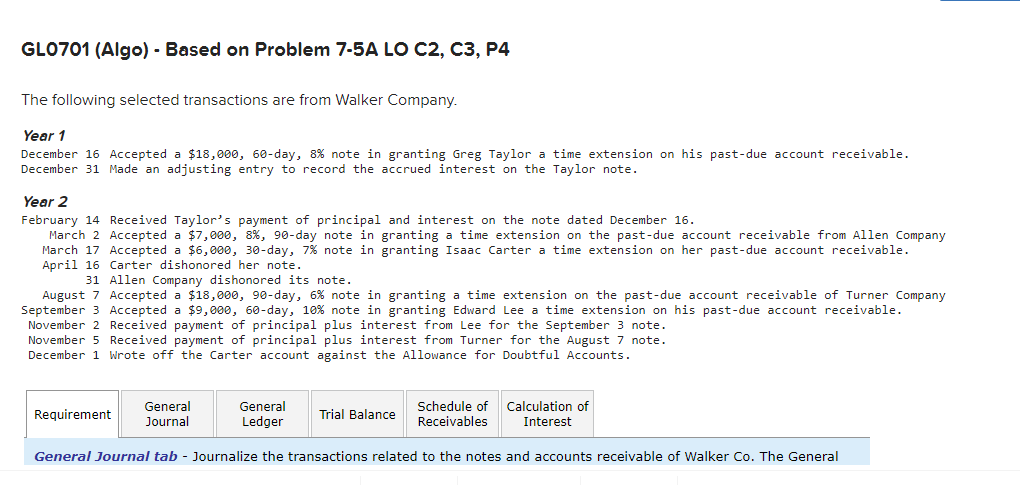

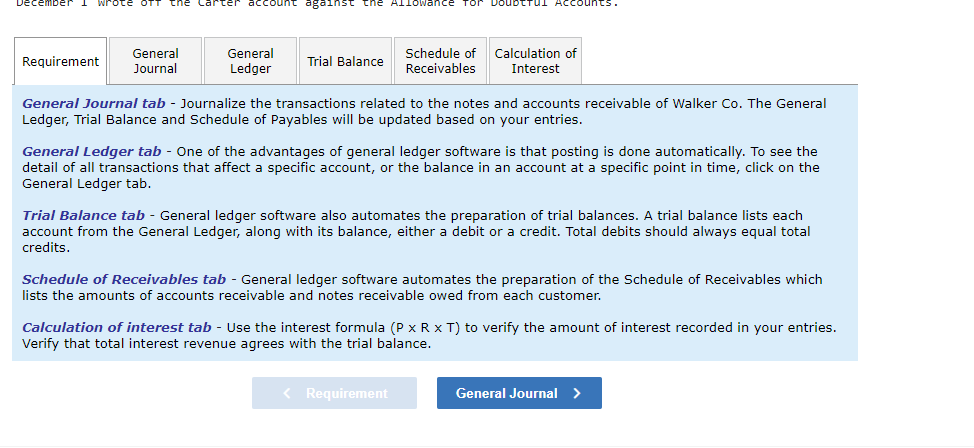

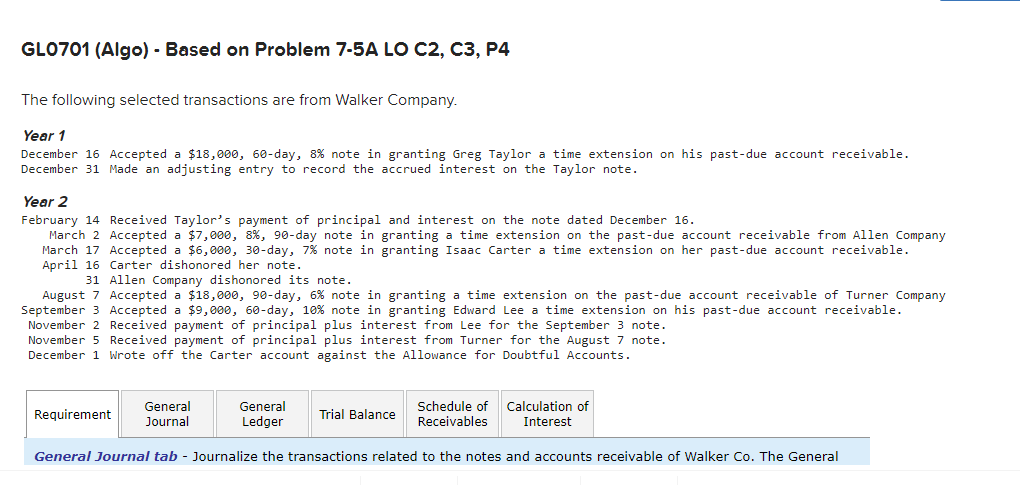

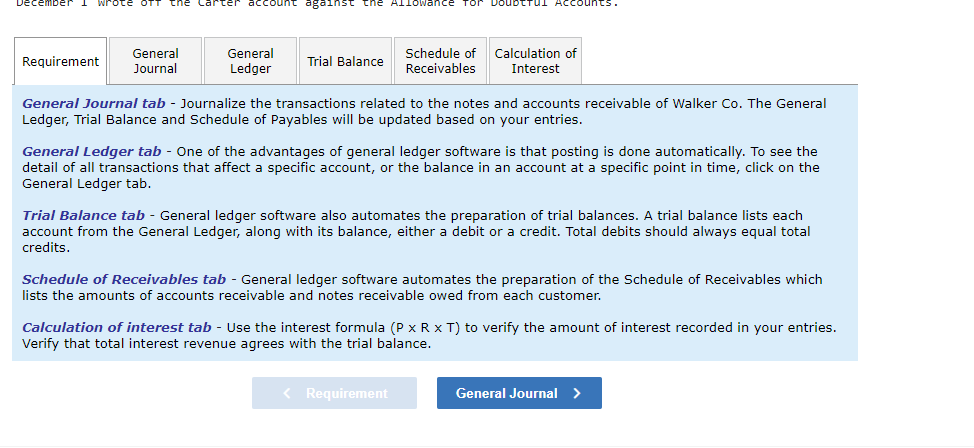

The following selected transactions are from Walker Company. Year 1 December 16 Accepted a $18,000,60-day, 8\% note in granting Greg Taylor a time extension on his past-due account receivable. December 31 Made an adjusting entry to record the accrued interest on the Taylor note. Year 2 February 14 Received Taylor's payment of principal and interest on the note dated December 16. March 2 Accepted a $7,000,8%,90-day note in granting a time extension on the past-due account receivable from Allen Company March 17 Accepted a $6,000,30-day, 7\% note in granting Isaac Carter a time extension on her past-due account receivable. April 16 Carter dishonored her note. 31 Allen Company dishonored its note. August 7 Accepted a $18,000, 90-day, 6% note in granting a time extension on the past-due account receivable of Turner Company September 3 Accepted a $9,000,60-day, 10\% note in granting Edward Lee a time extension on his past-due account receivable. November 2 Received payment of principal plus interest from Lee for the September 3 note. November 5 Received payment of principal plus interest from Turner for the August 7 note. December 1 Wrote off the Carter account against the Allowance for Doubtful Accounts. General Journal tab - Journalize the transactions related to the notes and accounts receivable of Walker Co. The General General Journal tab - Journalize the transactions related to the notes and accounts receivable of Walker Co. The General Ledger, Trial Balance and Schedule of Payables will be updated based on your entries. General Ledger tab - One of the advantages of general ledger software is that posting is done automatically. To see the detail of all transactions that affect a specific account, or the balance in an account at a specific point in time, click on the General Ledger tab. Trial Balance tab - General ledger software also automates the preparation of trial balances. A trial balance lists each account from the General Ledger, along with its balance, either a debit or a credit. Total debits should always equal total credits. Schedule of Receivables tab - General ledger software automates the preparation of the Schedule of Receivables which lists the amounts of accounts receivable and notes receivable owed from each customer. Calculation of interest tab - Use the interest formula (PRT) to verify the amount of interest recorded in your entries. Verify that total interest revenue agrees with the trial balance