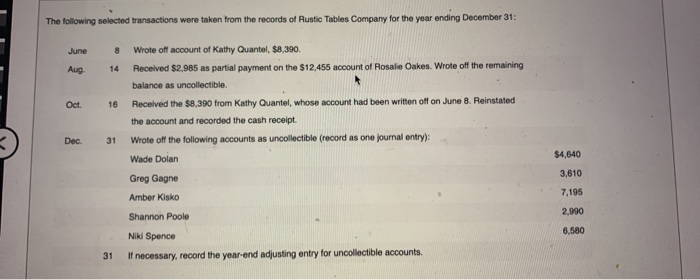

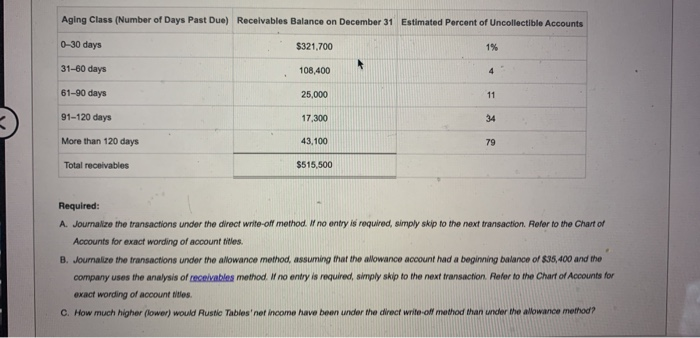

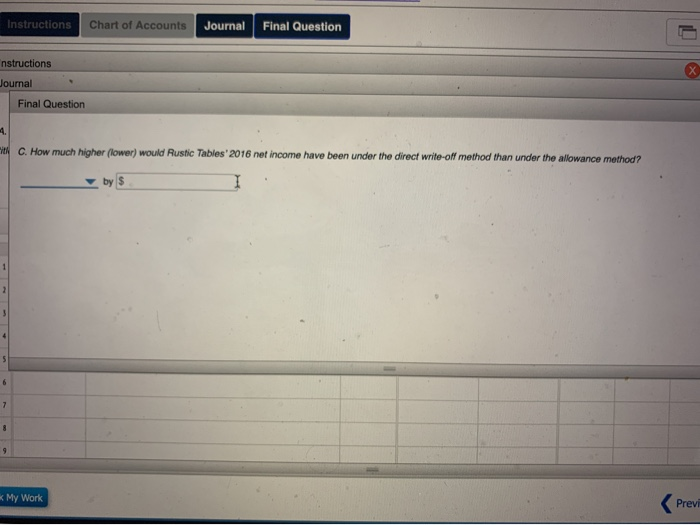

The following selected transactions were taken from the records of Rustic Tables Company for the year ending December 31: June 8 Aug 14 Oct. 16 Wrote of account of Kathy Quantel, 8,390 Received $2,985 as partial payment on the $12,455 account of Rosalie Oakes. Wrote off the remaining balance as uncollectible Received the $8,390 from Kathy Quantel, whose account had been written off on June 8. Reinstated the account and recorded the cash receipt. Wrote off the following accounts as uncollectible (record as one journal entry): Wade Dolan Greg Gagne Amber Kisko Dec. 31 $4,640 3,610 7,195 2,990 Shannon Poole 6.580 Nikl Spence 31 If necessary, record the year-end adjusting entry for uncollectible accounts Aging Class (Number of Days Past Due) Receivables Balance on December 31 Estimated Percent of Uncollectible Accounts 0-30 days $321,700 1% 31-60 days 108,400 4 61-90 days 25,000 11 91-120 days 17.300 34 More than 120 days 43,100 79 Total receivables $515,500 Required: A. Journalize the transactions under the direct write-off method. I no entry is required, simply skip to the next transaction. Refer to the Chart of Accounts for exact wording of account titles. B. Journalize the transactions under the allowance method, assuming that the allowance account had a beginning balance of $35,400 and the company uses the analysis of receivables method. Il no entry is required, simply skip to the next transaction. Refer to the Chart of Accounts for exact wording of account titles. C. How much higher (lower) would Rustle Tables net income have been under the direct write-off method than under the allowance method? eBook Show Me How Calculator Entries for bad debt expense under the direct write-off and allowance methods Instructions Chart of Accounts Journal Final Question HI MI Instructions Journal JOURNAL ACCOUNTING EQUATION DATE DESCRIPTION POST. REY DEBIT CREDIT ASSETS LIABUES EQUITY 2 I 13 14 Previous Next Check My Work Email Instructor Save and Exit Submit Assignment for Grading Instructions Chart of Accounts Journal Final Question 0 Instructions Journal B. Journalize the transactions under the allowance method, assuming that the allowance account had a beginning balance of $35,400 and the company uses the analysis of receivables method. Il no enby is required, simply skip to the next transaction. Refer to the Chart of Accounts for exact wording of account titles PAGE 1 JOURNAL ACCOUNTING EQUATION DESCRIPTION ASSETS DERY CREDIT POST. REF. DATE LIABILITIES EQUITY 1 I 3 9 10 Previous Ne Check My Work Email Instructor Save and Exit Submit Assignment for Instructions Chart of Accounts Journal Final Question nstructions Journal Final Question 4. C. How much higher (lower) would Rustic Tables'2016 net income have been under the direct write-off method than under the allowance method? by $ 7 8 9 k My Work Previ