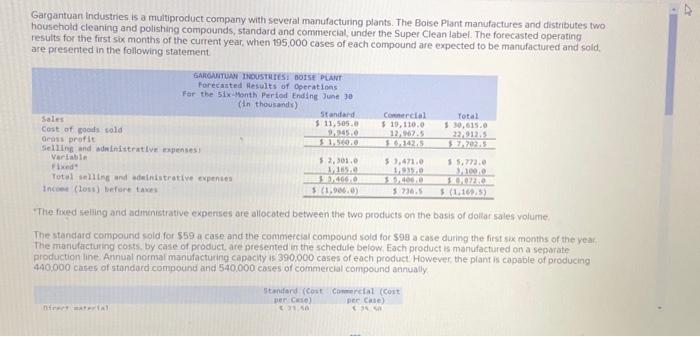

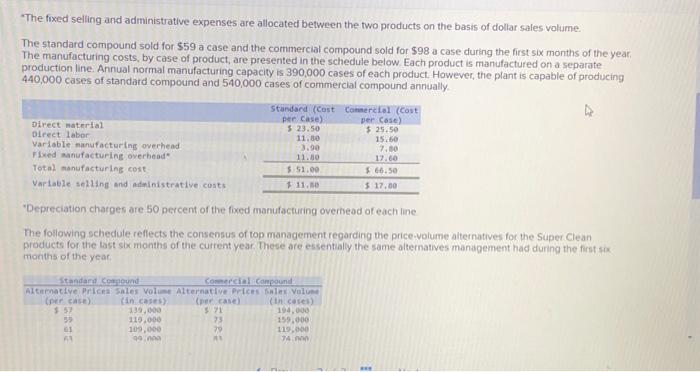

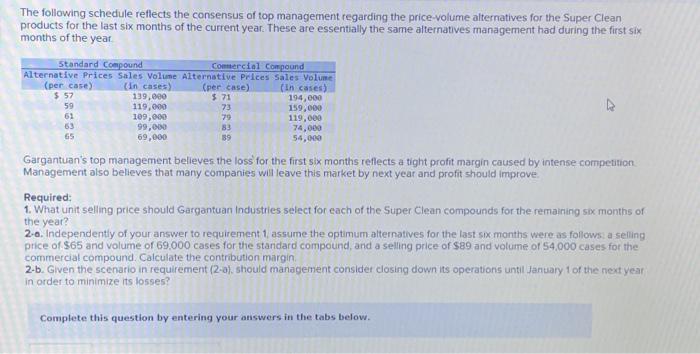

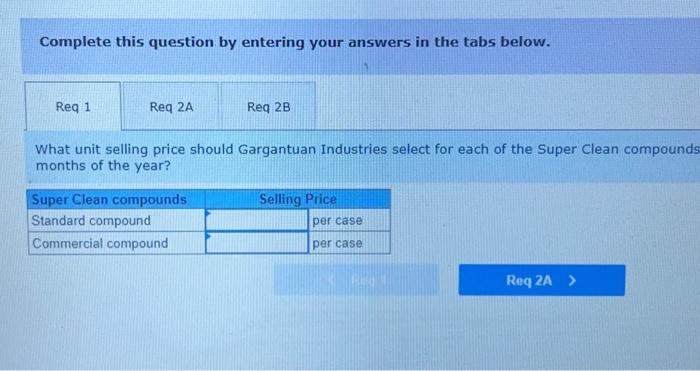

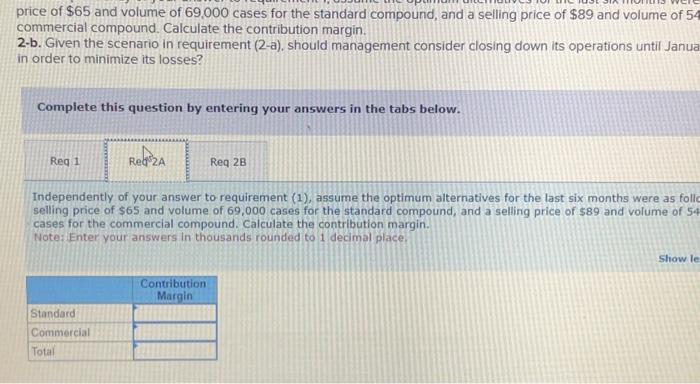

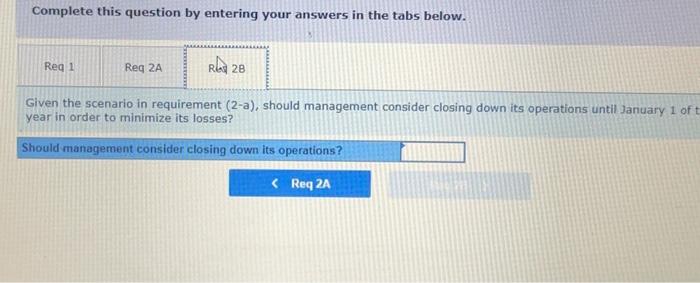

The following schedule reflects the consensus of top management regarding the price-volume alternatives for the Super Clean products for the last six months of the current year. These are essentially the same alternatives management had during the first six months of the year. Gargantuan's top management believes the loss' for the first six months reflects a tight profit margin caused by intense competition Management also believes that many companies will leave this market by next year and profit should improve Required: 1. What unit selling price should Gargantuan Industries select for each of the Super Clean compounds for the remaining six months of the year? 2. Independently of your answer to requirement 1 , assume the optimum alternatives for the last six months were as follows: a selling price of \\( \\$ 65 \\) and volume of 69,000 cases for the standard compound, and a selling price of \\( \\$ 89 \\) and volume of 54,000 cases for the commercial compound. Calculate the contribution margin. 2-b. Given the scenario in requirement (2-o), should management consider closing down its operations until January 1 of the next year in order to minimize its losses? Gargantuan industries is a multiproduct company with several manufacturing plants. The Boise Plant manufactures and distributes two houschold cleaning and polishing compounds, standard and commercial, under the Super Clean label. The forecasted operating results for the first six months of the current year, when 195.000 cases of each compound are expected to be manufactured and sold, are presented in the following statement. The fixed seling ard administrative expenses are aliocoted between the two products on the basis of dollar sales volume. The standard compound sold for \\( \\$ 59 \\) a case and the commercial compound sold for \\( \\$ 98 \\) a case during the first six months of the year. The manufacturing cossts, by case of product, are presented in the schedule befow. Each product is manufactured on a separate production line Annual normal manufacturing capocity is 390,000 cases of each product. However, the plant is capable of producing 440.000 cases of standard compound and 540.000 cases of commercial compound annually. Complete this question by entering your answers in the tabs below. What unit selling price should Gargantuan Industries select for each of the Super Clean compounc months of the year? price of \\( \\$ 65 \\) and volume of 69,000 cases for the standard compound, and a selling price of \\( \\$ 89 \\) and volume of 5 commercial compound. Calculate the contribution margin. 2-b. Given the scenario in requirement (2-a), should management consider closing down its operations until Januc in order to minimize its losses? Complete this question by entering your answers in the tabs below. Independently of your answer to requirement (1), assume the optimum alternatives for the last six months were as foll selling price of \\( \\$ 65 \\) and volume of 69,000 cases for the standard compound, and a selling price of \\( \\$ 89 \\) and volume of 5 . cases for the commercial compound. Calculate the contribution margin. Note: Enter your answers in thousands rounded to 1 decimal place. -The fixed selling and administrative expenses are allocated between the two products on the basis of dollar sales volume. The standard compound sold for \\( \\$ 59 \\) a case and the commercial compound sold for \\( \\$ 98 \\) a case during the first six months of the year. The manufacturing costs, by case of product, are presented in the schedule below. Each product is manufactured on a separate production line. Annual normal manufacturing capacity is 390,000 cases of each product. However, the plant is capable of producing 440,000 cases of standard compound and 540,000 cases of commercial compound annually. \"Depreciation chatges are 50 percent of the fixed manufacturing overhead of each line The following schedule reflects the consensus of top management regarding the price-volume alternatives for the Super Clean products for the last six months of the current year. These are essentialy the same alternatives management had during the first six months of the year Complete this question by entering your answers in the tabs below. Given the scenario in requirement \\( (2-a) \\), should management consider closing down its operations until January 1 of year in order to minimize its losses? Should management consider closing down its operations? The following schedule reflects the consensus of top management regarding the price-volume alternatives for the Super Clean products for the last six months of the current year. These are essentially the same alternatives management had during the first six months of the year. Gargantuan's top management believes the loss' for the first six months reflects a tight profit margin caused by intense competition Management also believes that many companies will leave this market by next year and profit should improve Required: 1. What unit selling price should Gargantuan Industries select for each of the Super Clean compounds for the remaining six months of the year? 2. Independently of your answer to requirement 1 , assume the optimum alternatives for the last six months were as follows: a selling price of \\( \\$ 65 \\) and volume of 69,000 cases for the standard compound, and a selling price of \\( \\$ 89 \\) and volume of 54,000 cases for the commercial compound. Calculate the contribution margin. 2-b. Given the scenario in requirement (2-o), should management consider closing down its operations until January 1 of the next year in order to minimize its losses? Gargantuan industries is a multiproduct company with several manufacturing plants. The Boise Plant manufactures and distributes two houschold cleaning and polishing compounds, standard and commercial, under the Super Clean label. The forecasted operating results for the first six months of the current year, when 195.000 cases of each compound are expected to be manufactured and sold, are presented in the following statement. The fixed seling ard administrative expenses are aliocoted between the two products on the basis of dollar sales volume. The standard compound sold for \\( \\$ 59 \\) a case and the commercial compound sold for \\( \\$ 98 \\) a case during the first six months of the year. The manufacturing cossts, by case of product, are presented in the schedule befow. Each product is manufactured on a separate production line Annual normal manufacturing capocity is 390,000 cases of each product. However, the plant is capable of producing 440.000 cases of standard compound and 540.000 cases of commercial compound annually. Complete this question by entering your answers in the tabs below. What unit selling price should Gargantuan Industries select for each of the Super Clean compounc months of the year? price of \\( \\$ 65 \\) and volume of 69,000 cases for the standard compound, and a selling price of \\( \\$ 89 \\) and volume of 5 commercial compound. Calculate the contribution margin. 2-b. Given the scenario in requirement (2-a), should management consider closing down its operations until Januc in order to minimize its losses? Complete this question by entering your answers in the tabs below. Independently of your answer to requirement (1), assume the optimum alternatives for the last six months were as foll selling price of \\( \\$ 65 \\) and volume of 69,000 cases for the standard compound, and a selling price of \\( \\$ 89 \\) and volume of 5 . cases for the commercial compound. Calculate the contribution margin. Note: Enter your answers in thousands rounded to 1 decimal place. -The fixed selling and administrative expenses are allocated between the two products on the basis of dollar sales volume. The standard compound sold for \\( \\$ 59 \\) a case and the commercial compound sold for \\( \\$ 98 \\) a case during the first six months of the year. The manufacturing costs, by case of product, are presented in the schedule below. Each product is manufactured on a separate production line. Annual normal manufacturing capacity is 390,000 cases of each product. However, the plant is capable of producing 440,000 cases of standard compound and 540,000 cases of commercial compound annually. \"Depreciation chatges are 50 percent of the fixed manufacturing overhead of each line The following schedule reflects the consensus of top management regarding the price-volume alternatives for the Super Clean products for the last six months of the current year. These are essentialy the same alternatives management had during the first six months of the year Complete this question by entering your answers in the tabs below. Given the scenario in requirement \\( (2-a) \\), should management consider closing down its operations until January 1 of year in order to minimize its losses? Should management consider closing down its operations