Answered step by step

Verified Expert Solution

Question

1 Approved Answer

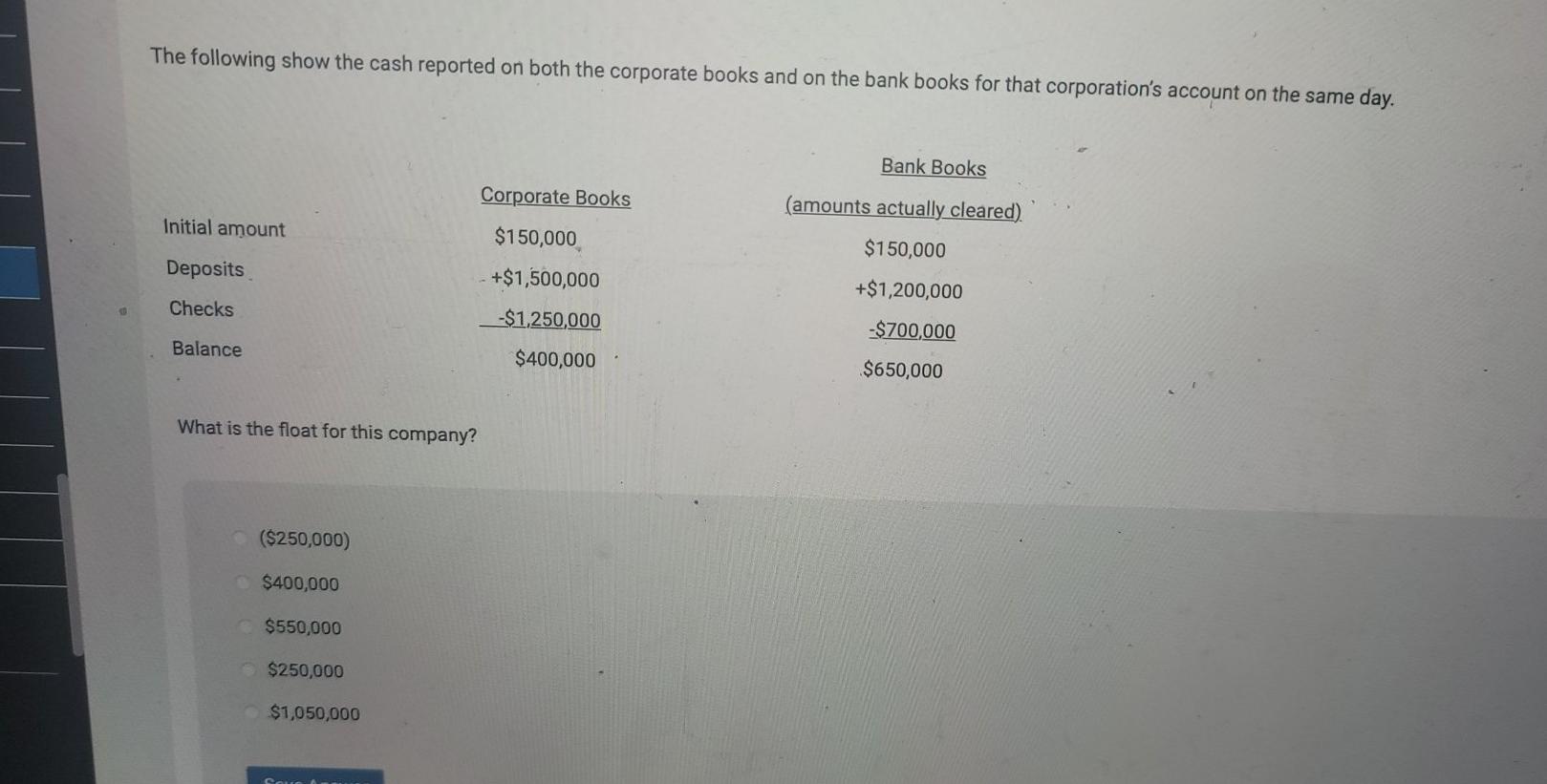

The following show the cash reported on both the corporate books and on the bank books for that corporation's account on the same day. Bank

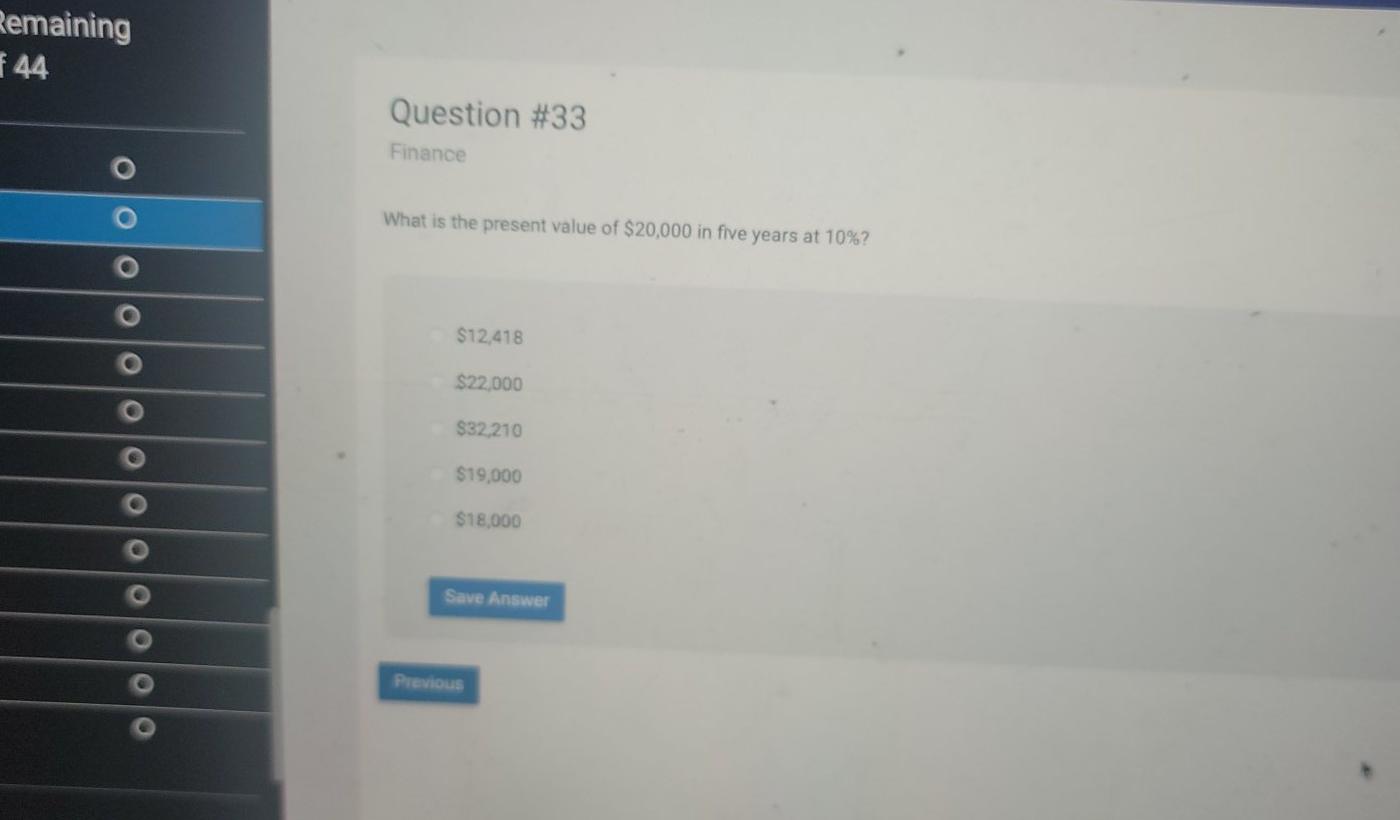

The following show the cash reported on both the corporate books and on the bank books for that corporation's account on the same day. Bank Books Corporate Books (amounts actually cleared) Initial amount $150,000 $150,000 Deposits +$1,500,000 +$1,200,000 Checks -$1,250,000 -$700,000 Balance $400,000 $650,000 What is the float for this company? ($250,000) $400,000 $550,000 $250,000 $1,050,000 Question #36 Finance If the Jasper Company purchases all of its outstanding shares at the current price, how much would it cost? $82,377,385.86 $13,761,030.08 $84,934.34 $93,117,702.02 $96,138,415.94 Save Answer Previous Question #35 Finance Baldwin Sensors had a net income last year of $37.4 million. Its quarterly dividend was $.35, and its stock price was $140.00. The EPS was $5.60. What was the payout ratio? 1% 14.97% 2.5% 25% 6.25% Save Answer Previous Next Finance If the nominal interest rate in Japan is higher than the nominal interest rate in Korea, then forex forecasters will tend to predict Purchasing Power Parity between the two countries will be at equilibrium. the Korean won will appreciate vis--vis the Japanese yen. inflation will be higher in Korea. the interest rates will regress toward the mean. the real interest rate will also differ between the two countries. Seve Answer Previous Remaining 44 Question #33 Finance What is the present value of $20,000 in five years at 10%? $12,418 $22.000 $32.210 $19,000 $18,000 Save Answer Previous

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started