The following selected accounts and their current balances appear in the ledger of Clairemont Co. for the fiscal year ended May 31, 2018: Cash $

The following selected accounts and their current balances appear in the ledger of Clairemont Co. for the fiscal year ended May 31, 2018:

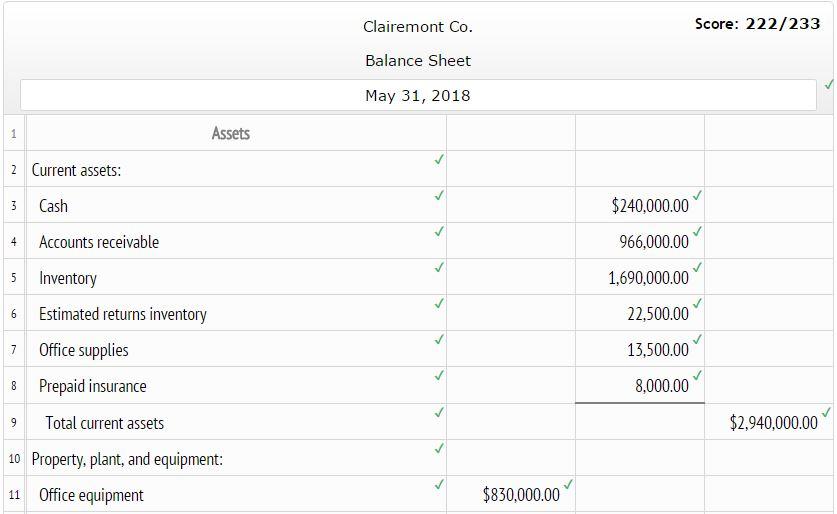

| Cash | $ 240,000 |

| Accounts receivable | 966,000 |

| Inventory | 1,690,000 |

| Estimated returns inventory | 22,500 |

| Office supplies | 13,500 |

| Prepaid insurance | 8,000 |

| Office equipment | 830,000 |

| Accumulated depreciation-office equipment | 550,000 |

| Store equipment | 3,600,000 |

| Accumulated depreciation-store equipment | 1,820,000 |

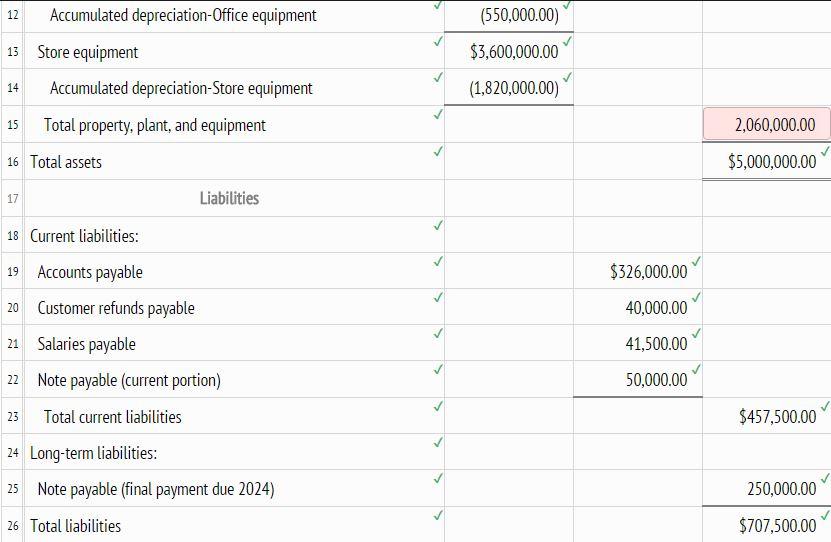

| Accounts payable | 326,000 |

| Customer refunds payable | 40,000 |

| Salaries payable | 41,500 |

| Note payable (final payment due 2024) | 300,000 |

| Common stock | 500,000 |

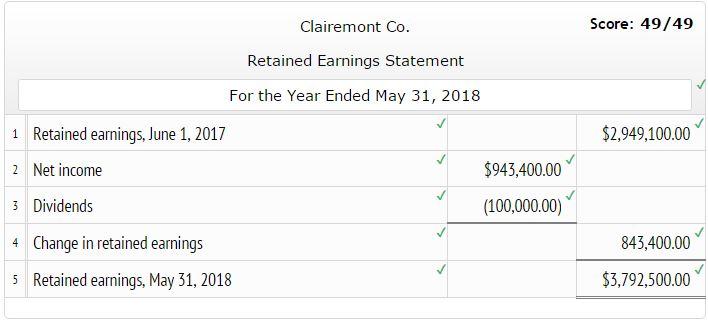

| Retained earnings | 2,949,100 |

| Dividends | 100,000 |

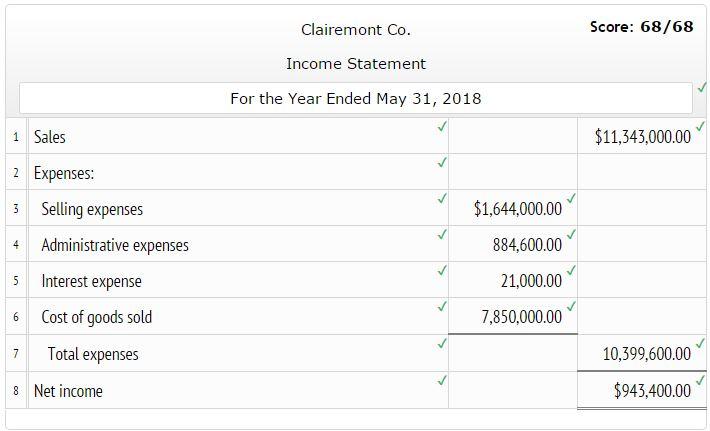

| Sales | 11,343,000 |

| Cost of goods sold | 7,850,000 |

| Sales salaries expense | 916,000 |

| Advertising expense | 550,000 |

| Depreciation expense-store equipment | 140,000 |

| Miscellaneous selling expense | 38,000 |

| Office salaries expense | 650,000 |

| Rent expense | 94,000 |

| Depreciation expense-office equipment | 50,000 |

| Insurance expense | 48,000 |

| Office supplies expense | 28,100 |

| Miscellaneous administrative expense | 14,500 |

| Interest expense | 21,000 |

Prepare balance sheet, assuming that the current portion of the note payable is $50,000. Be sure to complete the statement heading. Refer to the problem data and the list of Labels and Amount Descriptions provided for the exact wording of the answer choices for text entries. Negative amount should be indicated by the minus sign. A colon (:) will automatically appear if it is required. (I HAVE ALREADY DONE THIS. PLEASE CORRECT THE WRONG ANSWER IN THE RED CELL BELOW)

Prepare closing entries as of May 31, 2018. Refer to the Chart of Accounts for exact wording of account titles. Recall that closing entries involve all temporary accounts. No permanent accounts from the balance sheet are closed. Contra accounts, like Accumulated Depreciation-Office Equipment are treated like the account to which it is related (Office Equipment), with an opposite debit/credit effect in the closing process.Close the Revenue account to Income Summary. Next close all expense accounts and contra revenue accounts to Income Summary. Close Income Summary to the Retained Earnings account. Finally, close the Dividends account to the Retained Earnings account. There are 20 lines in the journal, with line one being the description "closing entries" with no debit or credit amounts. I have included the income statement and retained earnings statement below for reference, in addition to the chart of accounts.

| CHART OF ACCOUNTS | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Clairemont Co. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| General Ledger | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Clairemont Co. Score: 222/233 Balance Sheet May 31, 2018 1 Assets 2 Current assets: Cash $240,000.00 4 Accounts receivable 966,000.00 5 Inventory 1,690,000.00 6 Estimated returns inventory 22,500.00 Office supplies 13,500.00 7 Prepaid insurance 8.000.00 8 Total current assets $2,940,000.00 9. 10 Property, plant, and equipment: 11 Office equipment $830,000.00

Step by Step Solution

3.50 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started