Answered step by step

Verified Expert Solution

Question

1 Approved Answer

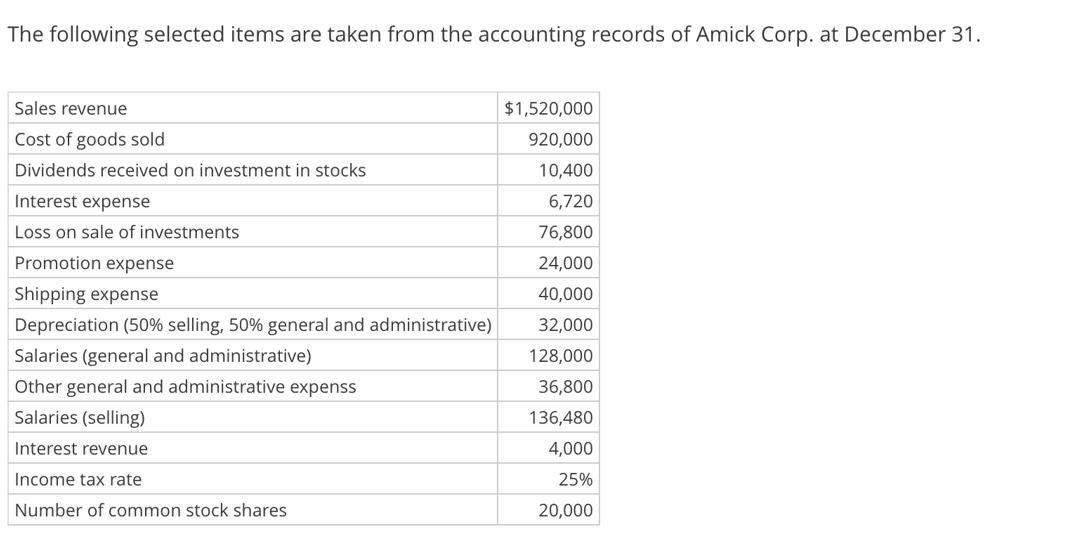

The following selected items are taken from the accounting records of Amick Corp. at December 31. Sales revenue Cost of goods sold Dividends received

The following selected items are taken from the accounting records of Amick Corp. at December 31. Sales revenue Cost of goods sold Dividends received on investment in stocks Interest expense Loss on sale of investments Promotion expense Shipping expense Depreciation (50% selling, 50% general and administrative) Salaries (general and administrative) Other general and administrative expenss Salaries (selling) Interest revenue Income tax rate Number of common stock shares $1,520,000 920,000 10,400 6,720 76,800 24,000 40,000 32,000 128,000 36,800 136,480 4,000 25% 20,000 a. Prepare a single-step income statement (including earnings per share). Include income taxes in its own section. b. Prepare a multiple-step income statement (including earnings per share).

Step by Step Solution

★★★★★

3.50 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

a SingleStep Income Statement including earnings per share Amick Corp Income Statement For the Year ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started