Question

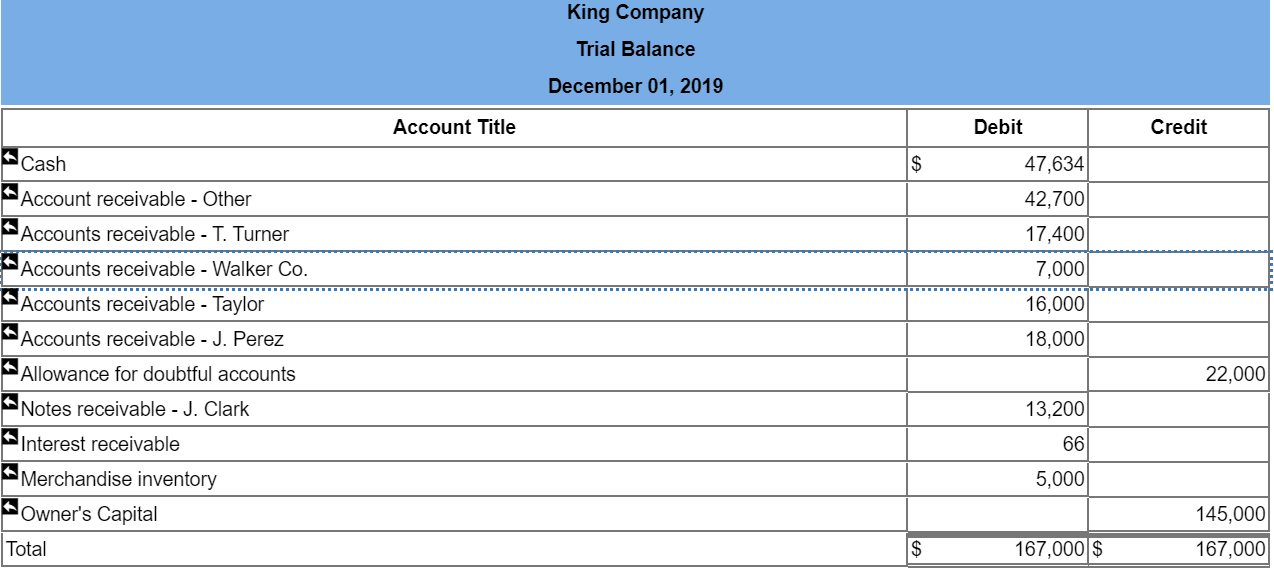

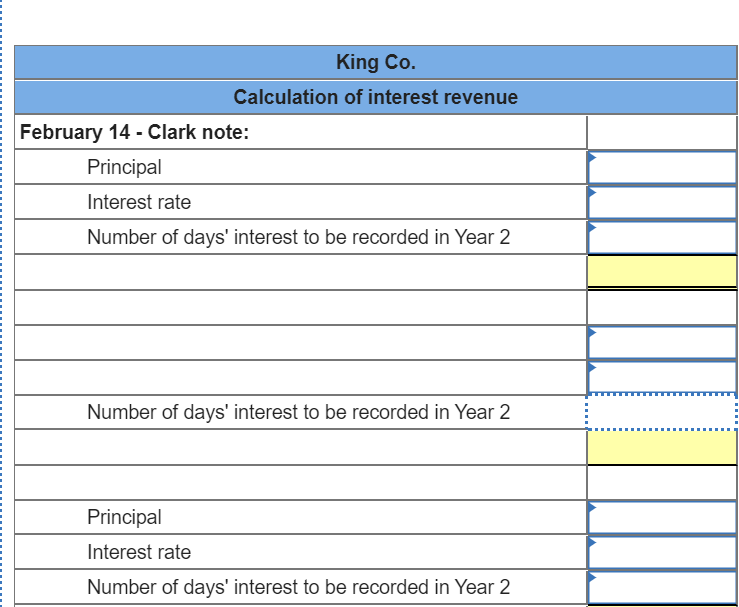

The following selected transactions are from King Company. Year 1 Dec. 16 Accepted a $13,200, 60-day, 12% note in granting Jean Clark a time extension

The following selected transactions are from King Company. Year 1

| Dec. | 16 | Accepted a $13,200, 60-day, 12% note in granting Jean Clark a time extension on his past-due account receivable. | |||

| 31 | Made an adjusting entry to record the accrued interest on the Clark note. |

Year 2

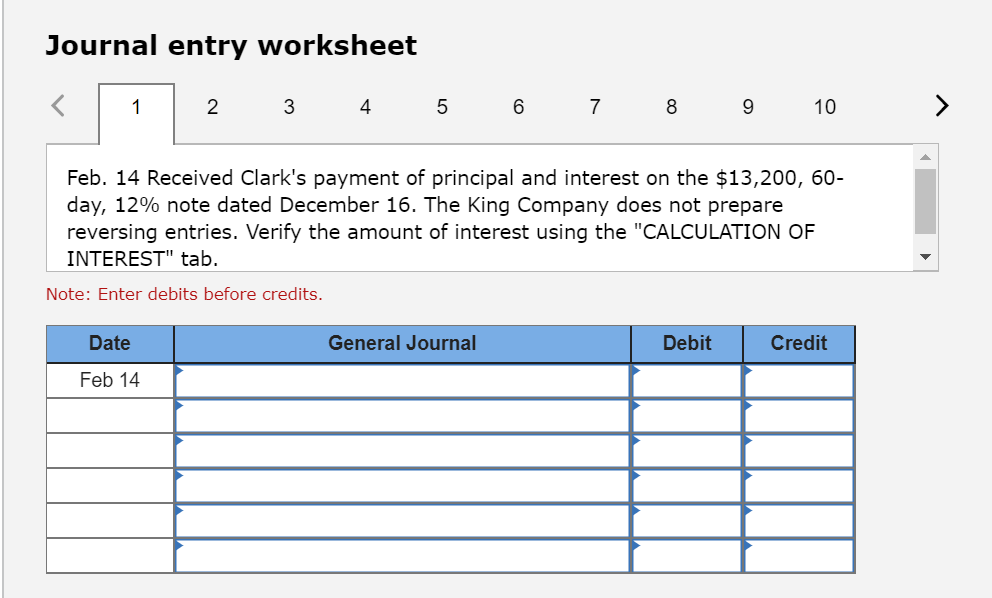

| Feb. | 14 | Received Clarks payment of principal and interest on the note dated December 16. | |||

| Mar. | 2 | Accepted a $7,000, 6%, 90-day note in granting a time extension on the past-due account receivable from Walker Co. | |||

| 17 | Accepted a $18,000, 30-day, 7% note in granting Juan Perez a time extension on her past-due account receivable. | ||||

| Apr. | 16 | Perez dishonored her note. | |||

| May | 31 | Walker Co. dishonored its note. | |||

| Aug. | 7 | Accepted a $16,000, 90-day, 6% note in granting a time extension on the past-due account receivable of Taylor Co. | |||

| Sep. | 3 | Accepted a $17,400, 60-day, 10% note in granting Tony Turner a time extension on his past-due account receivable. | |||

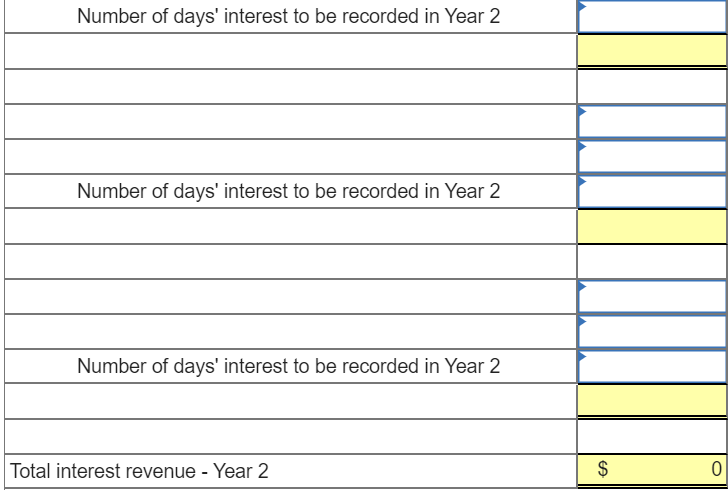

| Nov. | 2 | Received payment of principal plus interest from Turner for the September 3 note. | |||

| Nov. | 5 | Received payment of principal plus interest from Taylor for the August 7 note. | |||

| Dec. | 1 | Wrote off the Perez account against the Allowance for Doubtful Accounts. |

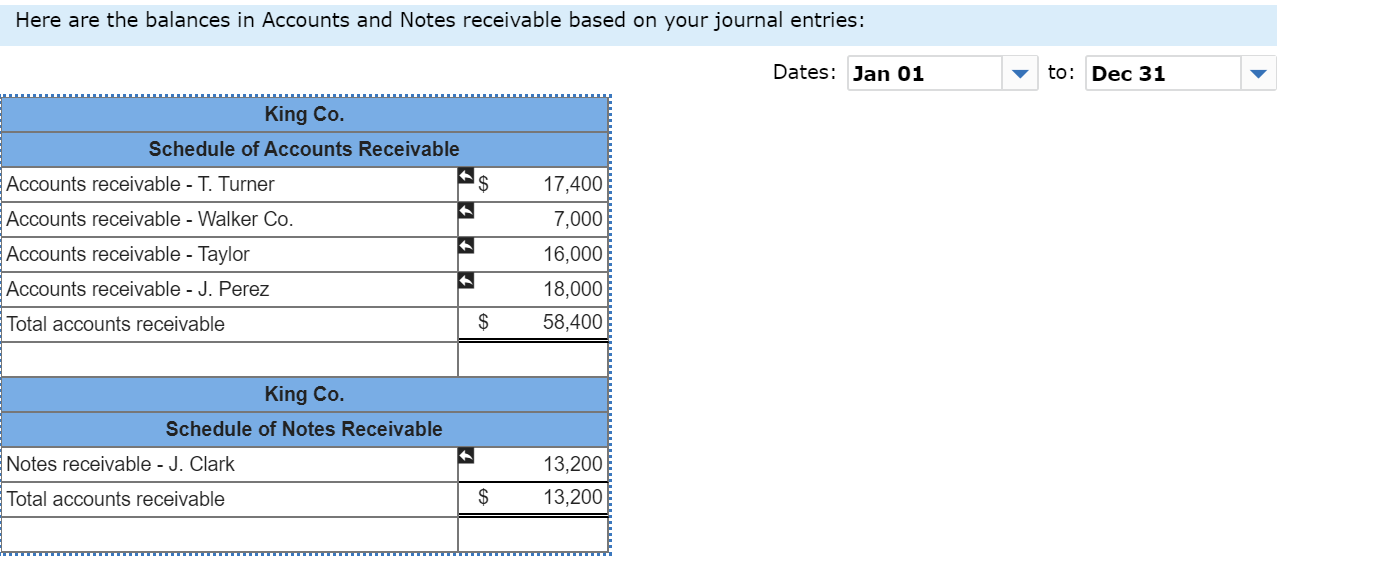

2) March 2 Mar. 2 Accepted an $7,000, 6%, 90-day note in granting a time extension on the past-due account receivable from Walker Co.

2) March 2 Mar. 2 Accepted an $7,000, 6%, 90-day note in granting a time extension on the past-due account receivable from Walker Co.

3) Mar. 17 Accepted a $18,000, 30-day, 7% note in granting Juan Perez a time extension on her past-due account receivable.

4) April 16 Apr. 16 Perez dishonored her note.

5) May 31 Walker Co. dishonored its note.

6) Aug. 7 Accepted a(n) $16,000, 90-day, 6% note in granting a time extension on the past-due account receivable of Taylor Co.

7) Sept. 3 Accepted a $17,400, 60-day, 10% note in granting Tony Turner a time extension on his past-due account receivable.

8) Nov. 2 Received payment of principal plus interest from Turner for the September 3 note.

9) Nov. 5 Received payment of principal plus interest from Taylor for the August 7 note.

10) Dec. 1 Wrote off the Perez account against Allowance for Doubtful Accounts. No additional interest was accrued.

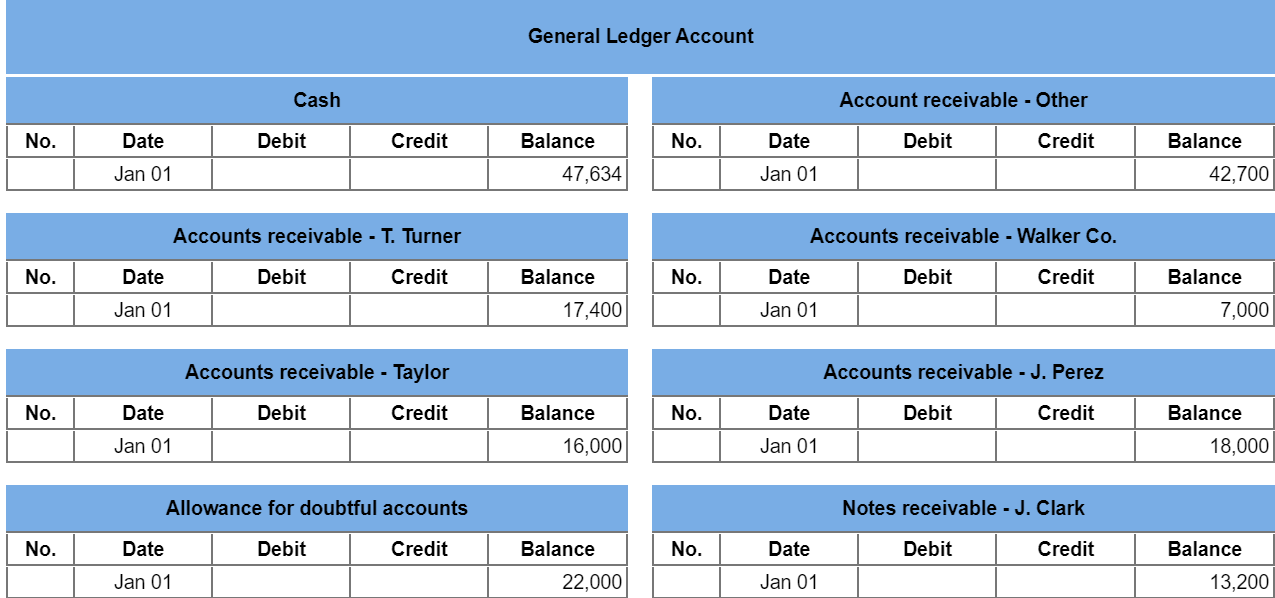

Options for General Journal

- 000: No journal entry required

- 101: Cash

- 103: Account receivable - Other

- 104: Accounts receivable - T. Turner

- 105: Accounts receivable - Walker Co.

- 106: Accounts receivable - Taylor

- 107: Accounts receivable - J. Perez

- 108: Accounts receivable - J. Clark

- 109: Allowance for doubtful accounts

- 110: Notes receivable - T. Turner

- 111: Notes receivable - Walker Co.

- 112: Notes receivable - Taylor

- 113: Notes receivable - J. Perez

- 114: Notes receivable - J. Clark

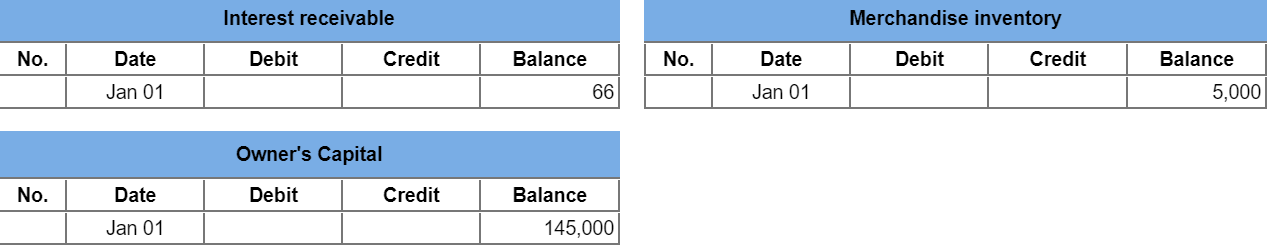

- 118: Interest receivable

- 120: Merchandise inventory

- 201: Accounts payable - T. Turner

- 202: Accounts payable - Walker Co.

- 203: Accounts payable - Taylor

- 204: Accounts payable - J. Clark

- 209: Salaries payable

- 226: Unearned fees

- 301: Owner's Capital

- 302: Owner's withdrawals

- 403: Sales

- 404: Sales returns and allowances

- 405: Sales discounts

- 406: Interest revenue

- 600: Cost of goods sold

- 602: Purchases

- 603: Purchases returns and allowances

- 604: Purchases discounts

- 640: Rent expense

- 652: Freight-in

- 655: Bad debts expense

- 660: Delivery expense

- 665: Interest expense

- 700: Income summary

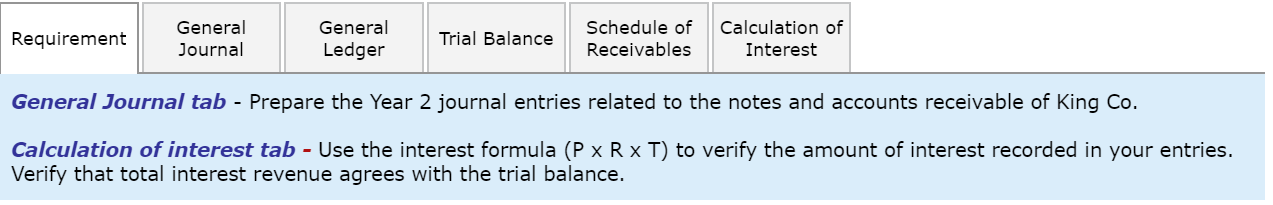

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started