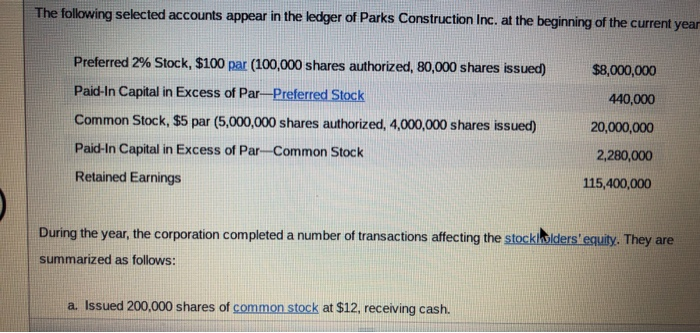

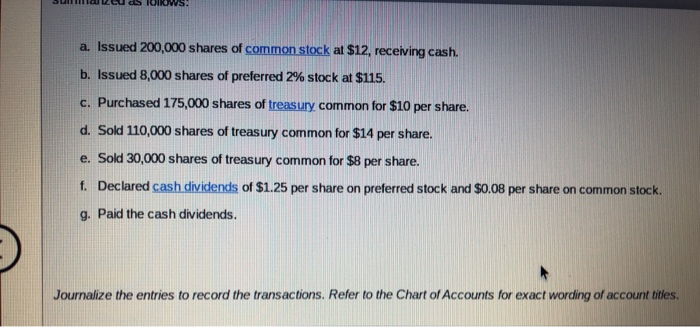

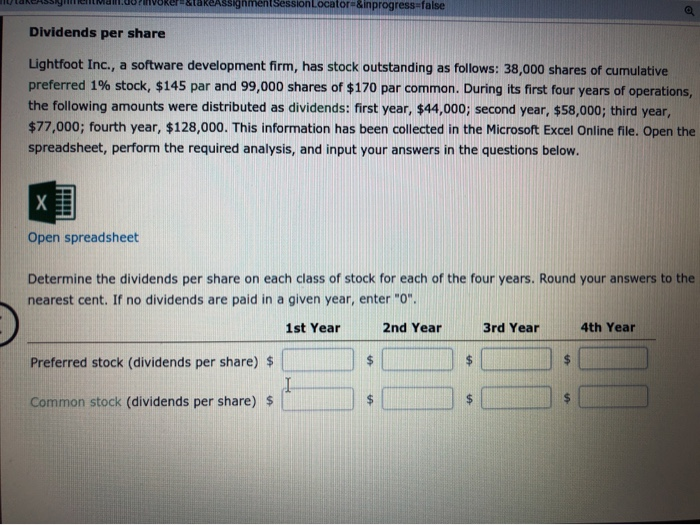

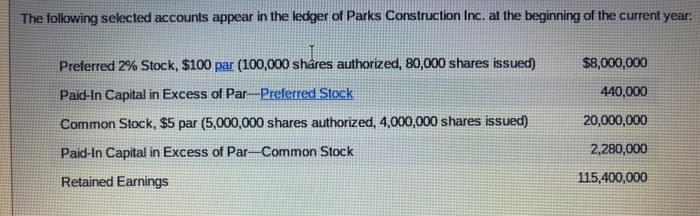

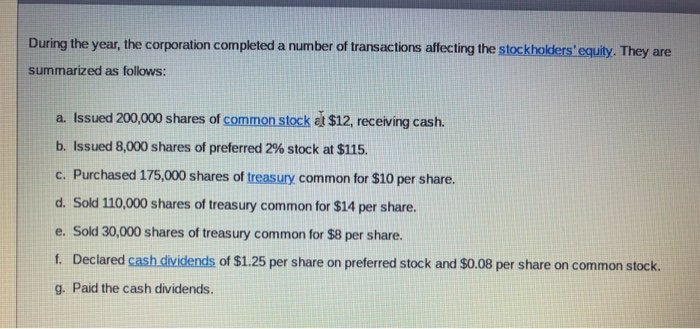

The following selected accounts appear in the ledger of Parks Construction Inc. at the beginning of the current year Preferred 2% Stock, $100 par (100,000 shares authorized, 80,000 shares issued) Paid-In Capital in Excess of Par-Preferred Stock Common Stock, $5 par (5,000,000 shares authorized, 4,000,000 shares issued) Paid-In Capital in Excess of Par Common Stock Retained Earnings $8,000,000 440,000 20,000,000 2,280,000 115,400,000 During the year, the corporation completed a number of transactions affecting the stockholders' equity. They are summarized as follows: a. Issued 200,000 shares of common stock at $12, receiving cash. a. Issued 200,000 shares of common stock at $12, receiving cash. b. Issued 8,000 shares of preferred 2% stock at $115. c. Purchased 175,000 shares of treasury common for $10 per share. d. Sold 110,000 shares of treasury common for $14 per share. e. Sold 30,000 shares of treasury common for $8 per share. f. Declared cash dividends of $1.25 per share on preferred stock and $0.08 per share on common stock. g. Paid the cash dividends. Journalize the entries to record the transactions. Refer to the Chart of Accounts for exact wording of account titles. eAssignmentSessionLocator-&inprogress-false Dividends per share Lightfoot Inc., a software development firm, has stock outstanding as follows: 38,000 shares of cumulative preferred 1% stock, $145 par and 99,000 shares of $170 par common. During its first four years of operations, the following amounts were distributed as dividends: first year, $44,000; second year, $58,000; third year, $77,000; fourth year, $128,000. This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below. X Open spreadsheet Determine the dividends per share on each class of stock for each of the four years. Round your answers to the nearest cent. If no dividends are paid in a given year, enter "0". 1st Year 2nd Year 3rd Year 4th Year Preferred stock (dividends per share) $ $ I Common stock (dividends per share) $ $ $ The following selected accounts appear in the ledger of Parks Construction Inc. at the beginning of the current year: $8,000,000 440,000 Preferred 2% Stock, $100 par (100,000 shares authorized, 80,000 shares issued) Paid-In Capital in Excess of Par Preferred Stock Common Stock, $5 par (5,000,000 shares authorized, 4,000,000 shares issued) Paid-In Capital in Excess of Par-Common Stock 20,000,000 2,280,000 Retained Earnings 115,400,000 During the year, the corporation completed a number of transactions affecting the stockholders' equity. They are summarized as follows: a. Issued 200,000 shares of common stock al $12, receiving cash. b. Issued 8,000 shares of preferred 2% stock at $115. c. Purchased 175,000 shares of treasury common for $10 per share. d. Sold 110,000 shares of treasury common for $14 per share. e. Sold 30,000 shares of treasury common for $8 per share. f. Declared cash dividends of $1.25 per share on preferred stock and $0.08 per share on common stock. g. Paid the cash dividends