The following selected accounts and account balances were taken from the records of Nowell Company. Except as otherwise indicated, all balances are as of December

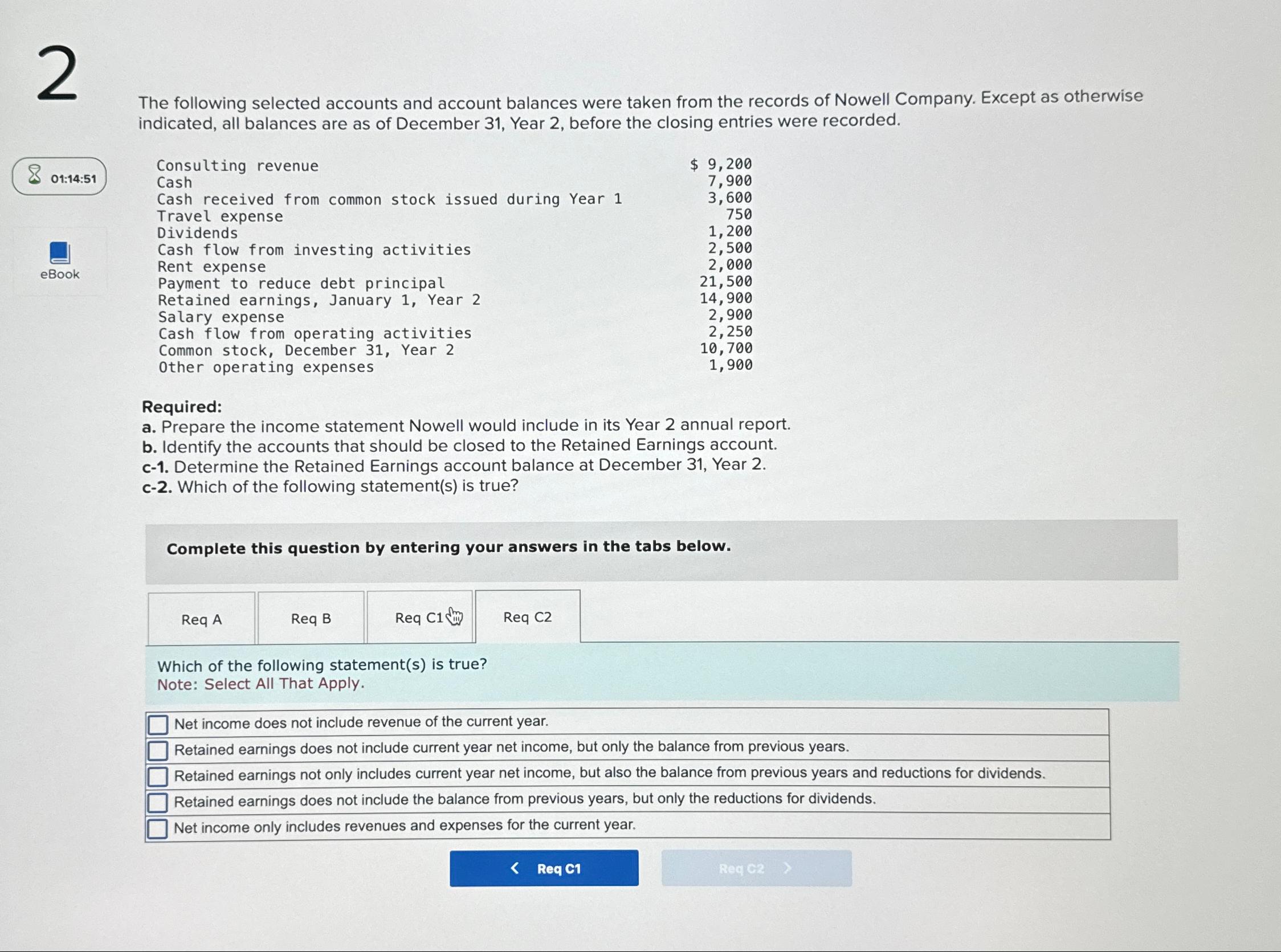

The following selected accounts and account balances were taken from the records of Nowell Company. Except as otherwise indicated, all balances are as of December 31, Year 2, before the closing entries were recorded.\ 01:14:51\ Consulting revenue\ Cash\ Cash received from common stock issued during Year 1\ Travel expense\ Dividends\ Cash flow from investing activities\ Rent expense\ Payment to reduce debt principal\ Retained earnings, January 1, Year 2\ Salary expense\ Cash flow from operating activities\ Common stock, December 31, Year 2\ other operating expenses\

9,200\ 7,900\ 3,600\ 750\ 1,200\ 2,500\ 2,000\ 21,500\ 14,900\ 2,900\ 2,250\ 10,700\ 1,900\ Required:\ a. Prepare the income statement Nowell would include in its Year 2 annual report.\ b. Identify the accounts that should be closed to the Retained Earnings account.\ c-1. Determine the Retained Earnings account balance at December 31, Year 2.\ c-2. Which of the following statement(s) is true?\ Complete this question by entering your answers in the tabs below.\

ReqA\ Req B\ Req

C1\ 1 Iili\ Req C2\ Which of the following statement(s) is true?\ Note: Select All That Apply.\ Net income does not include revenue of the current year.\ Retained earnings does not include current year net income, but only the balance from previous years.\ Retained earnings not only includes current year net income, but also the balance from previous years and reductions for dividends.\ Retained earnings does not include the balance from previous years, but only the reductions for dividends.\ Net income only includes revenues and expenses for the current year.\ ReqC1\ RegCe2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started