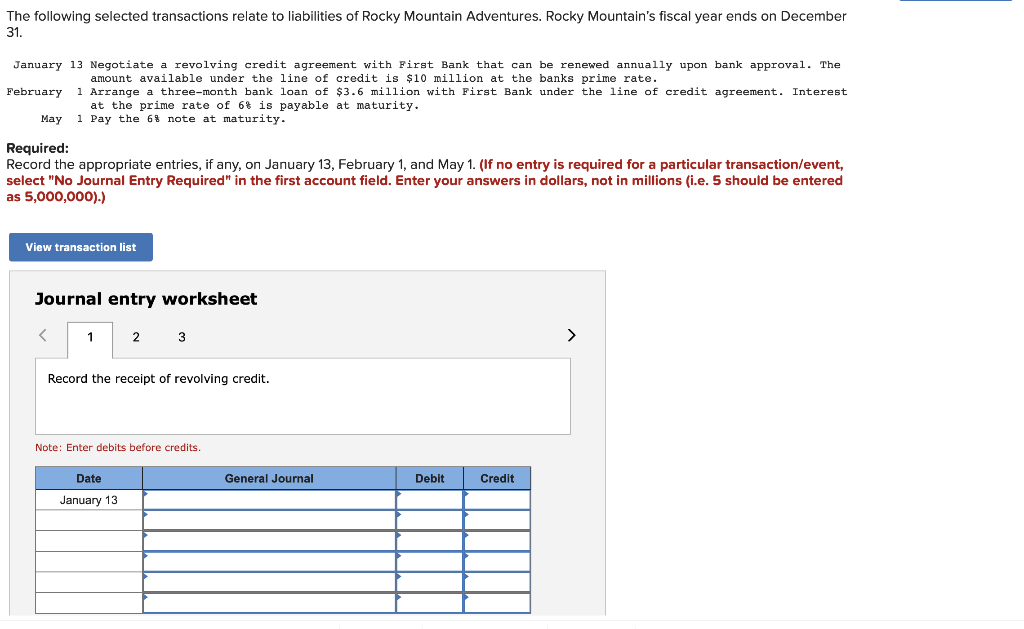

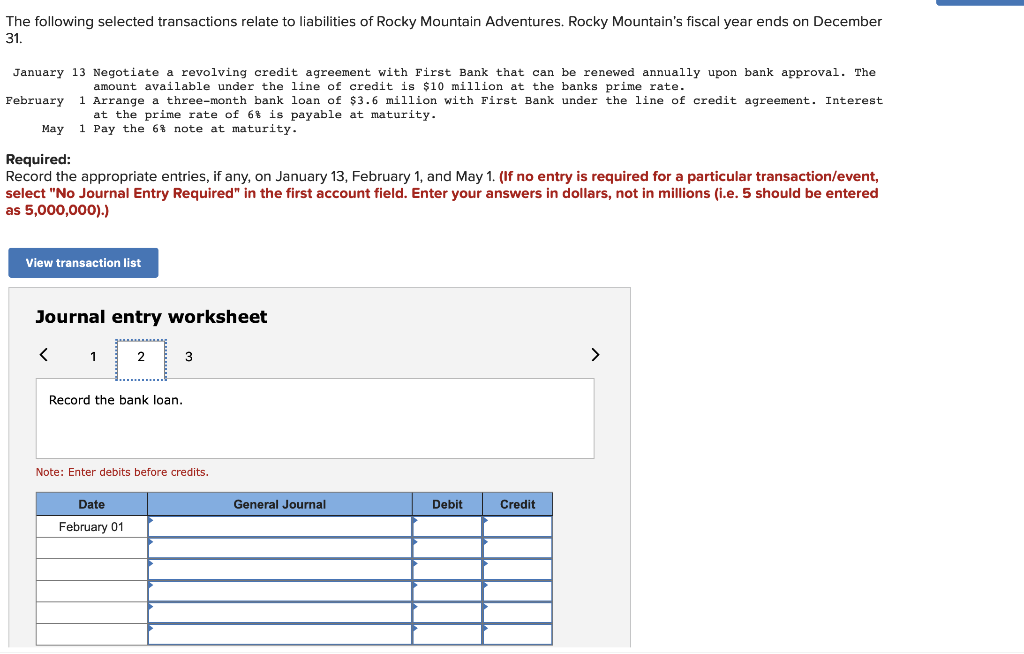

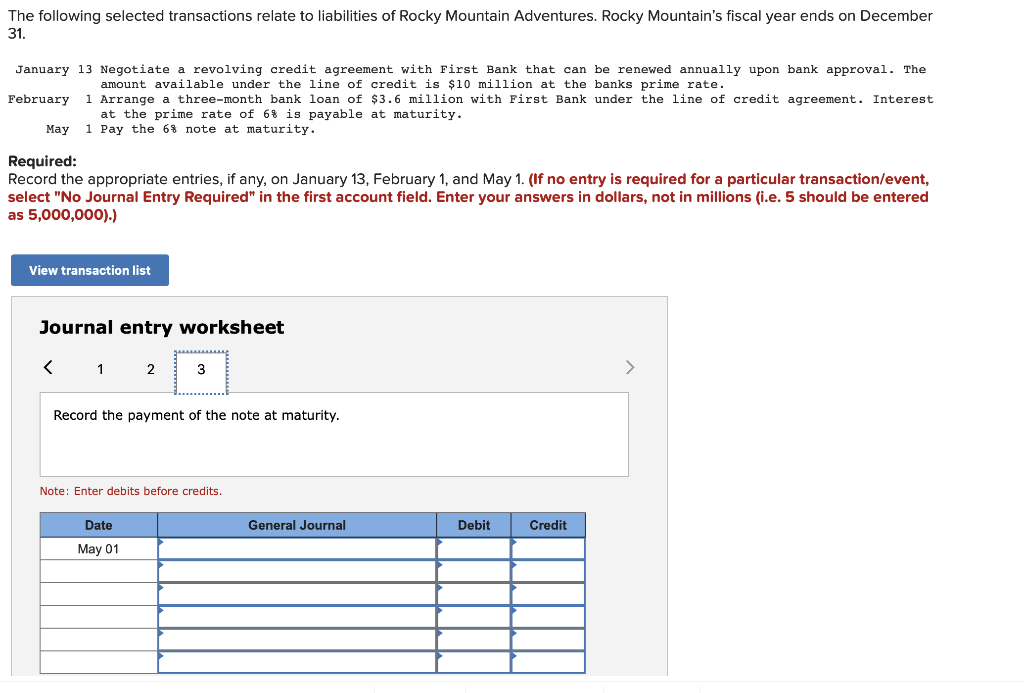

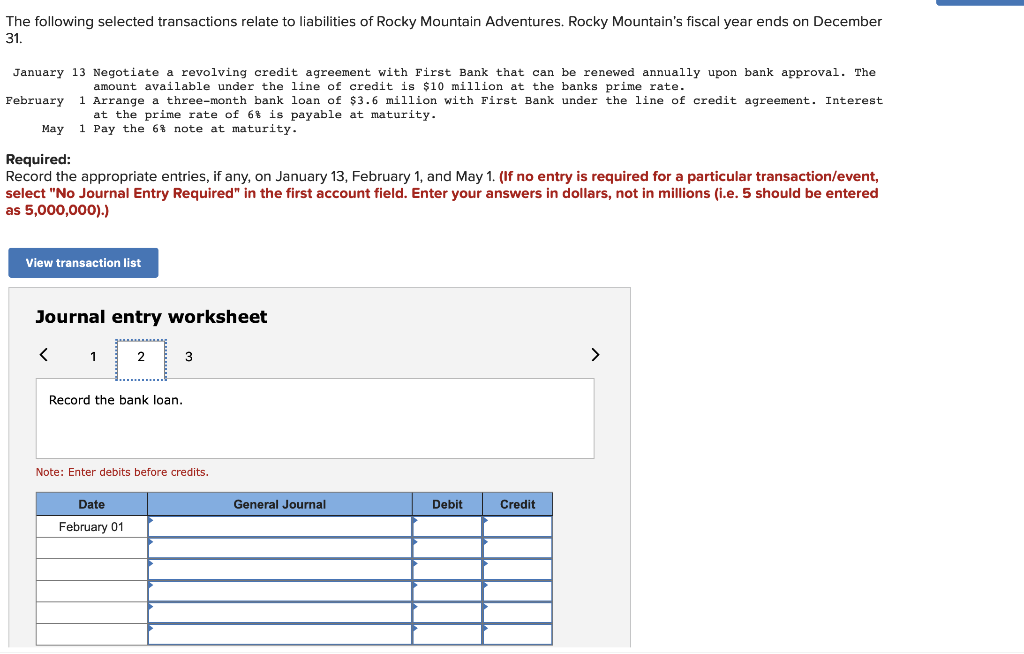

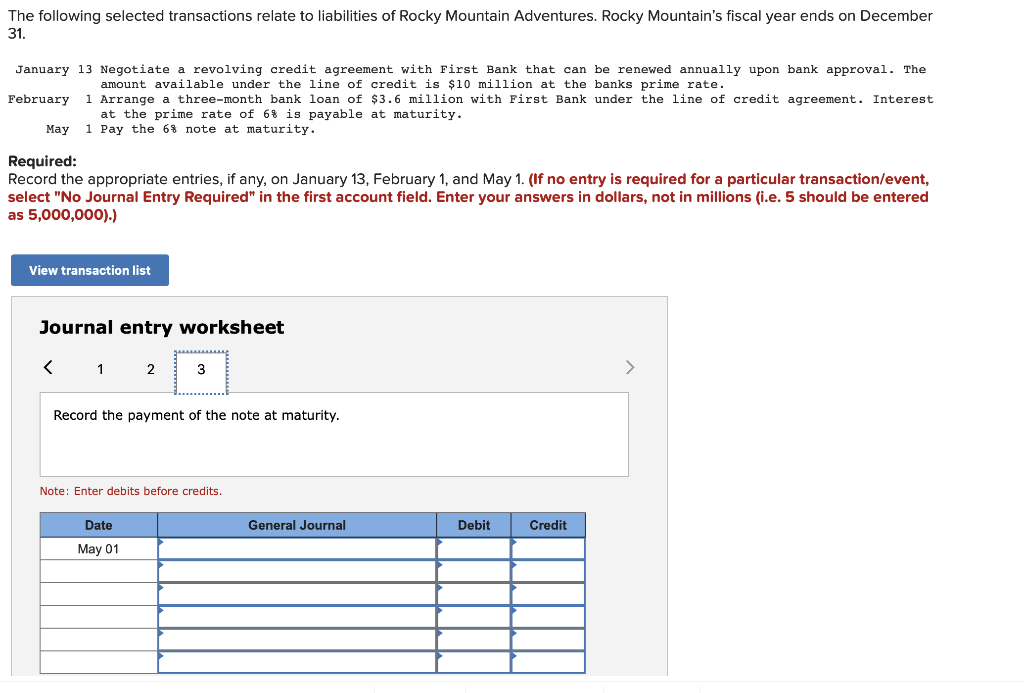

The following selected transactions relate to liabilities of Rocky Mountain Adventures. Rocky Mountain's fiscal year ends on December 31. January 13 Negotiate a revolving credit agreement with First Bank that can be renewed annually upon bank approval. The amount available under the line of credit is $10 million at the banks prime rate. February 1 Arrange a three-month bank loan of $3.6 million with First Bank under the line of credit agreement. Interest at the prime rate of 6% is payable at maturity. May 1 Pay the 68 note at maturity. Required: Record the appropriate entries, if any, on January 13, February 1, and May 1. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field. Enter your answers in dollars, not in millions (i.e. 5 should be entered as 5,000,000).) View transaction list Journal entry worksheet Record the receipt of revolving credit. Note: Enter debits before credits. Date General Journal Debit Credit January 13 The following selected transactions relate to liabilities of Rocky Mountain Adventures. Rocky Mountain's fiscal year ends on December 31. January 13 Negotiate a revolving credit agreement with First Bank that can be renewed annually upon bank approval. The amount available under the line of credit is $10 million at the banks prime rate. February 1 Arrange a three-month bank loan of $3.6 million with First Bank under the line of credit agreement. Interest at the prime rate of 68 is payable at maturity. May 1 Pay the 6% note at maturity. Required: Record the appropriate entries, if any, on January 13, February 1, and May 1. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field. Enter your answers in dollars, not in millions (i.e. 5 should be entered as 5,000,000).) View transaction list Journal entry worksheet Record the bank loan. Note: Enter debits before credits General Journal Debit Credit Date February 01 The following selected transactions relate to liabilities of Rocky Mountain Adventures. Rocky Mountain's fiscal year ends on December 31. January 13 Negotiate a revolving credit agreement with First Bank that can be renewed annually upon bank approval. The amount available under the line of credit is $10 million at the banks prime rate. February 1 Arrange a three-month bank loan of $3.6 million with First Bank under the line of credit agreement. Interest at the prime rate of 6% is payable at maturity. May 1 Pay the 68 note at maturity. Required: Record the appropriate entries, if any, on January 13, February 1, and May 1. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field. Enter your answers in dollars, not in millions (i.e. 5 should be entered as 5,000,000).) View transaction list Journal entry worksheet Record the payment of the note at maturity. Note: Enter debits before credits. General Journal Debit Credit Date May 01