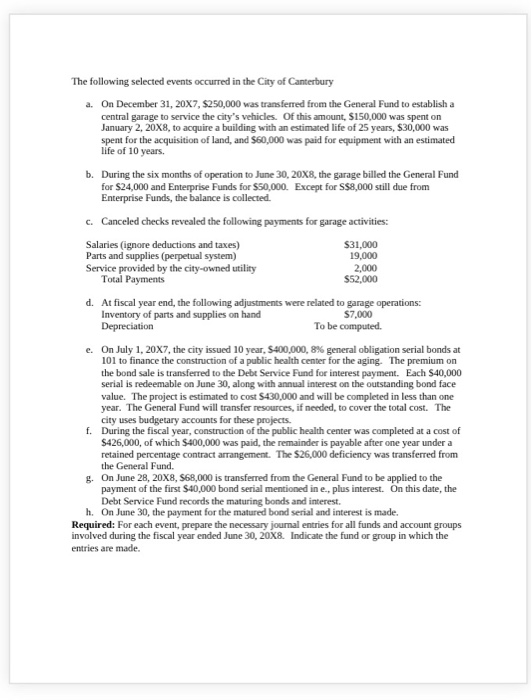

The following selected events occurred in the City of Canterbury a. On December 31, 20X7, 5250,000 was transferred from the General Fund to establish a central garage to service the city's vehicles. Of this amount, $150,000 was spent on January 2, 20X8, to acquire a building with an estimated life of 25 years, $30,000 was spent for the acquisition of land, and $60,000 was paid for equipment with an estimated life of 10 years. b. During the six months of operation to June 30, 20x8, the garage billed the General Fund for $24,000 and Enterprise Funds for $50,000. Except for $58,000 still due from Enterprise Funds, the balance is collected c. Canceled checks revealed the following payments for garage activities: Salaries (ignore deductions and taxes) $31,000 Parts and supplies (perpetual system) 19,000 Service provided by the city-owned utility 2,000 Total Payments $52,000 d. At fiscal year end, the following adjustments were related to garage operations: Inventory of parts and supplies on hand $7,000 Depreciation To be computed. e. On July 1, 20X7, the city issued 10 year, S400,000, 8% general obligation serial bonds at 101 to finance the construction of a public health center for the aging. The premium on the bond sale is transferred to the Debt Service Fund for interest payment. Each 40,000 serial is redeemable on June 30, along with annual interest on the outstanding bond face value. The project is estimated to cost $430,000 and will be completed in less than one year. The General Fund will transfer resources, if needed, to cover the total cost. The city uses budgetary accounts for these projects. f. During the fiscal year, construction of the public health center was completed at a cost of $426,000, of which $400,000 was paid, the remainder is payable after one year under a retained percentage contract arrangement. The $26,000 deficiency was transferred from the General Fund. g. On June 28, 20x8, 568,000 is transferred from the General Fund to be applied to the payment of the first $40,000 bond serial mentioned in e., plus interest. On this date, the Debt Service Fund records the maturing bonds and interest. h. On June 30, the payment for the matured bond serial and interest is made. Required: For each event, prepare the necessary journal entries for all funds and account groups involved during the fiscal year ended June 30, 20X8. Indicate the fund or group in which the entries are made. The following selected events occurred in the City of Canterbury a. On December 31, 20X7, 5250,000 was transferred from the General Fund to establish a central garage to service the city's vehicles. Of this amount, $150,000 was spent on January 2, 20X8, to acquire a building with an estimated life of 25 years, $30,000 was spent for the acquisition of land, and $60,000 was paid for equipment with an estimated life of 10 years. b. During the six months of operation to June 30, 20x8, the garage billed the General Fund for $24,000 and Enterprise Funds for $50,000. Except for $58,000 still due from Enterprise Funds, the balance is collected c. Canceled checks revealed the following payments for garage activities: Salaries (ignore deductions and taxes) $31,000 Parts and supplies (perpetual system) 19,000 Service provided by the city-owned utility 2,000 Total Payments $52,000 d. At fiscal year end, the following adjustments were related to garage operations: Inventory of parts and supplies on hand $7,000 Depreciation To be computed. e. On July 1, 20X7, the city issued 10 year, S400,000, 8% general obligation serial bonds at 101 to finance the construction of a public health center for the aging. The premium on the bond sale is transferred to the Debt Service Fund for interest payment. Each 40,000 serial is redeemable on June 30, along with annual interest on the outstanding bond face value. The project is estimated to cost $430,000 and will be completed in less than one year. The General Fund will transfer resources, if needed, to cover the total cost. The city uses budgetary accounts for these projects. f. During the fiscal year, construction of the public health center was completed at a cost of $426,000, of which $400,000 was paid, the remainder is payable after one year under a retained percentage contract arrangement. The $26,000 deficiency was transferred from the General Fund. g. On June 28, 20x8, 568,000 is transferred from the General Fund to be applied to the payment of the first $40,000 bond serial mentioned in e., plus interest. On this date, the Debt Service Fund records the maturing bonds and interest. h. On June 30, the payment for the matured bond serial and interest is made. Required: For each event, prepare the necessary journal entries for all funds and account groups involved during the fiscal year ended June 30, 20X8. Indicate the fund or group in which the entries are made