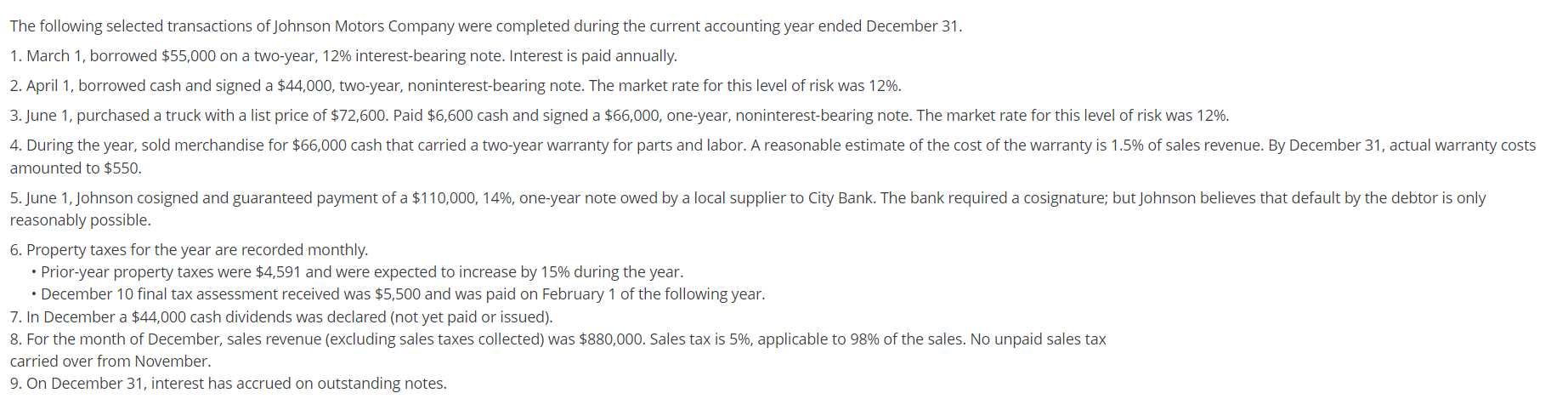

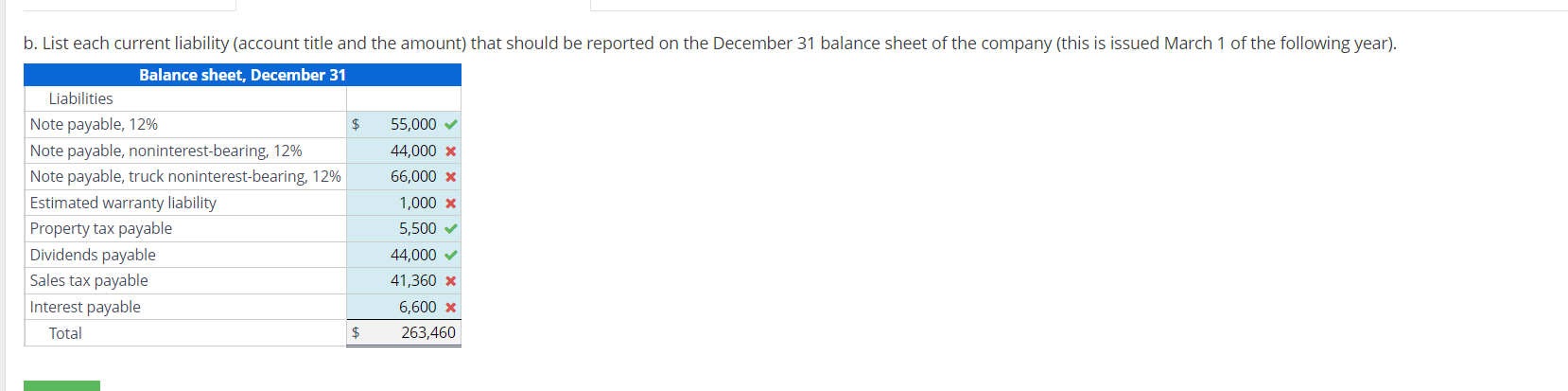

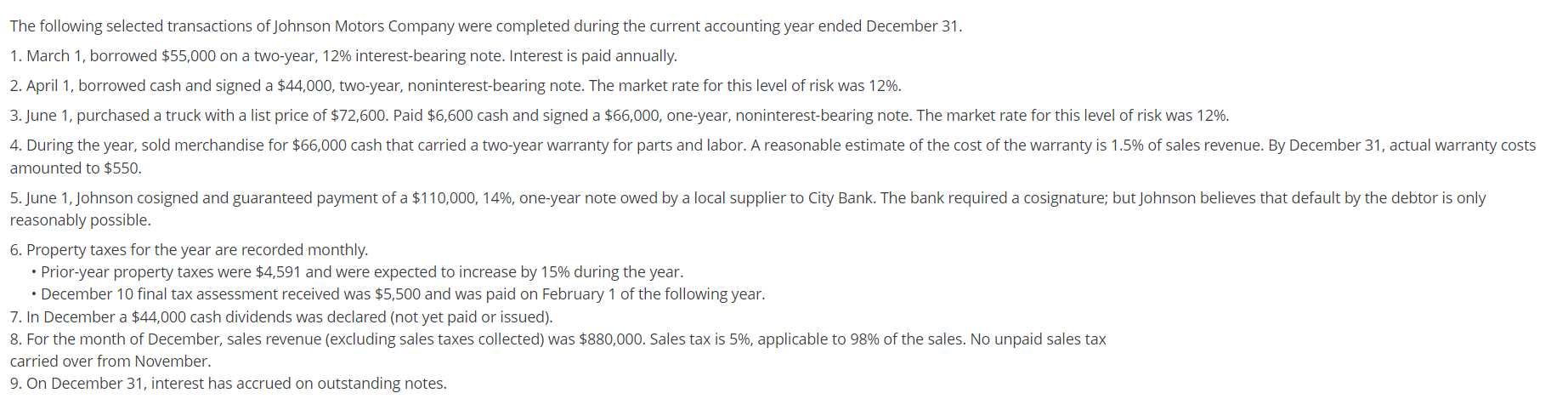

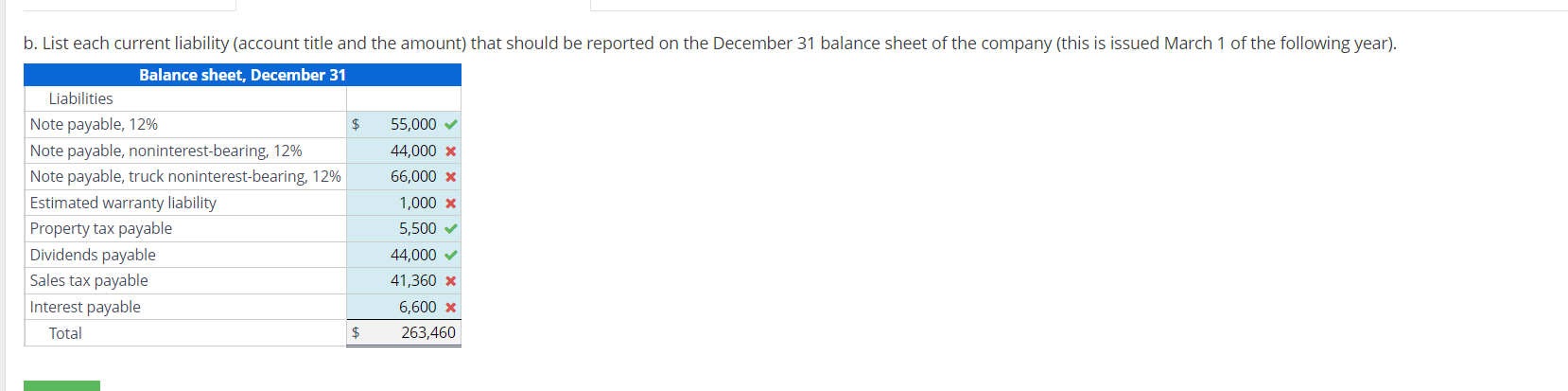

The following selected transactions of Johnson Motors Company were completed during the current accounting year ended December 31 . 1. March 1, borrowed $55,000 on a two-year, 12% interest-bearing note. Interest is paid annually. 2. April 1, borrowed cash and signed a $44,000, two-year, noninterest-bearing note. The market rate for this level of risk was 12%. 3. June 1, purchased a truck with a list price of $72,600. Paid $6,600 cash and signed a $66,000, one-year, noninterest-bearing note. The market rate for this level of risk was 12%. amounted to $550. reasonably possible. 6. Property taxes for the year are recorded monthly. - Prior-year property taxes were $4,591 and were expected to increase by 15% during the year. - December 10 final tax assessment received was $5,500 and was paid on February 1 of the following year. 7. In December a $44,000 cash dividends was declared (not yet paid or issued). 8. For the month of December, sales revenue (excluding sales taxes collected) was $880,000. Sales tax is 5%, applicable to 98% of the sales. No unpaid sales tax carried over from November. 9. On December 31, interest has accrued on outstanding notes. b. List each current liability (account title and the amount) that should be reported on the December 31 balance sheet of the company (this is issued March 1 of the following year). - Note: Round answers to the nearest whole dollar. The following selected transactions of Johnson Motors Company were completed during the current accounting year ended December 31 . 1. March 1, borrowed $55,000 on a two-year, 12% interest-bearing note. Interest is paid annually. 2. April 1, borrowed cash and signed a $44,000, two-year, noninterest-bearing note. The market rate for this level of risk was 12%. 3. June 1, purchased a truck with a list price of $72,600. Paid $6,600 cash and signed a $66,000, one-year, noninterest-bearing note. The market rate for this level of risk was 12%. amounted to $550. reasonably possible. 6. Property taxes for the year are recorded monthly. - Prior-year property taxes were $4,591 and were expected to increase by 15% during the year. - December 10 final tax assessment received was $5,500 and was paid on February 1 of the following year. 7. In December a $44,000 cash dividends was declared (not yet paid or issued). 8. For the month of December, sales revenue (excluding sales taxes collected) was $880,000. Sales tax is 5%, applicable to 98% of the sales. No unpaid sales tax carried over from November. 9. On December 31, interest has accrued on outstanding notes. b. List each current liability (account title and the amount) that should be reported on the December 31 balance sheet of the company (this is issued March 1 of the following year). - Note: Round answers to the nearest whole dollar