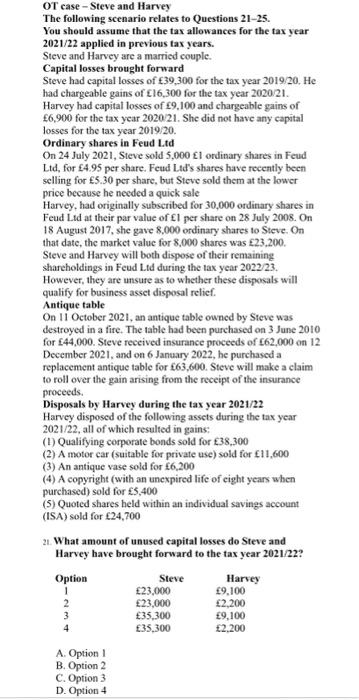

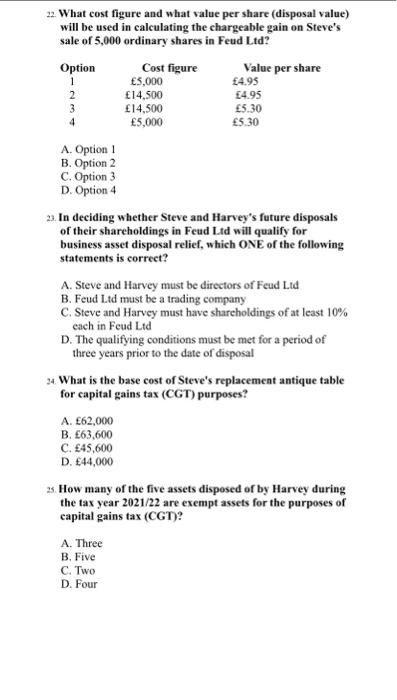

The following scenario relates to Questions 21-25. You should assume that the tax allowances for the tax year 2021/22 applied in previous tax years. Steve and Harvey are a married couple. Capital losses brought forward Steve had capital losses of 39,300 for the tax year 2019/20. He had chargeable gains of f16,300 for the tax year 2020.21. Harvey had capital losses of 9,100 and chargeable gains of 6,900 for the tax ycar 202021 . She did not have any capital losses for the tax year 2019/20. Ordinary shares in Feud L.td On 24 July 2021, Steve sold 5,000f1 ordinary shares in Feud Ltd, for 4.95 per share. Feud Ltd's shares have recently been selling for 5.30 per share, but Steve sold them at the lower price because he needed a quick sale Harvey, had originally subseribed for 30,000 ordinary shares in Feud Ltd at their par value of 1 per share on 28 July 2008 . On 18 August 2017, she gave 8,000 ordinary shares to Steve. On that date, the market value for 8.000 shares was 23,200. Steve and Harvey will both dispose of their remaining sharcholdings in Feud Ltd during the tax year 2022/23. However, they are unsure as to whether these disposals will qualify for business asset disposal relief. Antique table On 11 October 2021, an antique table owned by Sieve was destroyed in a fire. The table had been purchased on 3 June 2010 for 44,000. Steve reccived insurance proceeds of L62,000 an 12 December 2021, and on 6 January 2022 , he purchased a replacement antique table for 463,600 . Steve will make a claim to roll over the gain arising from the receipt of the insurance proceeds. Disposals by Harvey during the tax year 2021/22 Harvey disposed of the following assets during the tax year 2021/22, all of which resulted in gains: (1) Qualifying corporate bonds sold for 38,300 (2) A motor car (suitable for private use) sold for 11,600 (3) An antique vase sold for 6,200 (4) A copyright (with an unexpired life of cight years when purchased) sold for $5,400 (5) Quoted shares held within an individual savings account (ISA) sold for 24,700 21. What amount of unused capital losses do Steve and Harvey have brought forward to the tax year 2021/22? A. Option I B. Option 2 C. Option 3 D. Option 4 22. What cost figure and what value per share (disposal value) will be used in calculating the chargeable gain on Steve's sale of 5,000 ordinary shares in Feud Ltd? A. Option 1 B. Option 2 C. Option 3 D. Option 4 23. In deciding whether Steve and Harvey's future disposals of their shareholdings in Fcud L.td will qualify for business asset disposal relief, which ONE of the following statements is correct? A. Steve and Harvey must be directors of Feud Ltd B. Feud Ltd must be a trading company C. Steve and Harvey must have shareholdings of at least 10% each in Feud Ltd D. The qualifying conditions must be met for a period of three years prior to the date of disposal 24. What is the base cost of Steve's replacement antique table for capital gains tax (CGT) purposes? A. 62,000 B. 63,600 C. 45,600 D. 44,000 25. How many of the five assets disposed of by Harvey during the tax year 2021/22 are exempt assets for the purposes of capital gains tax (CGT)? A. Three B. Five C. Two D. Four The following scenario relates to Questions 21-25. You should assume that the tax allowances for the tax year 2021/22 applied in previous tax years. Steve and Harvey are a married couple. Capital losses brought forward Steve had capital losses of 39,300 for the tax year 2019/20. He had chargeable gains of f16,300 for the tax year 2020.21. Harvey had capital losses of 9,100 and chargeable gains of 6,900 for the tax ycar 202021 . She did not have any capital losses for the tax year 2019/20. Ordinary shares in Feud L.td On 24 July 2021, Steve sold 5,000f1 ordinary shares in Feud Ltd, for 4.95 per share. Feud Ltd's shares have recently been selling for 5.30 per share, but Steve sold them at the lower price because he needed a quick sale Harvey, had originally subseribed for 30,000 ordinary shares in Feud Ltd at their par value of 1 per share on 28 July 2008 . On 18 August 2017, she gave 8,000 ordinary shares to Steve. On that date, the market value for 8.000 shares was 23,200. Steve and Harvey will both dispose of their remaining sharcholdings in Feud Ltd during the tax year 2022/23. However, they are unsure as to whether these disposals will qualify for business asset disposal relief. Antique table On 11 October 2021, an antique table owned by Sieve was destroyed in a fire. The table had been purchased on 3 June 2010 for 44,000. Steve reccived insurance proceeds of L62,000 an 12 December 2021, and on 6 January 2022 , he purchased a replacement antique table for 463,600 . Steve will make a claim to roll over the gain arising from the receipt of the insurance proceeds. Disposals by Harvey during the tax year 2021/22 Harvey disposed of the following assets during the tax year 2021/22, all of which resulted in gains: (1) Qualifying corporate bonds sold for 38,300 (2) A motor car (suitable for private use) sold for 11,600 (3) An antique vase sold for 6,200 (4) A copyright (with an unexpired life of cight years when purchased) sold for $5,400 (5) Quoted shares held within an individual savings account (ISA) sold for 24,700 21. What amount of unused capital losses do Steve and Harvey have brought forward to the tax year 2021/22? A. Option I B. Option 2 C. Option 3 D. Option 4 22. What cost figure and what value per share (disposal value) will be used in calculating the chargeable gain on Steve's sale of 5,000 ordinary shares in Feud Ltd? A. Option 1 B. Option 2 C. Option 3 D. Option 4 23. In deciding whether Steve and Harvey's future disposals of their shareholdings in Fcud L.td will qualify for business asset disposal relief, which ONE of the following statements is correct? A. Steve and Harvey must be directors of Feud Ltd B. Feud Ltd must be a trading company C. Steve and Harvey must have shareholdings of at least 10% each in Feud Ltd D. The qualifying conditions must be met for a period of three years prior to the date of disposal 24. What is the base cost of Steve's replacement antique table for capital gains tax (CGT) purposes? A. 62,000 B. 63,600 C. 45,600 D. 44,000 25. How many of the five assets disposed of by Harvey during the tax year 2021/22 are exempt assets for the purposes of capital gains tax (CGT)? A. Three B. Five C. Two D. Four