---------------------------------------------------------------

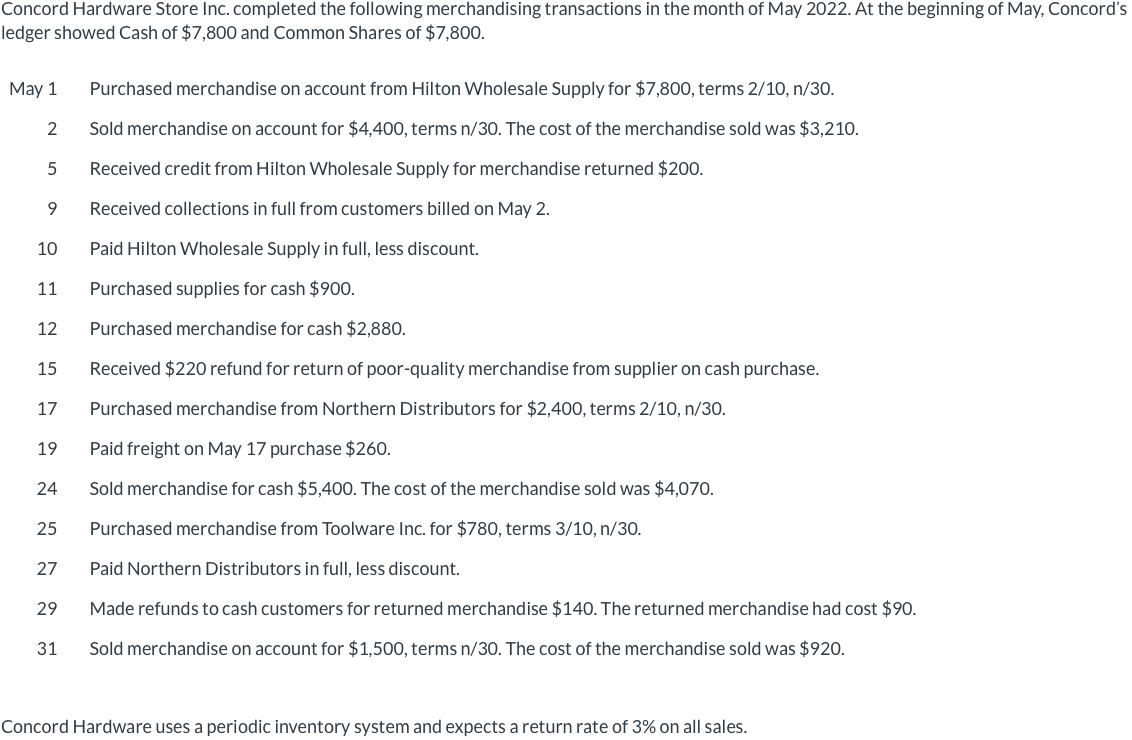

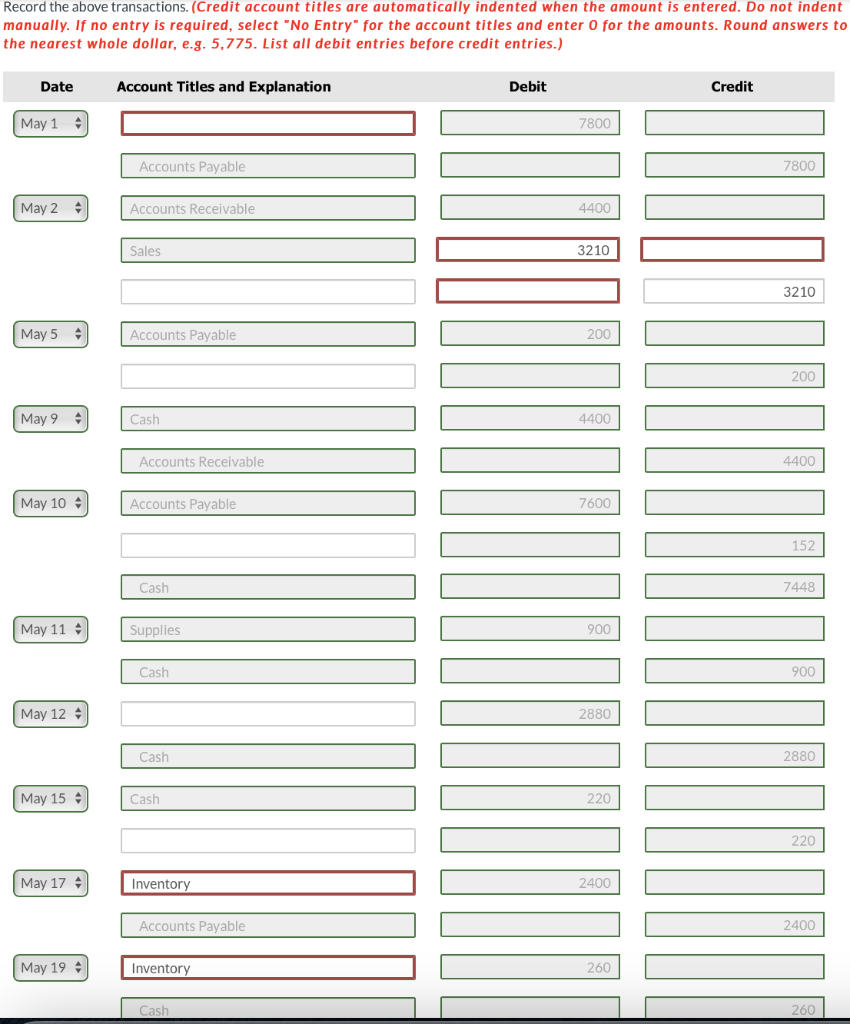

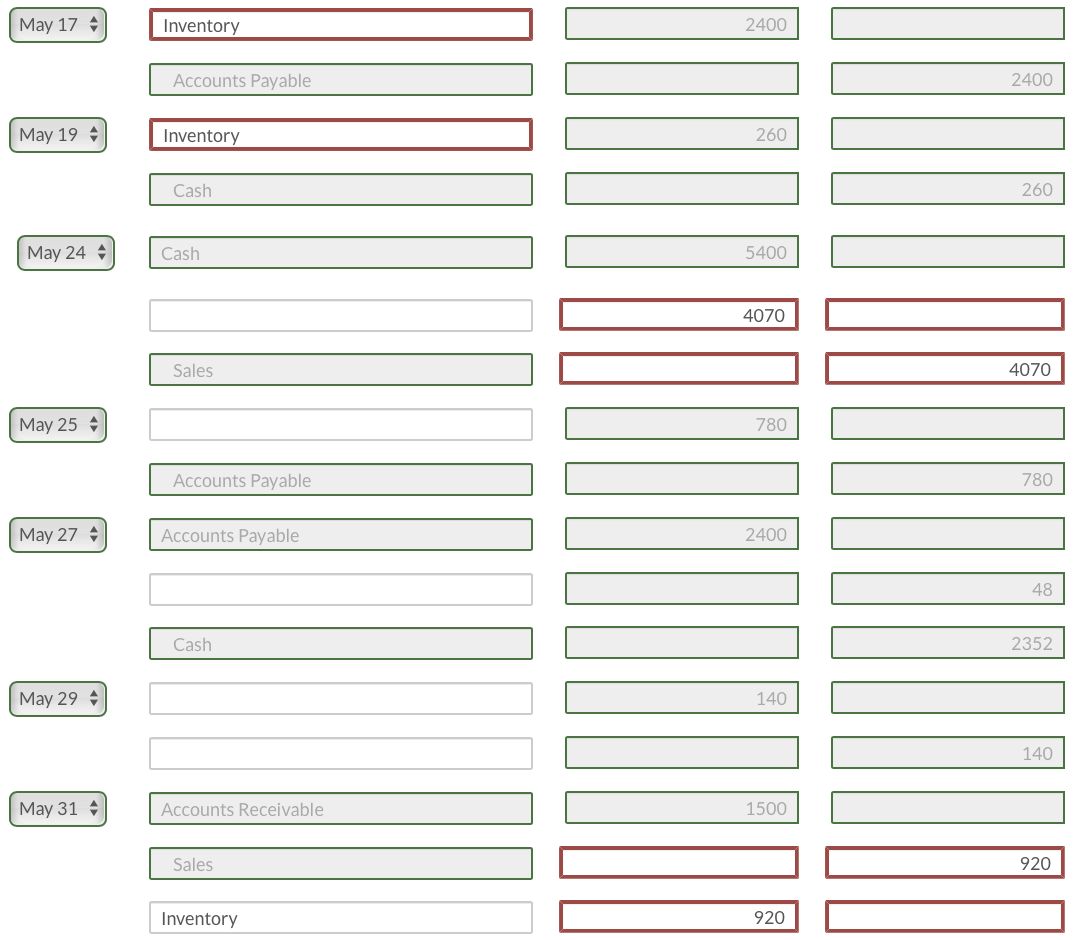

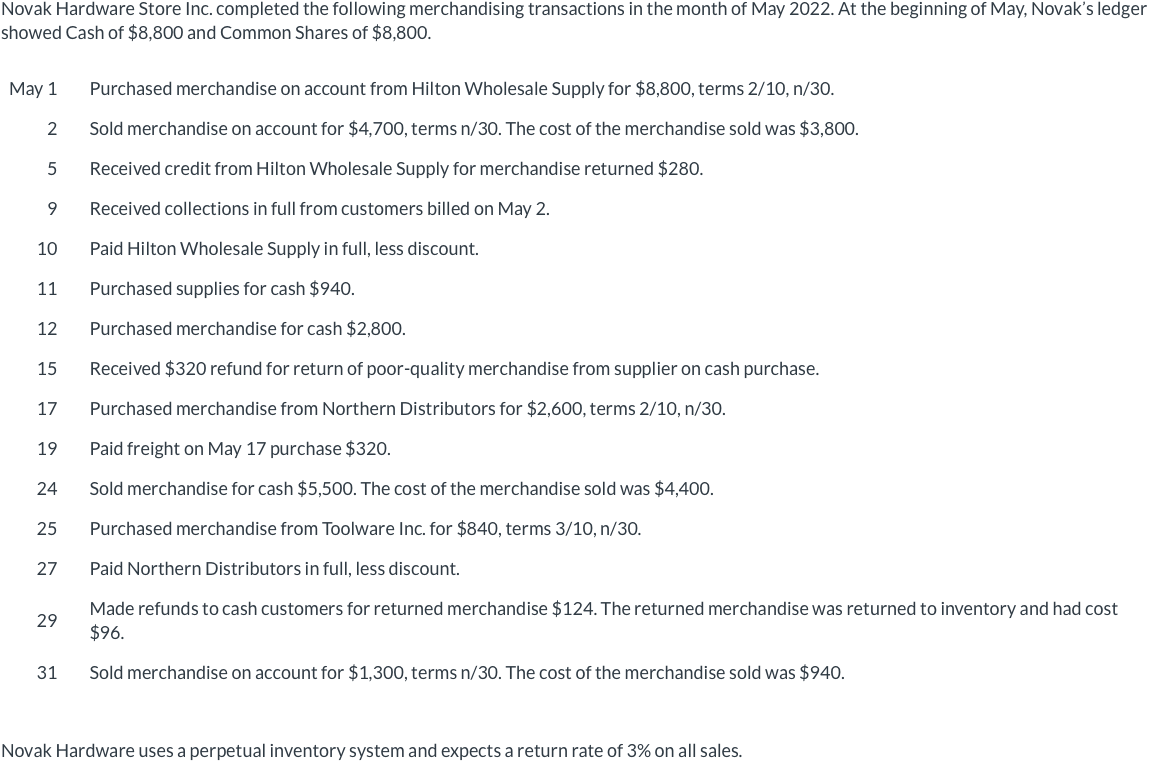

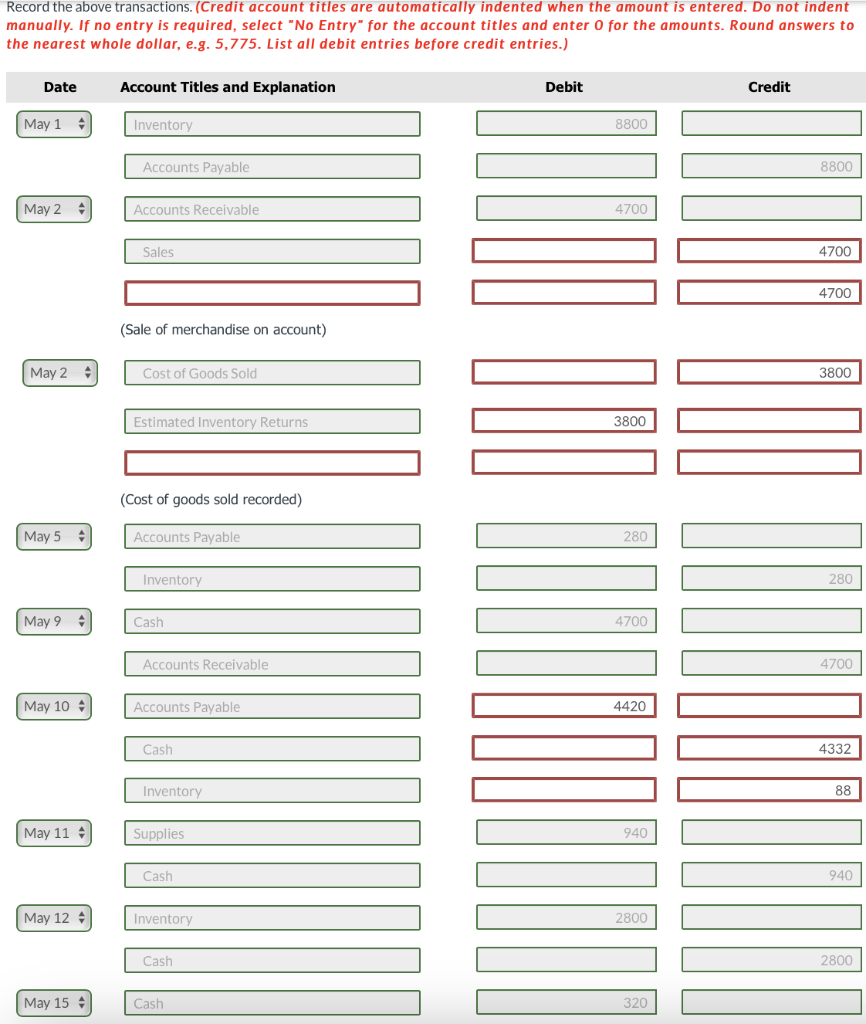

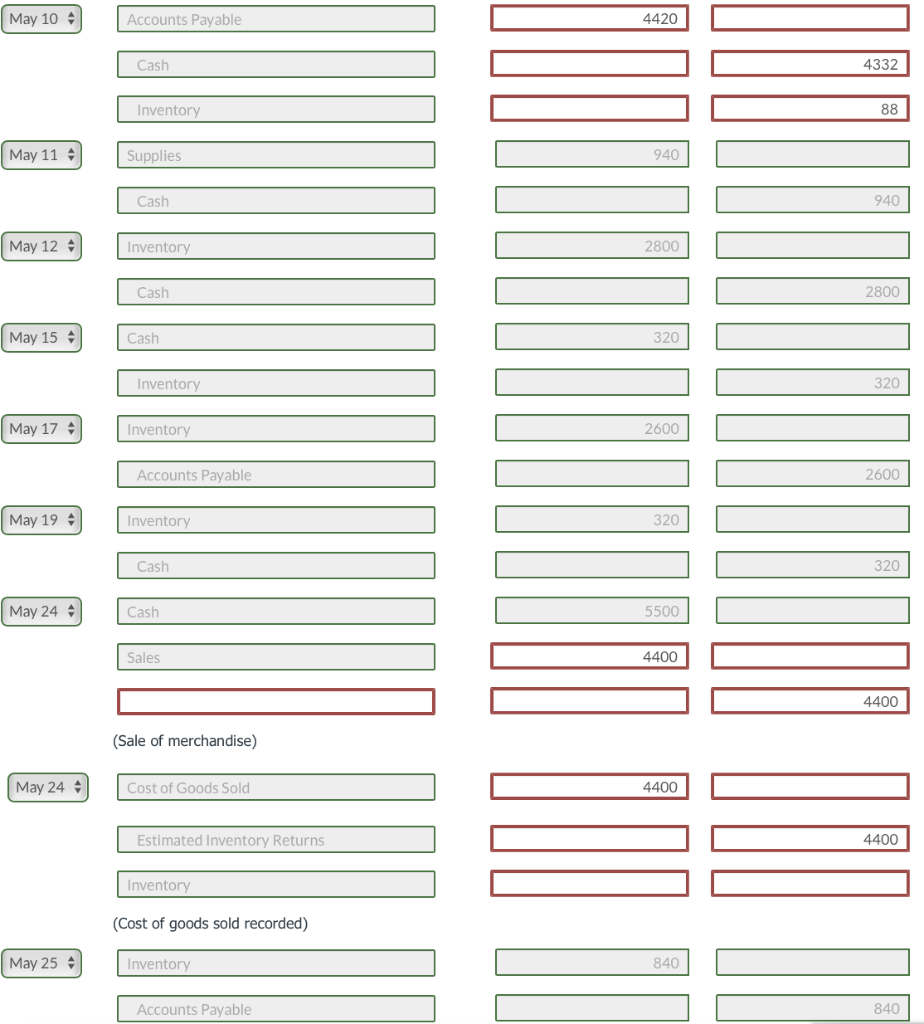

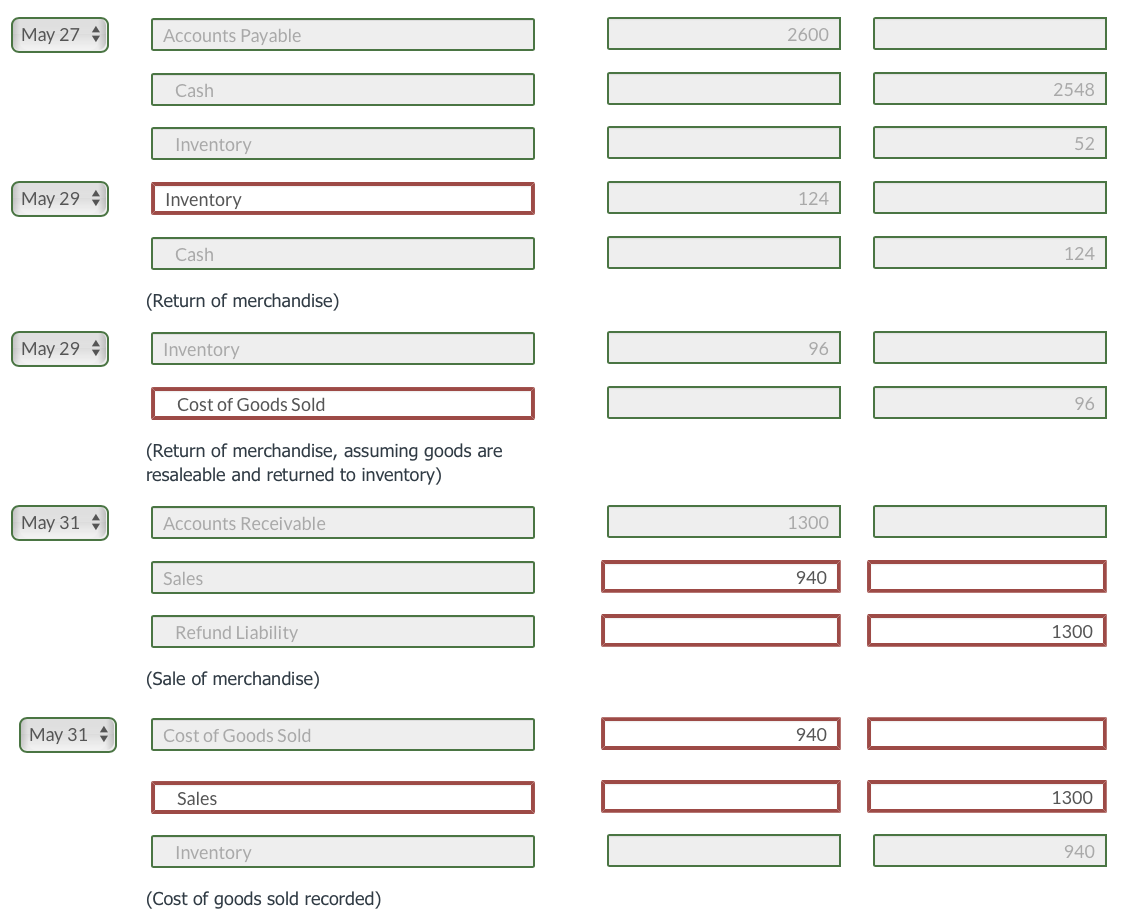

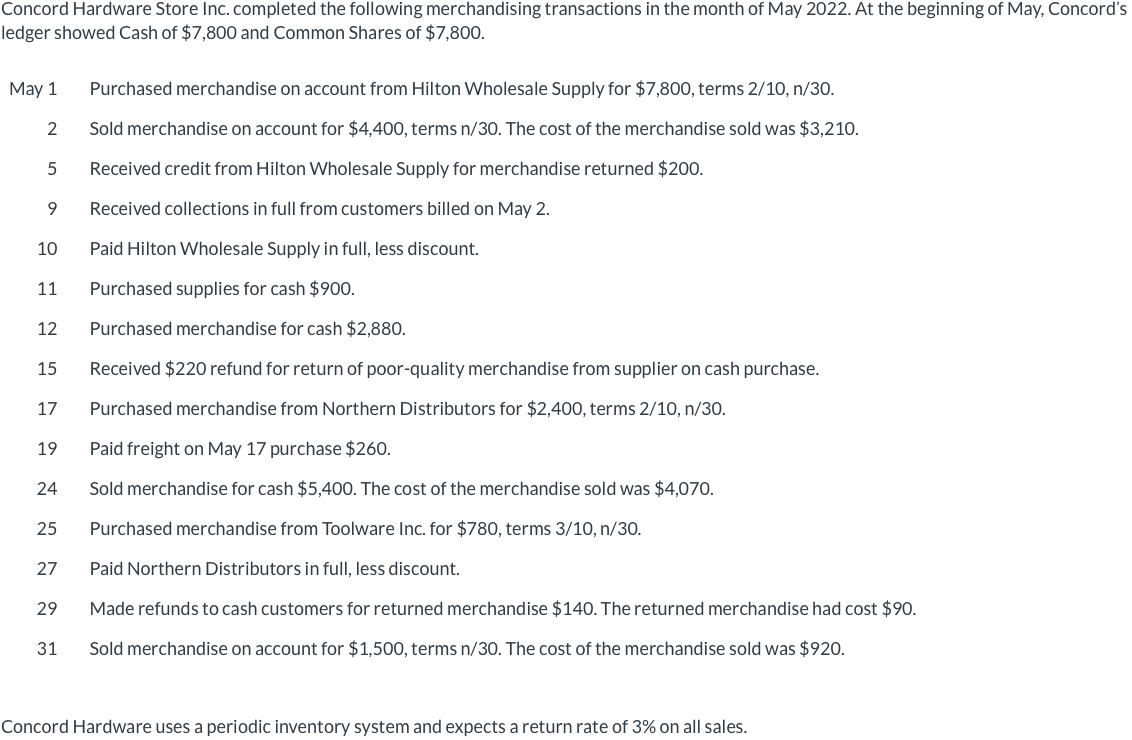

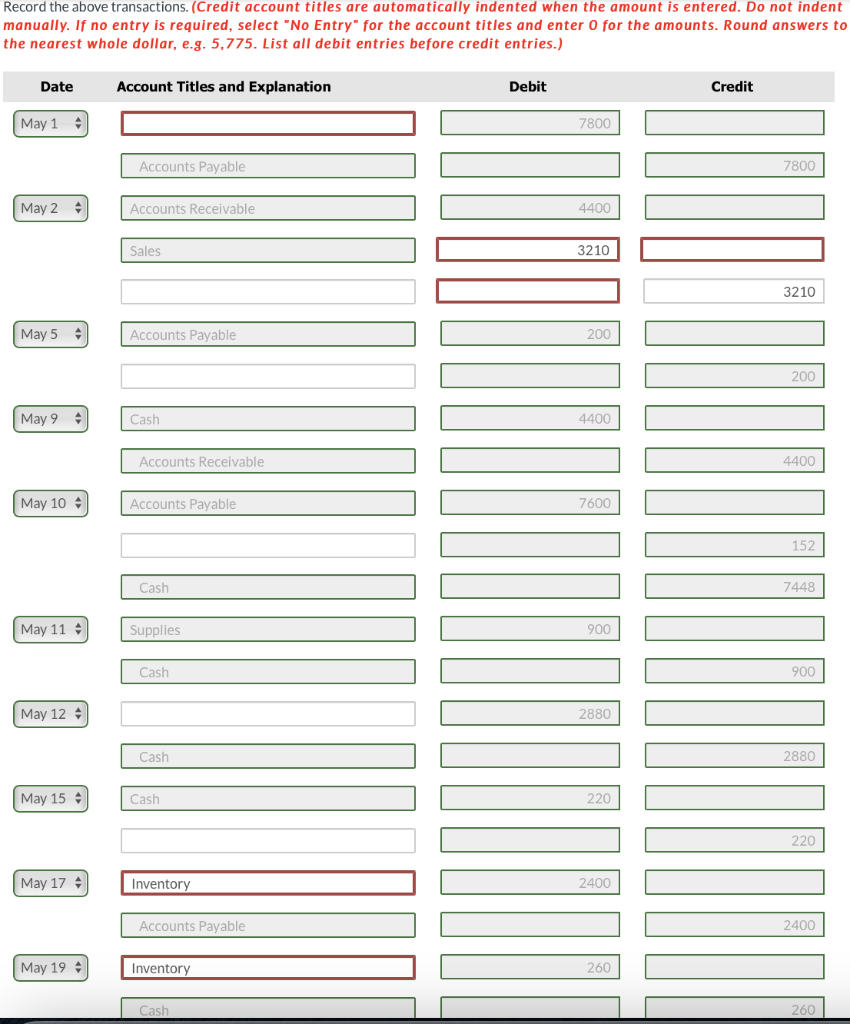

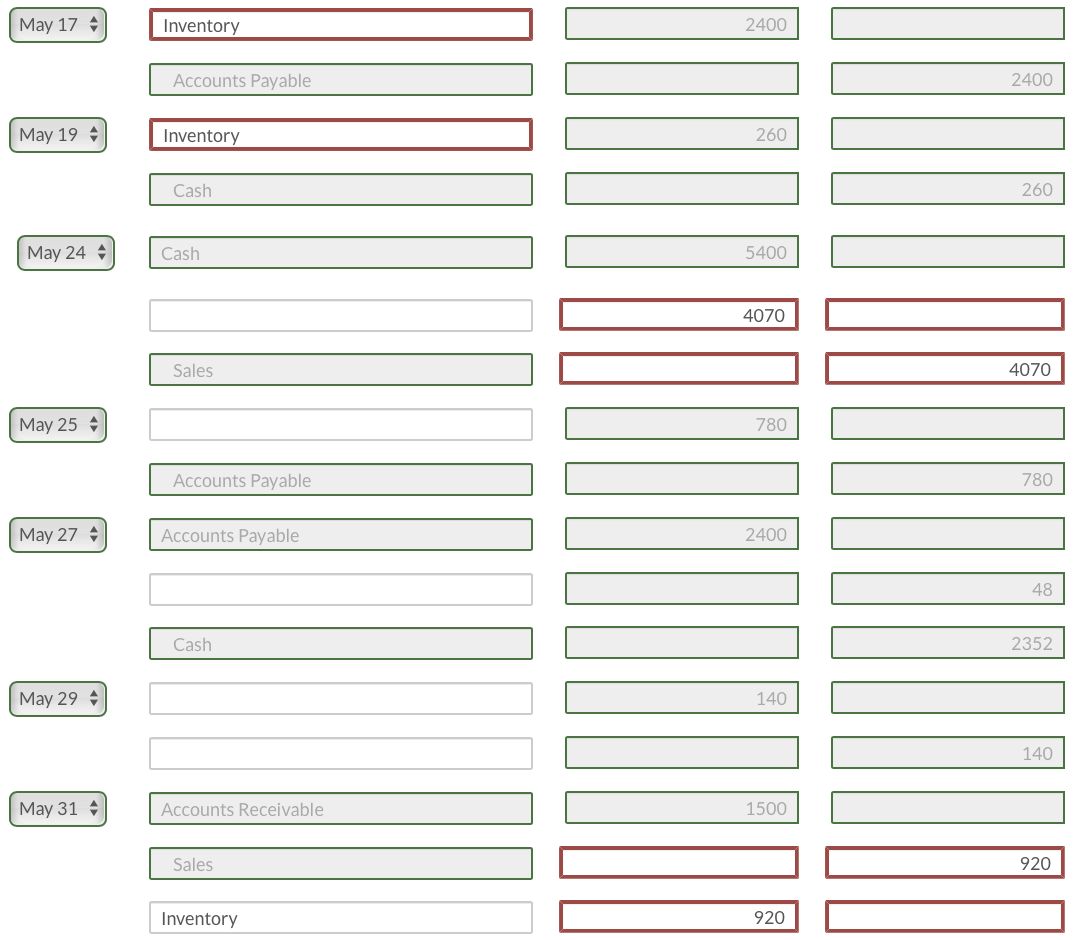

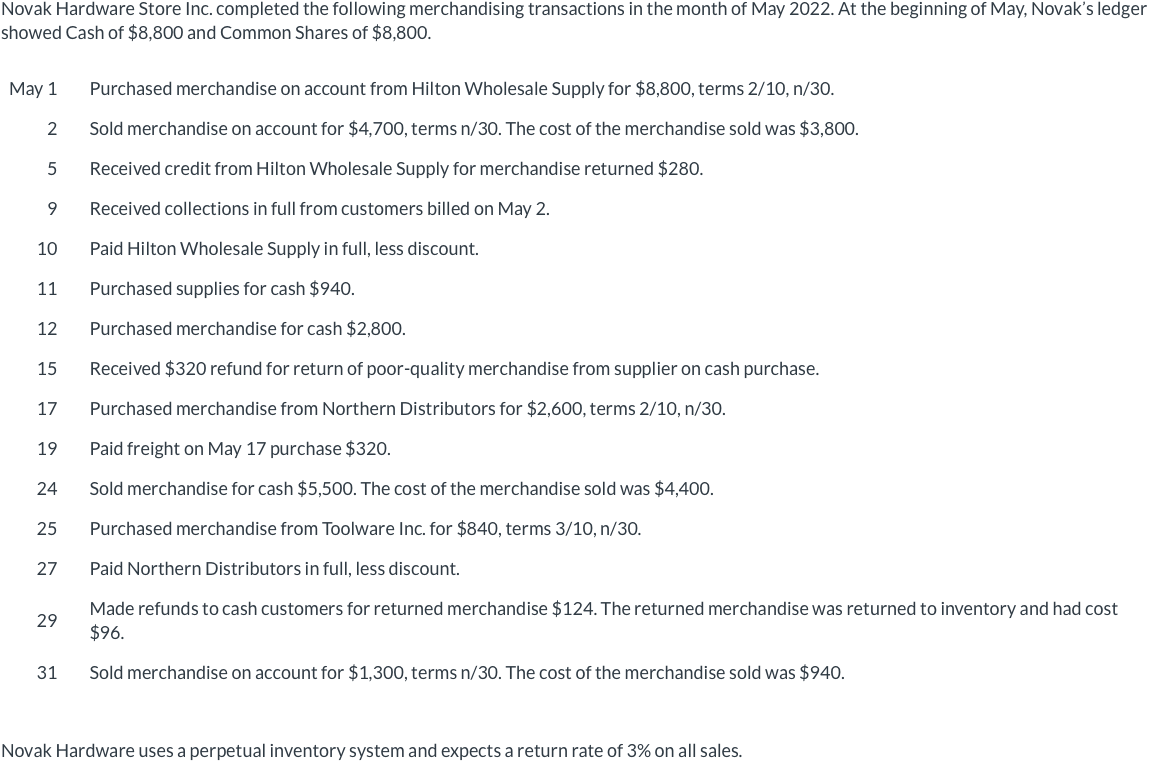

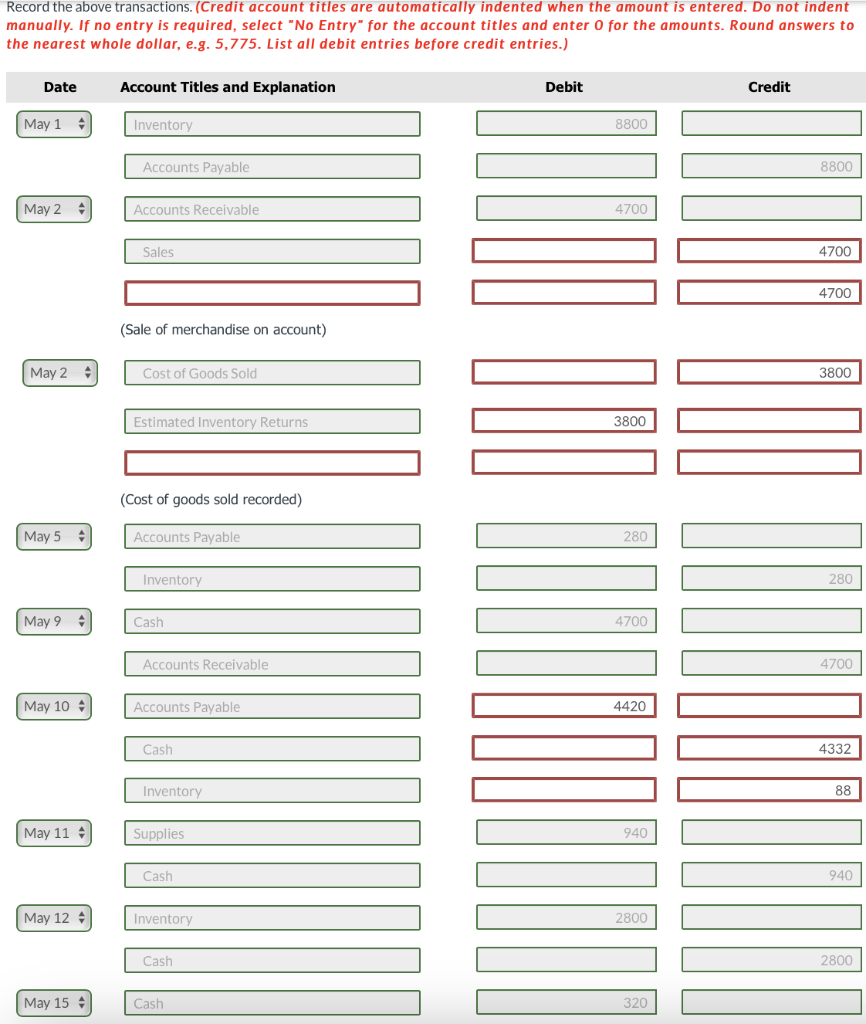

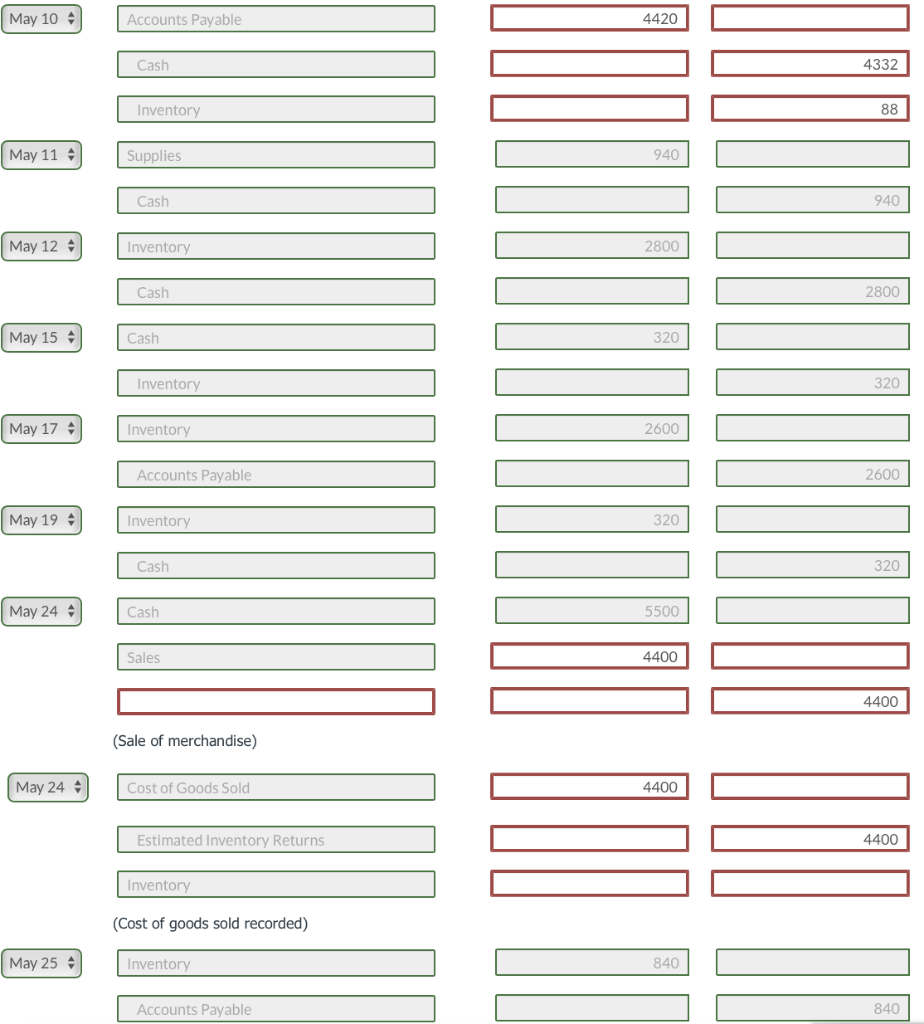

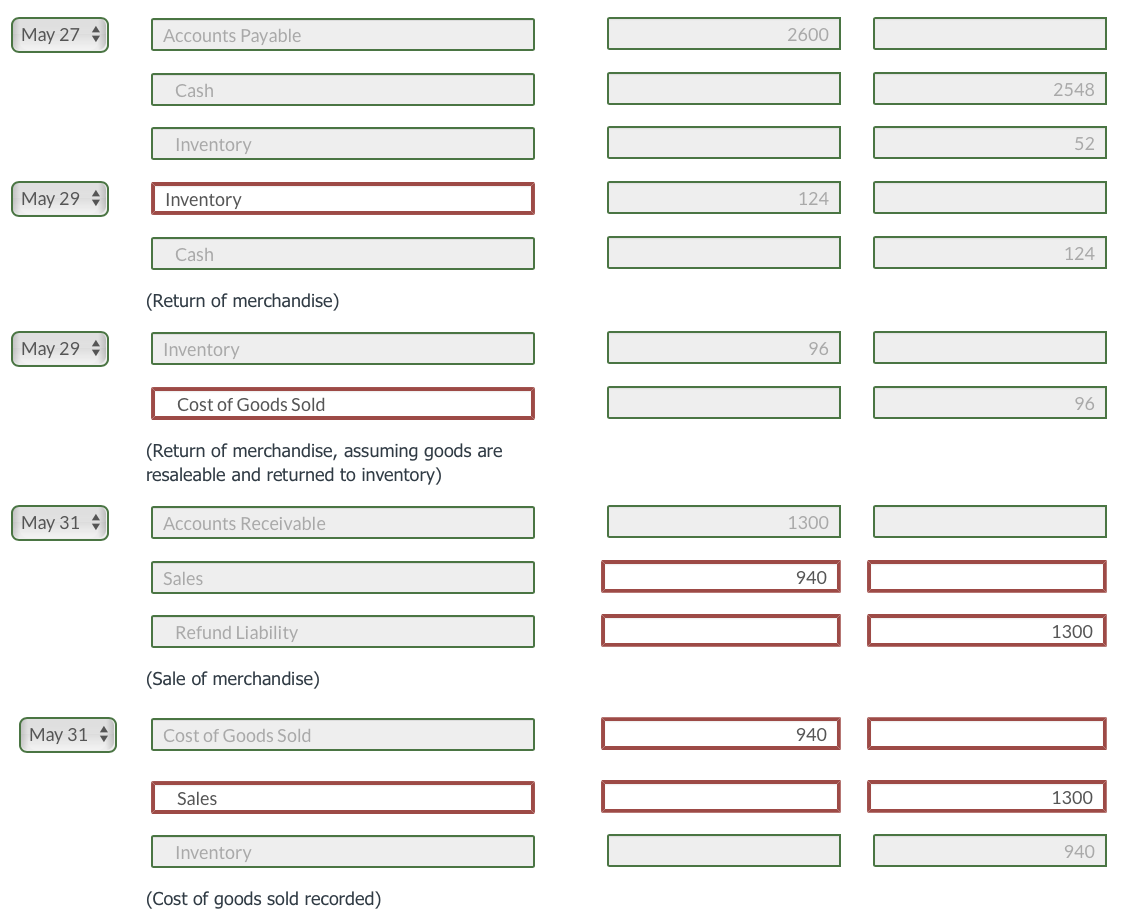

The following selected information is presented for Marigold Limited for the year ended February 28, 2021. Marigold uses a periodic inventory system. Administrativeexpenses118,500Inventory,Feb.28,202177,840 Commonshares83,300Purchasediscounts38,220 Deferred revenue 4,410 Purchase returns and allowances 20,420 Dividendsdeclared41,160Purchases267,540 Freight in 8,290 Sales 385,180 Incometaxexpense9,150Sellingexpenses8,900 Interest expense 7,680 MARIGOLD LIMITED Statement of Income Year Ended February 28, 2021 Sales Cost of Goods Sold Inventory, beginning $ $ 267540 Less \begin{tabular}{|l|r|r|} \hline Purchase Discounts & 38220 \\ \hline Purchase Returns and Allowances & is \\ \hline Net purchases & 20420 \\ \hline Add : Freight In & 208900 \\ \hline \end{tabular} Cost of goods purchased Cost of goods available for sale \begin{tabular}{rr|} \hline 217190 \\ \hline & \\ \hline & 44070 \\ \hline \\ \hline \end{tabular} Cost of Goods Sold. Gross profit Operating expenses Total operating expenses Income from operations Other income and expenses Income before income tax Net income Concord Hardware Store Inc. completed the following merchandising transactions in the month of May 2022. At the beginning of May, Concord's ledger showed Cash of $7,800 and Common Shares of $7,800. May 1 Purchased merchandise on account from Hilton Wholesale Supply for $7,800, terms 2/10,n/30. 2 Sold merchandise on account for $4,400, terms n/30. The cost of the merchandise sold was $3,210. 5 Received credit from Hilton Wholesale Supply for merchandise returned $200. 9 Received collections in full from customers billed on May 2. 10 Paid Hilton Wholesale Supply in full, less discount. 11 Purchased supplies for cash $900. 12 Purchased merchandise for cash $2,880. 15 Received $220 refund for return of poor-quality merchandise from supplier on cash purchase. 17 Purchased merchandise from Northern Distributors for $2,400, terms 2/10,n/30. 19 Paid freight on May 17 purchase $260. 24 Sold merchandise for cash $5,400. The cost of the merchandise sold was $4,070. 25 Purchased merchandise from Toolware Inc. for $780, terms 3/10,n/30. 27 Paid Northern Distributors in full, less discount. 29 Made refunds to cash customers for returned merchandise $140. The returned merchandise had cost $90. 31 Sold merchandise on account for $1,500, terms n/30. The cost of the merchandise sold was $920. Concord Hardware uses a periodic inventory system and expects a return rate of 3% on all sales. Record the above transactions. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Round answers to May 17 Inventory 2400 Accounts Payable \begin{tabular}{|r|} \hline 2400 \\ \hline \end{tabular} May 19 Inventory 260 May 24 \begin{tabular}{|} 4070 \\ \hline \end{tabular} 4070 May 25 780 Accounts Payable May 27 Accounts Payable Cash May 29 May 31 \begin{tabular}{|l|} \hline Accounts Receivable \\ \end{tabular} Sales 920 Inventory 920 Novak Hardware Store Inc. completed the following merchandising transactions in the month of May 2022. At the beginning of May, Novak's ledger showed Cash of $8,800 and Common Shares of $8,800. May 1 Purchased merchandise on account from Hilton Wholesale Supply for $8,800, terms 2/10,n/30. 2 Sold merchandise on account for $4,700, terms n/30. The cost of the merchandise sold was $3,800. 5 Received credit from Hilton Wholesale Supply for merchandise returned $280. 9 Received collections in full from customers billed on May 2. 10 Paid Hilton Wholesale Supply in full, less discount. 11 Purchased supplies for cash $940. 12 Purchased merchandise for cash $2,800. 15 Received $320 refund for return of poor-quality merchandise from supplier on cash purchase. 17 Purchased merchandise from Northern Distributors for $2,600, terms 2/10,n/30. 19 Paid freight on May 17 purchase $320. 24 Sold merchandise for cash $5,500. The cost of the merchandise sold was $4,400. 25 Purchased merchandise from Toolware Inc. for $840, terms 3/10,n/30. 27 Paid Northern Distributors in full, less discount. 29 Made refunds to cash customers for returned merchandise $124. The returned merchandise was returned to inventory and had cost $96. 31 Sold merchandise on account for $1,300, terms n/30. The cost of the merchandise sold was $940. Record the above transactions. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Round answers to the nearest whole dollar, e.g. 5,775. List all debit entries before credit entries.) May 10 Accounts Payable \begin{tabular}{|r|r|} \hline & \\ \hline & \\ \hline \end{tabular} May 11 Supplies \begin{tabular}{|} \hline 940 \\ \hline \end{tabular} \begin{tabular}{|} \hline \\ \hline 940 \\ \hline \end{tabular} May 12 - Inventory May 15 - Cash 420 May 17 Inventory 2600 Accounts Payable \begin{tabular}{|} \hline \\ \hline 320 \\ \hline \end{tabular} 2600 May 19 * Inventory \begin{tabular}{|} \hline \\ \hline 320 \\ \hline \end{tabular} May 24 (Sale of merchandise) May 24 Cost of Goods Sold Estimated Inventory Returns \begin{tabular}{|} \\ \\ \\ \\ \hline \end{tabular} (Cost of goods sold recorded) May 25 - Inventory \begin{tabular}{|} 840 \\ \hline \end{tabular} Accounts Payable May 27 Accounts Payable 2600 \begin{tabular}{|l|l|} \hline Cash & \\ \hline Inventory & 124 \\ \hline Inventory & \\ \hline Cash & \\ \hline \end{tabular} 2548 (Return of merchandise) May 29 Inventory Cost of Goods Sold (Return of merchandise, assuming goods are resaleable and returned to inventory) May 31 Accounts Receivable Sales (Sale of merchandise) May 31 Cost of Goods Sold 940 Sales 1300 Inventory (Cost of goods sold recorded) May 17 Inventory 2400 Accounts Payable \begin{tabular}{|r|} \hline 2400 \\ \hline \end{tabular} May 19 Inventory 260 May 24 \begin{tabular}{|} 4070 \\ \hline \end{tabular} 4070 May 25 780 Accounts Payable May 27 Accounts Payable Cash May 29 May 31 \begin{tabular}{|l|} \hline Accounts Receivable \\ \end{tabular} Sales 920 Inventory 920 Record the above transactions. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Round answers to the nearest whole dollar, e.g. 5,775. List all debit entries before credit entries.) Novak Hardware Store Inc. completed the following merchandising transactions in the month of May 2022. At the beginning of May, Novak's ledger showed Cash of $8,800 and Common Shares of $8,800. May 1 Purchased merchandise on account from Hilton Wholesale Supply for $8,800, terms 2/10,n/30. 2 Sold merchandise on account for $4,700, terms n/30. The cost of the merchandise sold was $3,800. 5 Received credit from Hilton Wholesale Supply for merchandise returned $280. 9 Received collections in full from customers billed on May 2. 10 Paid Hilton Wholesale Supply in full, less discount. 11 Purchased supplies for cash $940. 12 Purchased merchandise for cash $2,800. 15 Received $320 refund for return of poor-quality merchandise from supplier on cash purchase. 17 Purchased merchandise from Northern Distributors for $2,600, terms 2/10,n/30. 19 Paid freight on May 17 purchase $320. 24 Sold merchandise for cash $5,500. The cost of the merchandise sold was $4,400. 25 Purchased merchandise from Toolware Inc. for $840, terms 3/10,n/30. 27 Paid Northern Distributors in full, less discount. 29 Made refunds to cash customers for returned merchandise $124. The returned merchandise was returned to inventory and had cost $96. 31 Sold merchandise on account for $1,300, terms n/30. The cost of the merchandise sold was $940. May 27 Accounts Payable 2600 \begin{tabular}{|l|l|} \hline Cash & \\ \hline Inventory & 124 \\ \hline Inventory & \\ \hline Cash & \\ \hline \end{tabular} 2548 (Return of merchandise) May 29 Inventory Cost of Goods Sold (Return of merchandise, assuming goods are resaleable and returned to inventory) May 31 Accounts Receivable Sales (Sale of merchandise) May 31 Cost of Goods Sold 940 Sales 1300 Inventory (Cost of goods sold recorded) Record the above transactions. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Round answers to Concord Hardware Store Inc. completed the following merchandising transactions in the month of May 2022. At the beginning of May, Concord's ledger showed Cash of $7,800 and Common Shares of $7,800. May 1 Purchased merchandise on account from Hilton Wholesale Supply for $7,800, terms 2/10,n/30. 2 Sold merchandise on account for $4,400, terms n/30. The cost of the merchandise sold was $3,210. 5 Received credit from Hilton Wholesale Supply for merchandise returned $200. 9 Received collections in full from customers billed on May 2. 10 Paid Hilton Wholesale Supply in full, less discount. 11 Purchased supplies for cash $900. 12 Purchased merchandise for cash $2,880. 15 Received $220 refund for return of poor-quality merchandise from supplier on cash purchase. 17 Purchased merchandise from Northern Distributors for $2,400, terms 2/10,n/30. 19 Paid freight on May 17 purchase $260. 24 Sold merchandise for cash $5,400. The cost of the merchandise sold was $4,070. 25 Purchased merchandise from Toolware Inc. for $780, terms 3/10,n/30. 27 Paid Northern Distributors in full, less discount. 29 Made refunds to cash customers for returned merchandise $140. The returned merchandise had cost $90. 31 Sold merchandise on account for $1,500, terms n/30. The cost of the merchandise sold was $920. Concord Hardware uses a periodic inventory system and expects a return rate of 3% on all sales. May 10 Accounts Payable \begin{tabular}{|r|r|} \hline & \\ \hline & \\ \hline \end{tabular} May 11 Supplies \begin{tabular}{|} \hline 940 \\ \hline \end{tabular} \begin{tabular}{|} \hline \\ \hline 940 \\ \hline \end{tabular} May 12 - Inventory May 15 - Cash 420 May 17 Inventory 2600 Accounts Payable \begin{tabular}{|} \hline \\ \hline 320 \\ \hline \end{tabular} 2600 May 19 * Inventory \begin{tabular}{|} \hline \\ \hline 320 \\ \hline \end{tabular} May 24 (Sale of merchandise) May 24 Cost of Goods Sold Estimated Inventory Returns \begin{tabular}{|} \\ \\ \\ \\ \hline \end{tabular} (Cost of goods sold recorded) May 25 - Inventory \begin{tabular}{|} 840 \\ \hline \end{tabular} Accounts Payable