Question

The following shows the ratio analysis of Traction Software relative to the ABC Corporation. Evaluate the company relative to history and the other firm. Include

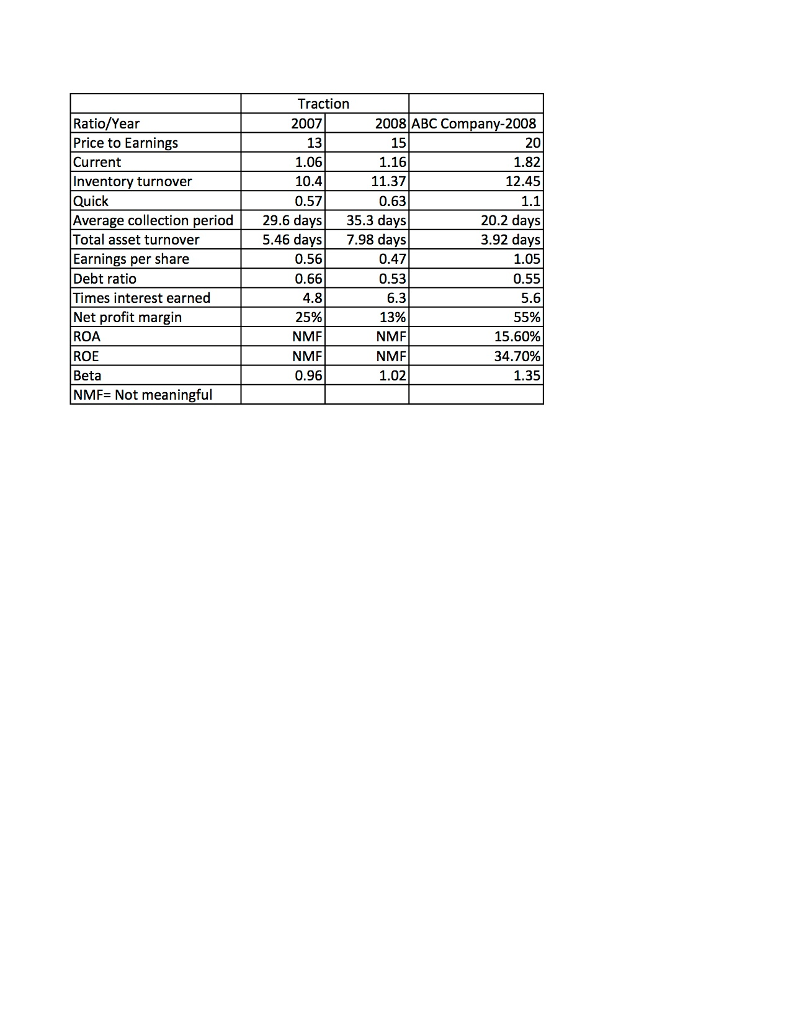

The following shows the ratio analysis of Traction Software relative to the ABC Corporation. Evaluate the company relative to history and the other firm. Include an explanation of each ratio as part of your answer. Tell the company story as signaled by the ratios. Which company will bondholders be more attracted to? Stockholders? Which company is more risky? Calculate the per share price for each year and company (Hint: use the P/E and EPS) Which company would you invest in and why? Traction Software

PLease explain the question and give detail answer

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started