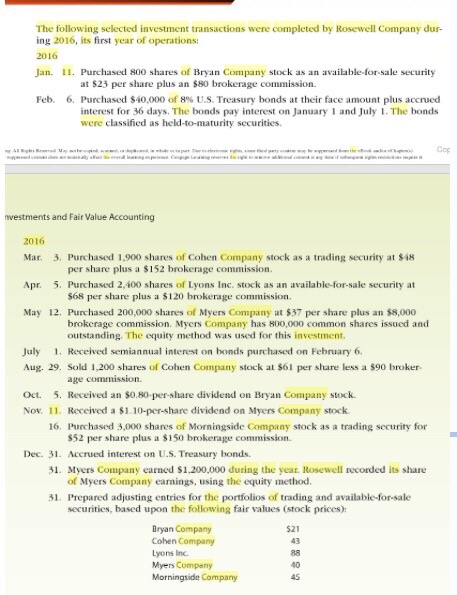

The following selected investment transactions were completed by Rosewell Company during 2016, its first year of operations: 2016 Jan. 11. Purchased 800 shares of Bryan Company stock as an available-for-sale security at S23 per share plus an $80 brokerage commission. Feb. 6, Purchased $40,000 of 8% US. Treasury bonds at their face amount plus accrued interest for 36 days. The bonds pay interest on January 1 and July 1.The bonds were classified as held-to-maturity securities. Investments and Fair Value Accounting 2016 Mar. 3, Purchased 1.900 shares of Cohen Company stock as a trading security at $18 per share plus a $152 brokerage commission. Apr 5. Purchased 2, 400 shares of Lyons Inc. stock as an available-for-sale security at $68 per share plus a $120 brokerage commission May 12, Purchased 200,000 shares of Myers Company at $37 per share plus an $8,000 brokerage commission. Myers Company has 800,000 common shares issued and outstanding. The equity method was used for this investment, July 1. Received semiannual interest on bonds purchased on February 6, Aug. 29. Sold 200 shares of Cohen Company stock at $61 per share less a $90 broker age commission. Oct. 5. Received an $0.80-per-share dividend on Bryan Company stock. Nov. 11, Received a $1.10-per-share dividend on Myers Company stock. 16, Purchased 3.000 shares of Morningside Company stock as a trading security for $52 per share plus a $150 brokerage commission. Dec. 31. Accrued interest on U.S. Treasury bonds. 31. Myers Company earned $1.200.000 during the year. Rose well recorded its share of Myers Company earnings, using the equity method. 31. Prepared adjusting entries for the portfolios of trading and available for sale securities, based upon the following fair values (stock prices): The following selected investment transactions were completed by Rosewell Company during 2016, its first year of operations: 2016 Jan. 11. Purchased 800 shares of Bryan Company stock as an available-for-sale security at S23 per share plus an $80 brokerage commission. Feb. 6, Purchased $40,000 of 8% US. Treasury bonds at their face amount plus accrued interest for 36 days. The bonds pay interest on January 1 and July 1.The bonds were classified as held-to-maturity securities. Investments and Fair Value Accounting 2016 Mar. 3, Purchased 1.900 shares of Cohen Company stock as a trading security at $18 per share plus a $152 brokerage commission. Apr 5. Purchased 2, 400 shares of Lyons Inc. stock as an available-for-sale security at $68 per share plus a $120 brokerage commission May 12, Purchased 200,000 shares of Myers Company at $37 per share plus an $8,000 brokerage commission. Myers Company has 800,000 common shares issued and outstanding. The equity method was used for this investment, July 1. Received semiannual interest on bonds purchased on February 6, Aug. 29. Sold 200 shares of Cohen Company stock at $61 per share less a $90 broker age commission. Oct. 5. Received an $0.80-per-share dividend on Bryan Company stock. Nov. 11, Received a $1.10-per-share dividend on Myers Company stock. 16, Purchased 3.000 shares of Morningside Company stock as a trading security for $52 per share plus a $150 brokerage commission. Dec. 31. Accrued interest on U.S. Treasury bonds. 31. Myers Company earned $1.200.000 during the year. Rose well recorded its share of Myers Company earnings, using the equity method. 31. Prepared adjusting entries for the portfolios of trading and available for sale securities, based upon the following fair values (stock prices)