were contributed or withdrawn during the year. Jill has get advised from his friend to analyze of these 2 stocks and he found the last year beta of the stock was 1.3, the risk-free rate was 4%, standard deviation was 14% and the expected market return was 8%. His friend informed him that due to pandemic Covid 19, the market is less volatile and the beta and the market risk premium both has reduced to 1.1 and 2%, while the standard deviation has increase to 16% and the beta is remaining the same. He feels great when his overall total return of his portfolio increased by 20% from 11% in last year. Required: 1. What is the holding period return for the year? A. 18.4% B. 17.3% C. 15.6% D. 21.1% E. None of the above value of Jensen's measure for his 2. What is the portfolio? A 7% B. 7.9% c. -1.8% D. 0.4% E. None of the above 3. A B. c D. E. What is the value of Sharpe's measure for his portfolio? 0.44 0.58 0.66 0.5 None of the above 4. Which of the following statements about Jensen's measure are CORRECT? I. Through its use of the capital asset pricing model, Jensen's measure automatically adjusts for market return. II. In general, the higher the Jensen's measure, the better a portfolio has performed III. Jensen's measure is referred to as alpha. IV. A positive Jensen's measure indicates an investment has underperformed the market on a risk-adjusted basis. A. I and IV only B. I and III only c I, II and III only D I III II and IV only E. None of the above 5. Jill sold 4000 shares of Colex stock and plan to replace it by purchasing 2000 shares Jugra stock in next year. This process known as A dollar cost averaging. B. market timing. . red herring baiting. D portfolio revision E. None of the above