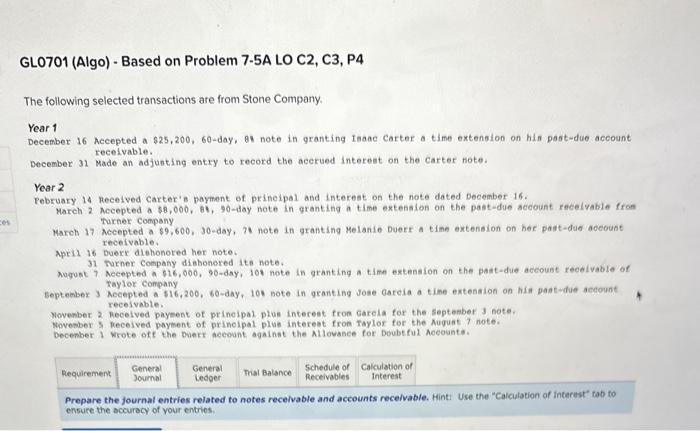

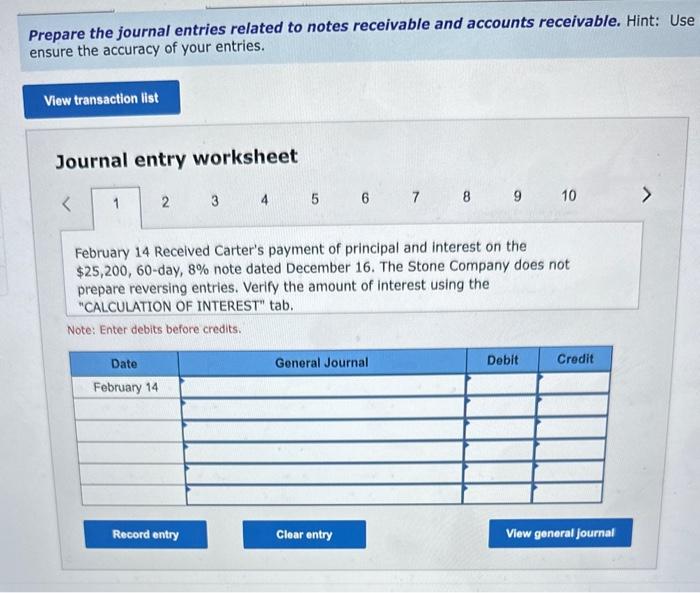

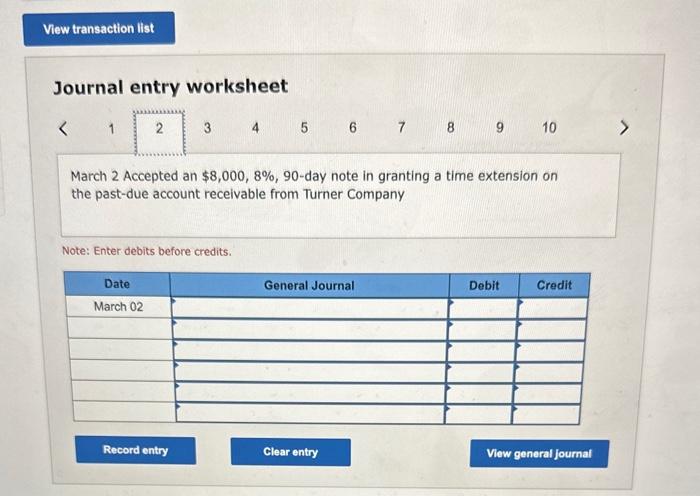

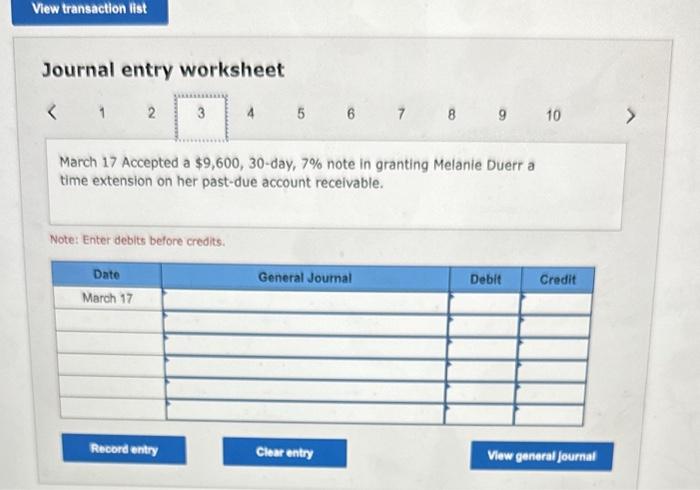

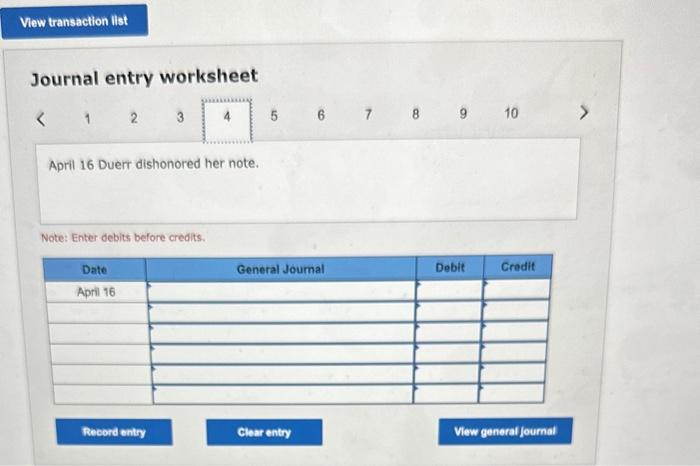

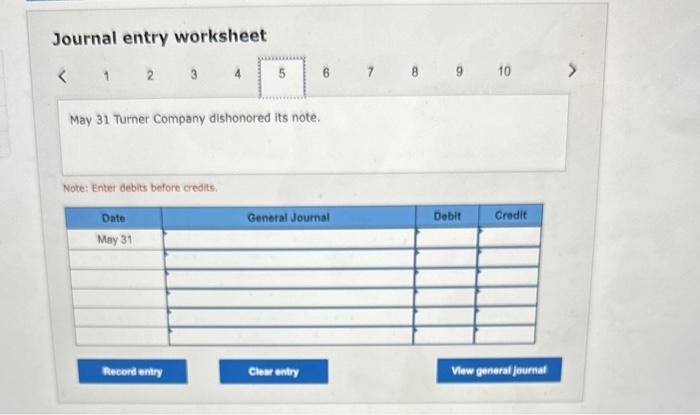

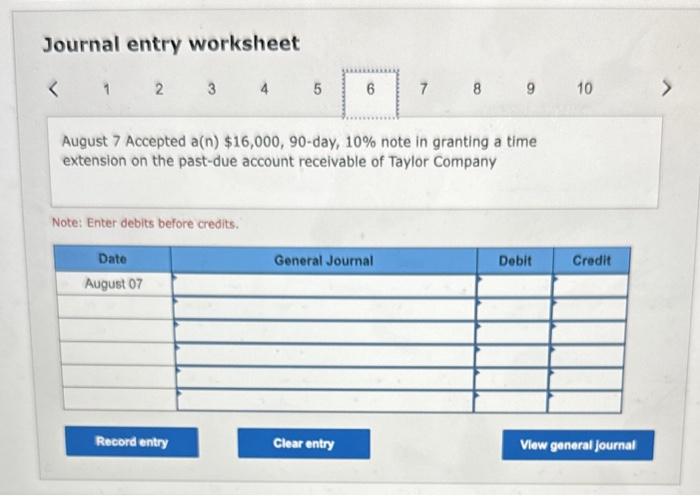

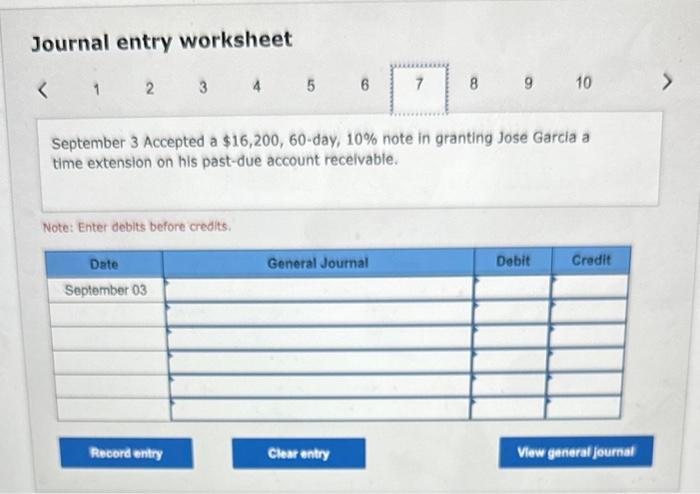

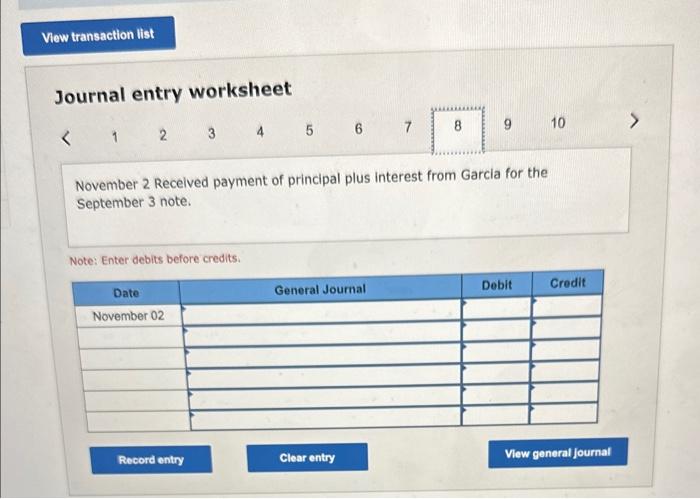

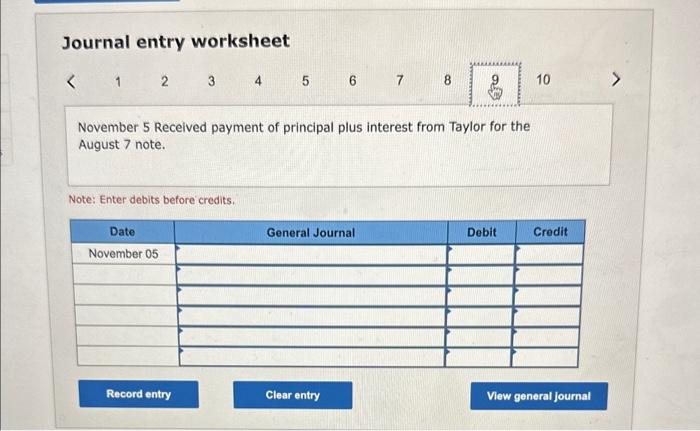

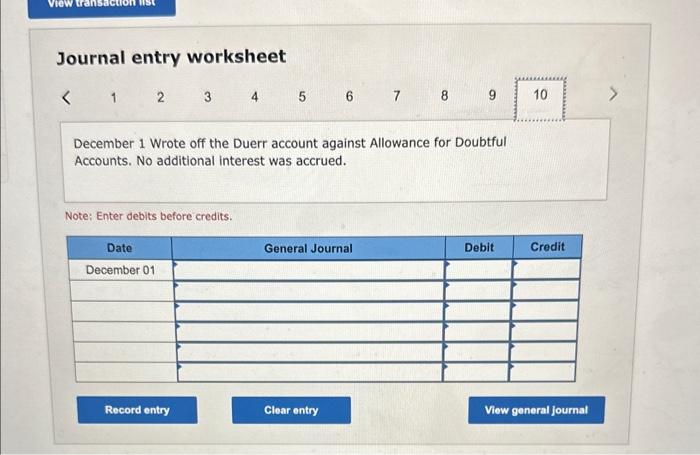

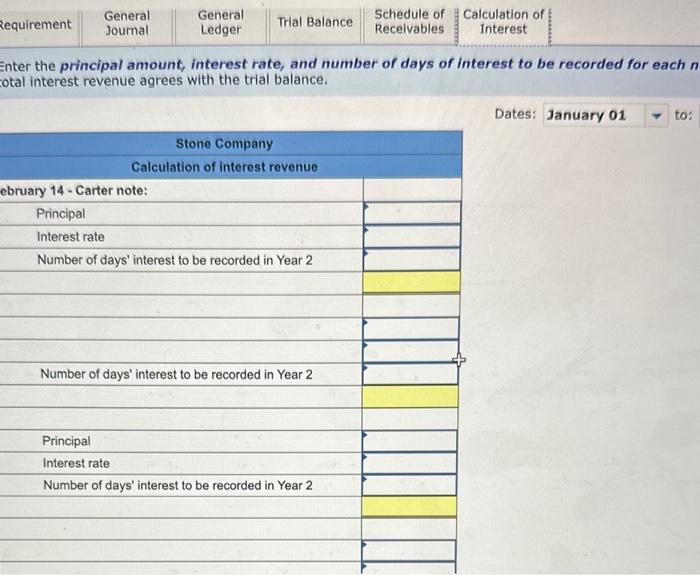

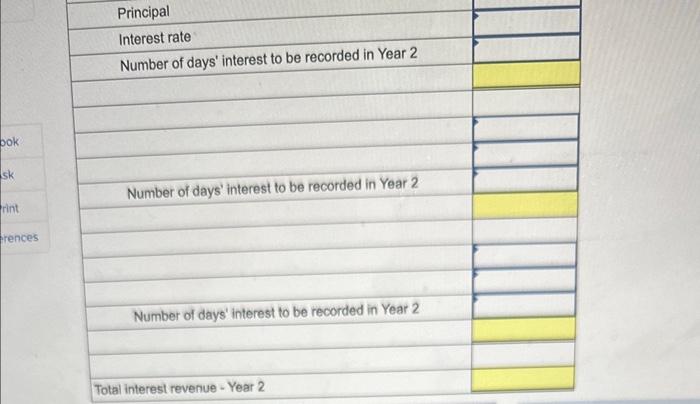

The following selected transactions are from Stone Company. Year 1 December 16 Accepted a $25,200,60-day, 88 note in granting taane Carter a time extension on his past-duo account receivable. December 31 Made an adjusting entry to record the acerued interest on the carter note. Year 2 Pebruary 14 Recelved carter's payment of prineipal and interest on the note dated becember 16. March 2 necepted a 38,000,81,90-day note in qranting a time extension on the past-due sccount recelvable from Turner Company March 17 necepted a $9,600,30-day, 2t note in granting Melanis Duerr a timn extention on her past-due aceount receivable. april 16 Duerr diehonored her note. 31 furner Company diabonored ith note. Muguat 7 Aecepted a $16,000,90-day, 10 note in granting a time extension on the past-die account receivable of Taylor Company September 3 Aecepted a 816,200 , 60-day, 10 t note in qranting sose Gareia a time extension on his past-diue actount receivable. Movenber 2 necelved payeent of prineipal plun interest fron Garela for the septenber 3 note. Novesber 3 keceived payenent of prineipal plue interest fron faylor for the Auguat 7 note. becenber I Wrote oft the buerr aceount againat the Allovasce for Doubtful Accounta. Prepare the journal entries related to notes receivable and accounts recelvable. Hint: Use the "Calculation of interest" tab to ensure the accurecy of your entries. Prepare the journal entries related to notes receivable and accounts receivable. Hint: Use ensure the accuracy of your entries. Journal entry worksheet 678910 February 14 Recelved Carter's payment of principal and interest on the $25,200,60-day, 8% note dated December 16 . The Stone Company does not prepare reversing entries. Verify the amount of interest using the "CALCULATION OF INTEREST" tab. Note: Enter debits before credits. Journal entry worksheet March 2 Accepted an $8,000,8%,90-day note in granting a time extension on the past-due account receivable from Turner Company Note: Enter debits before credits. Journal entry worksheet 56789 March 17 Accepted a $9,600,30-day, 7% note in granting Melanie Duerr a time extension on her past-due account receivable. Note: Enter deblts before credits. Journal entry worksheet