Answered step by step

Verified Expert Solution

Question

1 Approved Answer

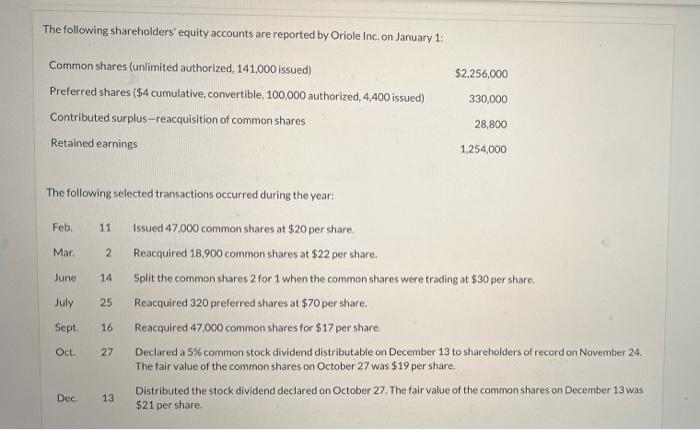

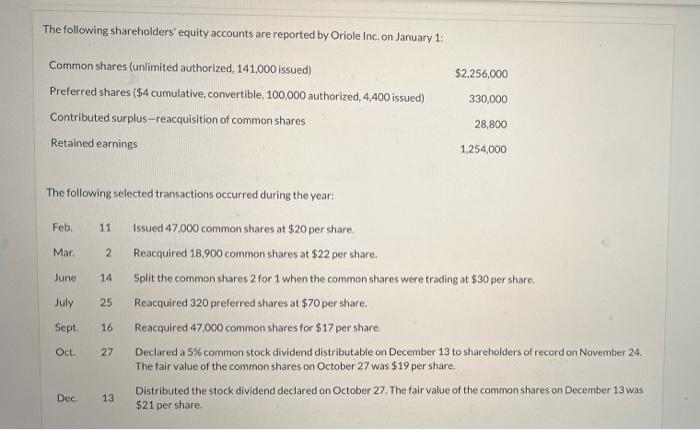

The following shareholders' equity accounts are reported by Oriole Inc. on January 1: $2,256,000 330,000 Common shares (unlimited authorized, 141,000 issued) Preferred shares ($4 cumulative,

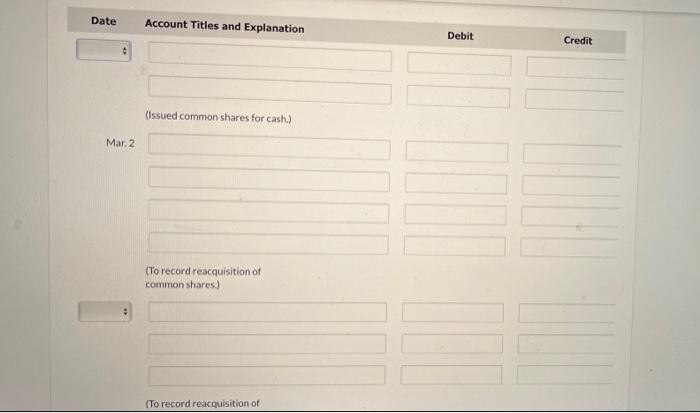

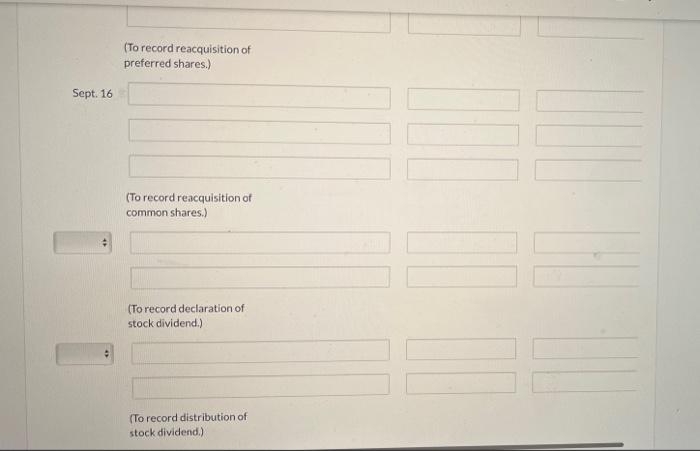

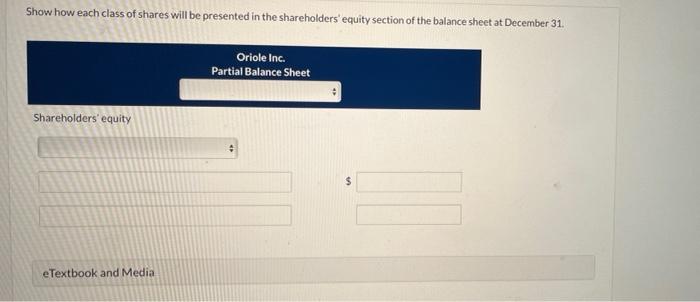

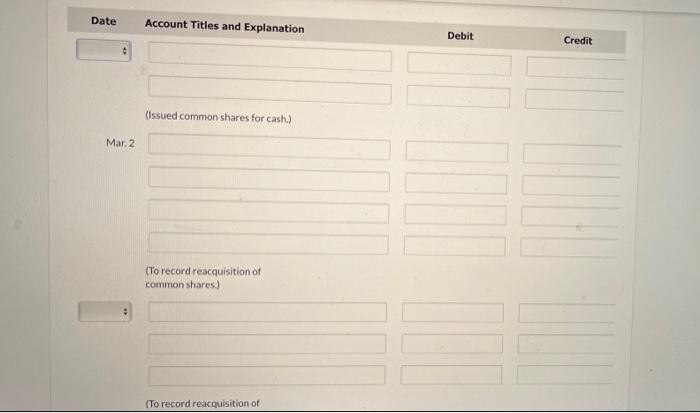

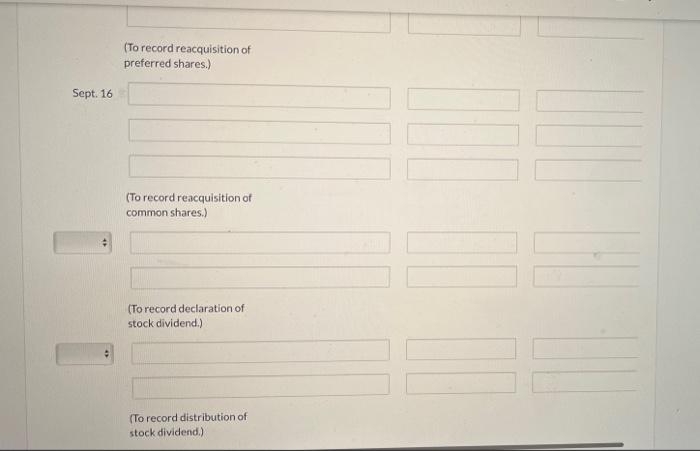

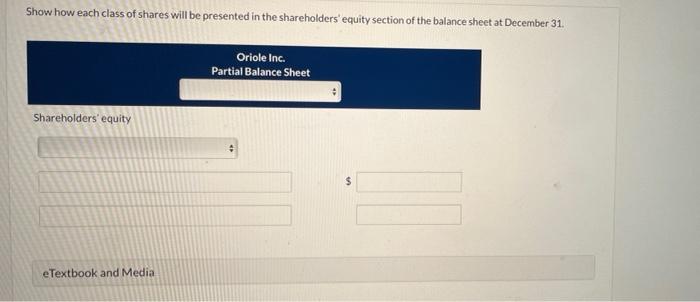

The following shareholders' equity accounts are reported by Oriole Inc. on January 1: $2,256,000 330,000 Common shares (unlimited authorized, 141,000 issued) Preferred shares ($4 cumulative, convertible 100,000 authorized, 4.400 issued) Contributed surplus-reacquisition of common shares Retained earnings 28,800 1,254,000 The following selected transactions occurred during the year: Feb. 11 Mar 2 June 14 July 25 Issued 47,000 common shares at $20 per share. Reacquired 18.900 common shares at $22 per share, Split the common shares 2 for 1 when the common shares were trading at $30 per share. Reacquired 320 preferred shares at $ 70 per share. Reacquired 47.000 common shares for $17 per share Declared a 5% common stock dividend distributable on December 13 to shareholders of record on November 24, The fair value of the common shares on October 27 was $19 per share. Distributed the stock dividend declared on October 27. The fair value of the common shares on December 13 was $21 per share Sept 16 Oct 27 Dec. 13 Date Account Titles and Explanation Debit Credit (Issued common shares for cash) Mar. 2 (To record reacquisition of common shares.) (To record reacquisition of (To record reacquisition of preferred shares.) Sept. 16 (To record reacquisition of common shares.) (To record declaration of stock dividend.) (To record distribution of stock dividend.) Show how each class of shares will be presented in the shareholders' equity section of the balance sheet at December 31. Oriole Inc. Partial Balance Sheet Shareholders' equity e Textbook and Media

The following shareholders' equity accounts are reported by Oriole Inc. on January 1: $2,256,000 330,000 Common shares (unlimited authorized, 141,000 issued) Preferred shares ($4 cumulative, convertible 100,000 authorized, 4.400 issued) Contributed surplus-reacquisition of common shares Retained earnings 28,800 1,254,000 The following selected transactions occurred during the year: Feb. 11 Mar 2 June 14 July 25 Issued 47,000 common shares at $20 per share. Reacquired 18.900 common shares at $22 per share, Split the common shares 2 for 1 when the common shares were trading at $30 per share. Reacquired 320 preferred shares at $ 70 per share. Reacquired 47.000 common shares for $17 per share Declared a 5% common stock dividend distributable on December 13 to shareholders of record on November 24, The fair value of the common shares on October 27 was $19 per share. Distributed the stock dividend declared on October 27. The fair value of the common shares on December 13 was $21 per share Sept 16 Oct 27 Dec. 13 Date Account Titles and Explanation Debit Credit (Issued common shares for cash) Mar. 2 (To record reacquisition of common shares.) (To record reacquisition of (To record reacquisition of preferred shares.) Sept. 16 (To record reacquisition of common shares.) (To record declaration of stock dividend.) (To record distribution of stock dividend.) Show how each class of shares will be presented in the shareholders' equity section of the balance sheet at December 31. Oriole Inc. Partial Balance Sheet Shareholders' equity e Textbook and Media

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started